Texas Alternatives Conference 2026 - Agenda

Agenda

Day 1: Monday, March 9

2:00pm – 4:00pm

Eighth Annual Women in Finance Leadership Tea

Co-hosted with SBAI

5:30pm – 8:00pm

All conference welcome dinner

Generously sponsored by Lighthouse Partners

Day 2: Tuesday, March 10

8:00am

Registration and networking breakfast

8:45am – 9:00am

Welcome remarks

Speakers

Peter Donovan is MFA’s Executive Vice President & Managing Director, Chief Operating Officer. He is responsible for MFA operations and finance, including accounting, budgeting, human resources and technology. He also leads and directs all efforts related to membership retention, development and growth. Mr. Donovan divides his time between MFA’s Washington D.C. and New York offices.

Mr. Donovan is a respected industry veteran with more than 25 years of experience. He joins MFA from Bank of America Merrill Lynch where he has served since 2004 in a variety of leadership roles in Fixed Income Prime Brokerage, sales and relationship management. He was previously co-head of U.S. prime brokerage sales at Morgan Stanley. Mr. Donovan holds a Bachelor’s degree in Finance from Lehigh University and a MBA from Fordham University.

Ben Webb advances investor partnership efforts in the Americas region for the Lighthouse Group. In this role, Ben sources and maintains relationships with institutional and high-net-worth investors, as well as their consultants and advisers, to foster long-term relationships. He joined Lighthouse in 2025 with over 10 years of industry-specific experience. Previously, Ben was a senior vice president at CAIS, where he served as a product specialist and led sales enablement initiatives focused on educating and expanding adoption of alternative investments within the independent wealth channel. Prior to that, Ben was an investment strategist at BMO Wealth Management where he assisted on portfolio construction, economic forecasting, and investment strategy. Ben earned a Bachelor of Business Administration in Accounting and Finance from Baylor University.

9:00am – 9:45am

Keynote fireside discussion

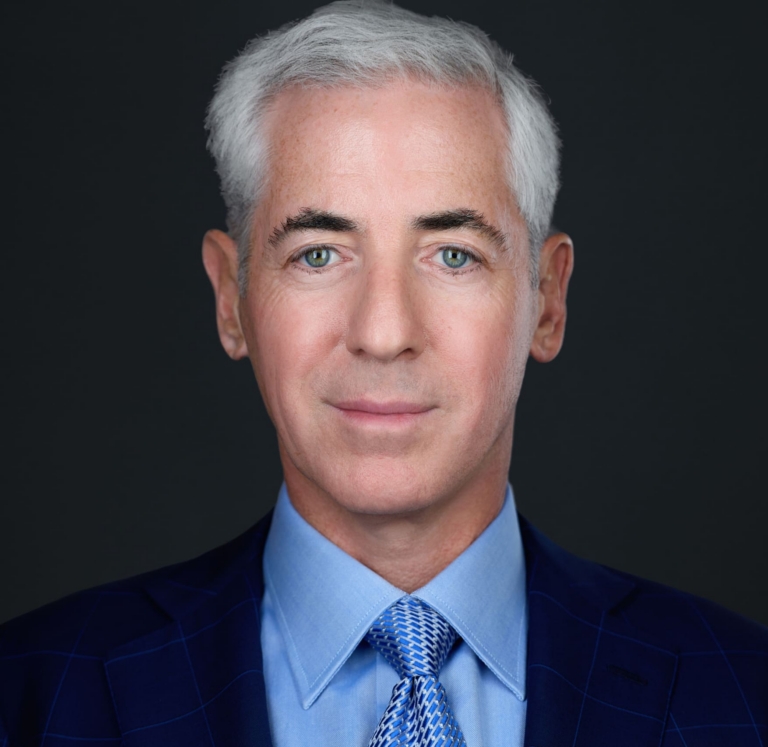

Speaker

Bill Ackman is CEO of Pershing Square, a leading investment firm with $30 billion of assets under management. Mr. Ackman founded Pershing Square in 2004.

Pershing Square principally makes investments in a concentrated portfolio of high-quality, simple, predictable, cash-generative durable growth businesses. Pershing Square often works with its portfolio companies as an engaged and active investor to help create substantial long-term value.

Prior to founding Pershing Square, Mr. Ackman co-founded Gotham Partners in 1992, a research-driven, value-oriented investment firm that managed public and private equity investments. Before Gotham, Mr. Ackman began his career in real estate investment banking at Ackman Brothers and Singer, Inc.

Mr. Ackman is co-trustee of The Pershing Square Foundation, a family foundation established in 2006 to support exceptional leaders and innovative organizations that tackle important issues and deliver scalable and sustainable global impact. Pershing Square Philanthropies, which includes The Pershing Square Foundation, has committed more than $930 million in grants and investments in target areas including health and medicine, education, economic development and innovation.

Mr. Ackman currently serves as Executive Chairman of the board of Howard Hughes Holdings Inc. and as CEO and Chairman of Pershing Square SPARC Holdings, Ltd. He has previously served on the boards of numerous private and public companies. In addition, he served as a member of the Investor Advisory Committee on Financial Markets of the Federal Reserve Bank of New York and the Board of Dean’s Advisors of Harvard Business School.

Mr. Ackman holds an MBA from Harvard Business School and a Bachelor of Arts, magna cum laude, from Harvard College.

Moderator

Dale West is the Senior Managing Director of Public Markets at the Teacher Retirement System of Texas in Austin, Texas. Mr. West’s team oversees the Trust’s portfolio of publicly-traded securities including both internal and externally managed strategies. TRS’ portfolio includes over $28 billion in hedge fund investments. Mr. West joined TRS in 2008 and serves on the Internal Investment Committee and Executive Committee.

Prior to joining TRS, Mr. West was based in London with the emerging markets equity team of T. Rowe Price International, where he covered telecoms and emerging markets. He also served in the U.S. Foreign Service, including a three-year posting to the American embassy in Bucharest, Romania.

Mr. West received an MBA from Stanford University, and is a graduate of the Plan II Honors Program at the University of Texas at Austin.

9:45am - 10:00am

Transition break

10:00am - 12:00pm

Institutional Investor Symposium

Invitation only

10:00am –10:40am

Inside the GP–LP legal negotiation: Legal terms, side letters, and strategy

General Session

Speakers

Lara Assaf provides creative, commercial and practical advice relating to the alternative investment funds industry to a broad spectrum of institutional investors and private fund sponsors.

Her practice focuses on private fund investments and formations, syndicated and direct co-investments, direct investments, as well as bespoke investment products, including funds of one, opportunity and sidecar funds, joint ventures and other strategic private investment partnerships. Lara offers comprehensive, strategic legal solutions to institutional investors and fund managers across the life cycle of a private fund. She also advises on a variety of fund operations and late-term transactions, including restructurings, continuation funds and other general partner (GP) led transactions.

Lara also has significant corporate and capital market experience, including public and private mergers and acquisitions, energy-related investments and acquisitions, portfolio company formation, offerings of debt and equity securities and federal securities law compliance.

Kellie Bobo is a partner in the Mergers and Acquisitions and Investment Management Practice Groups inthe Austin office at Haynes Boone, with a focus on advising clients in complex domestic and cross-border transactions. Her practice encompasses mergers, acquisitions, divestitures, private equityinvestments, and general corporate matters across a diverse range of industries.

Kellie has extensive experience representing public and private companies, private equity firms, andfamily offices in structuring and negotiating strategic transactions. She provides counsel on entityformation, corporate governance, and compliance matters, ensuring that clients navigate themarketplace effectively. In addition, Kellie represents clients across a broad range of industries invarious corporate and securities matters, including the preparation of securities filings with the SEC.

Kellie has experience in various corporate transactions, including:

– Advises on mergers, acquisitions, buyouts, and recapitalizations involving both public and privatecompanies, including private equity portfolio companies.

– Represents issuers in offerings and private placements of equity, debt, and convertible securities,as well as venture capital financings.

– Structures and forms business entities such as corporations, partnerships, and LLCs.

– Counsels clients on general corporate matters and regulatory compliance, including for privateequity and hedge funds.

Scott is the leader of Jackson Walker’s institutional investor practice, where he leads a team of lawyers experienced in representing institutional investors around the world with respect to alternative assets investments (e.g., “private markets” strategies such as private equity funds, real estate funds, infrastructure funds and credit funds as well as “public markets” strategies such as hedge funds, long-only funds, collective investment trusts, and separately managed accounts). Representative clients include: public and private pension plans, university and research endowments, sovereign wealth funds, insurance companies, corporate investment divisions, funds of funds and family offices.

One of Scott’s key focus areas is in bespoke investment arrangements, which can take the form of separately managed accounts, funds of one, master custody agreements, and strategic partnerships. These arrangements typically involve a high degree of customization, including bespoke investment guidelines and restrictions, changes to the standard of care, non-standard expense reimbursement, and highly customized management and incentive fee models. One of Scott’s favorite things to do is to work with clients to develop new incentive fee structures, including building and testing the fee models, because, in Scott’s words, “one cannot draft a fee schedule if one does not understand the math, and the best way to understand the math is to build the model.”

Greg Durst is the Senior Director of Global Fund Partnerships in the London office of Kirkland & Ellis International LLP.

Greg brings extensive experience and deep ties to the investor community and is working to streamline the interaction between LPs and GPs, helping to support clients to achieve shorter negotiations, faster closings and building the experience of partnership between capital providers and investment managers. Based in London with an international remit, Greg will also focus on deepening the relationships between Kirkland and its existing and potential clients and brings to the table three decades of professional services leadership experience in asset management, strategy consulting, banking and operations.

Most recently, Greg was the Senior Managing Director for Global Growth at the Institutional Limited Partners Association, the global trade body for allocators committing capital to private markets. He represented ILPA and its 600+ members in many industry conversations and engagements, serving as a senior contributor in retail capital in private markets, private credit, NAV facilities and continuation funds.

As part of his role, he led the development and launch of the association’s first formal engagement mechanism with the GP community on both the strategic and tactical issues facing the industry. In addition, Greg was the co-host of the association’s annual LP/GP Roundtables in New York and London, bringing together senior leaders and founders from GPs, CIO’s and heads of PE from the LPs. While at ILPA, he led many of the association’s growth efforts with general partners, the legal community and other service providers, including leading ILPA’s events business. Prior to joining Kirkland, he led the opening of ILPA’s European office in London, ILPA’s first non-North American office.

As a corporate development professional, Greg was ILPA’s point person for over 200 GPs and nearly 100 emerging managers. These conversations covered the gamut from fund structures, administration, technology, legal, compliance and reporting and capital raising strategies.

In addition to his work on behalf of the private equity industry, he has lead investor relations efforts at two private fund managers; been a strategy consultant with Bain & Company in their PE practice and a banker for sponsors at The Chase Manhattan Bank and Paribas Capital Markets.

Moderator

Supriya Randev is currently Head of U.S. Business Development at Caius Capital LLP, a European opportunistic credit hedge fund where she drives institutional growth and strategic engagement with North American allocators. Previously, she served as Director of Marketing and Investor Relations at East Lodge Capital crafting investor communications and building investor relationships for the firm. Recognized as one of the “Top 50 Women in Hedge Funds” in 2025, she is a frequent speaker at industry conferences and is focused on advancing cross-border capital formation between U.S. allocators and European credit markets.

10:40am – 11:20am

Capital raising and institutional investing trends

General Session

Speakers

Kate Baumann has 18 years of experience in the financial services industry. Ms. Baumann joined Empyrean in 2017 as Director of Business Development. She was named Head of Investor Relations in 2020 and Partner in 2022. Prior to joining Empyrean, from 2010 to 2017, Ms. Baumann was a member of the Investor Relations Team at Eton Park Capital Management in New York. Ms. Baumann began her career at J.P. Morgan Private Bank in 2007, where she worked as a Banking Analyst until 2009, and as a Global Investment Analyst from 2009 to 2010. She earned a BS in Business Administration-Finance, with a Minor in Spanish, from Georgetown University’s McDonough School of Business in 2007. Ms. Baumann is a co-founder of Women of Georgetown, an alumni networking initiative focused on cultivating the next generation of leaders, and remains actively involved as a member of their Board.

Ms. Boswell is an executive vice president and co-head of PIMCO’s Austin office, and she oversees the U.S. Non Profit practice, responsible for the coverage of endowments, foundations, and healthcare institutions. Prior to joining PIMCO in 2009, she worked as an equity research associate on the energy team at Credit Suisse and as a senior associate covering utilities in the corporate finance group at Moody’s Investors Service. She is a member of the board of directors of the YMCA of Austin and the Texas Alternatives Investments Association. She also serves on the University of Texas McCombs Master of Science in Finance Advisory Council. She has 19 years of investment experience and holds an MBA from the University of Chicago Booth School of Business as well as an undergraduate degree from Yale University.

Nicole Lacues is a Managing Director at Old City Investment Partners, where she focuses on manager sourcing and capital placement among a suite of high-quality clients raising private funds.

With over 20 years of experience in finance and alternatives, Nicole has worked across capital formation, investor relations, operations, compliance and equity sales. Prior to joining Old City, she held senior roles at NewView Capital, Alta Fox, Satori Capital and Nipun Capital where she played instrumental roles in implementing fundraising processes and creating frameworks for institutional quality investor servicing. Nicole brings particular expertise in formulating fundraising strategy for emerging managers and communicating complex concepts with clarity. Her passion lies in building high trust relationships with GPs and LPs alike.

She holds a BA in Economics from UC San Diego and is active in the Dallas community as a CASA advocate.

Moderator

Mithra Warrier is the Global Head of Financing Sales for Scotiabank, responsible for client strategy, growth and origination for the Prime Services and Collateral Management and Funding businesses.

Mithra has over twenty years of experience in the Financing markets. She was previously at Citigroup, TD Securities, and Barclays.

Mithra is a graduate of Northwestern University.

11:20am - 12:00pm

Beyond the traditional: Navigating alternatives in private wealth

Speakers

Mr. Sahadevan is Chief Operating Officer for Regan Capital, based in Dallas, Texas, an investment manager with approximately $3.8bn in assets. He has more than 22 years of experience across the alternative investment industry in both Europe and the U.S, having held leadership roles at multi-strategy hedge funds and credit-focused asset managers. His prior experience includes leadership positions at Garrison Investment Group, Mercer Park LP, and Sandelman Partners, as well as Amaranth Advisors, where he established and managed the firm’s European platform. Prior to this, Mr. Sahadevan was with JP Morgan’s Investment Bank in Europe. He holds a professional accounting qualification (CGMA, ACMA) and a Bachelor of Commerce (Honours) from the University of Birmingham, United Kingdom.

Chris is a Managing Director on the Pan-Alts team in the Americas and has over 22 years of experience in alternative investments. He is responsible for alternative investment programs in the Americas, supporting asset class research, portfolio construction and manager selection, strategy and implementation, and providing customized investment recommendations, and value-added research and content across alternative investments with a focus on the wealth management channel.

Prior to joining Aksia in 2025, Chris was a Managing Director of Private Markets at The Caprock Group, where he oversaw $3 billion in assets allocated across private markets. Before that he held various managerial roles, including Chief Investment Strategist at Venturi Wealth Management, Director of Private Equity at Texas Municipal Retirement System and Deputy CIO at Kentucky Retirement Systems. Previously, Chris was also a monthly columnist at Institutional Investor, and an Adjunct Professor at the University of Kentucky. Chris started his career at Calamos Investments and Thomson Reuters.

Chris graduated from the University of Illinois with a BS in Liberal Arts and Sciences and an MBA in Finance and Accounting. He holds an MSc in Financial Markets from the Illinois Institute of Technology and the CAIA designation. Chris is also a member of the Global Investor Board at AIMA, and author of the book Better Than Alpha: Three Steps to Capturing Excess Returns in a Changing World.

Michael Scott is a Senior Analyst at Albourne Partners on the Private Credit Investment Due Diligence team. He began his career at a Toronto-based credit hedge fund before joining TD’s Investment Manager Research team, helping to develop its alternatives platform with a focus on private credit. He holds an Honours Bachelor of Commerce (summa cum laude) from McMaster University, a Master of Finance and an MSc in Management (Finance) from Queen’s University, and is a CAIA charterholder.

Moderator

As a Senior Lead Tax Partner, Scott Woods co-leads KPMG’s National Credit Funds Tax Practice initiatives, providing tax advisory and compliance services for alternative investment fund clients. These clients include private credit, distressed debt, private equity, hedge funds, special situation funds, venture capital funds, fund of funds, and mortgage REITs. He has extensive experience in structuring and operating investment funds. As a thought leader in the alternative investments space, Scott frequently presents at conferences and KPMG events and contributes to several podcasts, discussing current topics and trends.

Scott is a graduate from the University of North Texas holding a BS in accounting, a BBA in finance, and an MS in taxation

12:00pm - 1:15pm

All conference lunch and networking

Generously sponsored by Coatue

1:15pm - 1:30pm

TAIA lifetime achievement presentation

Honoring a distinguished leader whose contributions have shaped alternatives investing

Award recipient

Salem Abraham is the President of Abraham Trading. Salem graduated cum laude from the University of Notre Dame in December 1987 with a bachelor’s degree in finance. He began his investing career as a futures trader while still in college, using quantitative models to trade global futures markets beginning in 1987. Throughout his career, Salem has managed investments in stocks, bonds, options, derivatives, and private equity. He has held full membership seats at both the Chicago Mercantile Exchange and the Chicago Board of Trade. His first investment experiences were shared with his grandfather, who employed him to buy and sell distressed minerals and ranches in the Texas Panhandle in the late 80s. In total, Salem has bought and sold more than 200,000 acres of land and resources. He manages investments in oil and gas properties, wind rights and residential, commercial, and agricultural real estate properties.

Salem has served on nonprofit investment boards for over 25 years. From 1995 to 2014, he served on the Amarillo Area Foundation Investment Committee. From 2004 to 2021, he served on the St. Jude Children’s Research Hospital Investment Committee. He assists with both large and small nonprofit endowments, with portfolios ranging from $1 million to over $4 billion in assets. His experiences with large and small institutional investors have provided insights into the unique mandates and challenges of managing foundation and endowment portfolios of all sizes. Salem started the Pickens-Abraham Foundation with T. Boone Pickens in 2008. The foundation provided college scholarships to accomplished graduating seniors in the Texas Panhandle. The investment strategy that Salem used for his part of the foundation was the inspiration for the Abraham Fortress Fund strategy. After Pickens’ death, the Pickens-Abraham Foundation dissolved, and Salem’s portion of the money became the Salem and Ruth Ann Abraham Foundation. The foundation provides education scholarships and donates to universities, family services, children’s causes, and health services.

Salem has been featured in Michael Covel’s books The Complete TurtleTrader and Trend Following. He has also appeared in Bloomberg Markets, Absolute Return, Barron’s, Institutional Investor, and The New York Times.

Salem continues to lead the research efforts at Abraham Trading Company.

Introduced by

Shaun joined Artemis Capital Management with 15 years of capital raising experience in the global macro hedge fund space. Before joining Artemis, Shaun directed the capital raising efforts at Abraham Trading Company for thirteen years and at e360 Power LLC for one year. Shaun attended The University of Texas at Austin. While at Texas, he was a captain of the Swimming & Diving team which won 4 consecutive NCAA National Championships. He graduated with a degree in Economics in 1991 and returned to The University of Texas at Austin for an MBA, which he received in 1997. Shaun was a member of the 1988 and 1992 USA Olympic Swim Teams, where he won two Olympic Gold Medals as a member of the 4X100 freestyle relay. Shaun is a member of The Harry Ransom Center Advisory Council, The Austin Bat Cave Board of Advisors and is a University of Texas Athletic Department Ambassador.

1:30pm - 2:00pm

Keynote fireside discussion: Investing in AI: A Conversation with Magnetar and CoreWeave

Speakers

Dave Snyderman is the Senior Managing Partner of Magnetar and Global Head of the firm’s Alternative Credit and Fixed Income business. He also serves as Chairman of the firm’s Investment Committee and is a member of both the Executive Committee and the Management Committee. As the Global Head of Alternative Credit and Fixed Income, Dave oversees the sourcing and management of investment opportunities across a broad range of private and public credit markets – including specialty finance, significant risk transfer (SRT) and opportunistic primary and secondary market investments across a variety of asset classes.

With over 25 years of experience in fixed income markets, Dave joined Magnetar in 2005 shortly after the firm’s launch.

Prior to joining Magnetar, Dave was Head of Global Credit and a Senior Managing Director at Citadel Investment Group. Over his nearly seven-year tenure at Citadel, he worked on the convertible bond desk, helped establish the credit trading desk and ultimately presided over the merger of these two groups. He also served in a senior leadership role as a member of Citadel’s Management, Portfolio Management and Investment/Risk Committees.

Earlier in his career, Dave managed portfolios focused on convertible securities, merger arbitrage and special situations at Koch Industries, Inc., working in the firm’s Houston, Wichita and Switzerland offices over a five-year period. He began his career at PricewaterhouseCoopers.

He holds a Bachelor of Arts in Economics from Washington University and completed the Certified Public Accountant exam.

Ernie Rogers is the Chief Architect, Strategic Financing at CoreWeave. Prior to joining CoreWeave, Ernie served both as a partner and the Chief Operating Officer at Magnetar, as well as a Director at CoreWeave. At Magnetar, he was responsible for all aspects of the firm’s operations and finances, including managing a diverse array of both back-office and select front-office teams. This broad array of responsibilities included deep involvement in firm strategy, launching and building new businesses and leading Magnetar’s artificial intelligence and blockchain initiatives.

2:00pm - 2:30pm

Finding value across alternative credit: Opportunities in asset-based finance, hybrid capital and capital solutions

Speakers

Mr. Ensminger-Law is a managing director and portfolio manager in the New York office. His responsibilities include sourcing and underwriting specialty finance and asset-based investments in the U.S. Prior to joining PIMCO in 2018, he was an analyst at Claren Road with a focus on structured credit and specialty finance investments. Mr. Ensminger-Law previously worked at Citigroup in the U.S. and Asia, focusing on structured finance, securitized products, and credit derivatives. He began his career at MMC, where he worked in a variety of roles focused on structured insurance and reinsurance transactions. He has 24 years of investment experience and holds an MBA from the University of Virginia and a bachelor’s degree from Brown University.

Michael Ginnings joined TPG Credit in 2022 and is a Firm Partner. Mike is a leader on the TPG Credit Solutions Platform where he oversees a team focused on investments in technology, media, and telecom companies. Mike has been a credit investor for over 15 years. Prior to joining TPG, Mike was a Managing Director at Contrarian Capital Management. Mike received a B.B.A. in Finance from the University of Texas at Austin. Mike was recognized by the McCombs School of Business at the University of Texas at Austin with the 2024 Rising Star Award, and he currently serves as the Chair of New York for McCombs.

David Lyon is Head of NB Capital Solutions. Prior to joining Neuberger Berman in 2014, he was the Director of Research at Ellis Lake Capital, a $500 million event-driven credit hedge fund based in New York. Before Ellis Lake, Mr. Lyon was one of three professionals responsible for the day-to-day management of a multi-billion-dollar portfolio of credit and equity investments at D. E. Shaw. At D. E. Shaw, Mr. Lyon was also responsible for the private equity efforts in the credit opportunities group and sat on several public and private company boards. Previously, Mr. Lyon was a Managing Director at The Cypress Group, a $3.5 billion private equity fund, where he was a member of the Investment Committee. Prior to Cypress, Mr. Lyon was one of five original professionals at Och-Ziff Capital Management and worked in the Mergers & Acquisitions department of Goldman Sachs. Mr. Lyon earned a M.B.A. from Harvard Business School and a B.A. in Philosophy from the University of Notre Dame, where he graduated summa cum laude and Phi Beta Kappa.

Moderator

2:30pm - 3:00pm

Inside the nuclear opportunity: A keynote interview with Charles Oppenheimer

Speaker

Charles Oppenheimer is the founder of the nonprofit Oppenheimer Project, dedicated to J. Robert Oppenheimer’s vision of international cooperation toward a safe future – by promoting hope, action and unity to address the world’s most pressing challenges. Charles is also founder and CEO of the startup Oppenheimer Energy, focused on nuclear energy deployment. Before founding the Oppenheimer entities, he spent 20+ years in Silicon Valley in the software industry, in roles ranging from programmer to CEO.

Charles has been a speaker at global events and conferences on science and diplomacy, nuclear non-proliferation, nuclear energy, AI and more. He has appeared in interviews by major media networks and in documentaries on the subject of his grandfather J. Robert Oppenheimer. Charles has also been widely published, including in The Bulletin of Atomic Scientists, TIME, The New York Times, Fast Company, Newsweek and USA Today. He is an investor in startups and social enterprises from Silicon Valley to Sub-Saharan Africa.

Moderator

John Ritter serves as Managing Director and Head of Real Assets covering real estate, infrastructure, and natural resources. Prior to TMRS, he served as the Head of Real Assets at the University of California’s endowment and started the Infrastructure and Natural Resource portfolios at the Teacher Retirement System of Texas. John has served as an adjunct professor at the University of Texas where he taught investments at both the undergraduate and graduate levels.

Ritter received JD, MBA, and BBA in Finance from the University of Texas at Austin and holds the Chartered Financial Analyst (CFA).

3:00pm - 3:30pm

Networking break

3:30pm - 3:45pm

Charity award: Kerr County Relief

Presented by

Austin Dickson is the CEO of the Community Foundation of the Texas Hill Country, a public charitable foundation serving a 10-county region of Central and South Texas. The Foundation makes grants to nonprofit organizations, provides academic scholarships, and invests in the long-term strength of Hill Country communities across areas such as education, healthcare, community development, conservation, the arts, and human services. The Foundation has taken a leading role in the community recovery efforts after the devastating July 2025 flooding in the Hill Country region. In addition to his civic leadership, Austin has spent 20 years in higher education teaching and mentoring future leaders. He currently teaches graduate-level courses in nonprofit leadership at Emory University and the University of Texas at San Antonio.

3:45pm – 4:15pm

Taking stock in Texas: TXSE’s emergence as a capital markets hub

Speakers

Nicole brings nearly 17 years of extensive experience collaborating with public and private companies across the United States. Previously, she served as senior managing director, listings at Nasdaq. In that capacity, Nicole played a pivotal role in driving the growth and development of Nasdaq’s listings and services, forging strategic partnerships throughout every stage of the capital markets lifecycle. Nicole is a graduate of Southern Methodist University.

Connor Hartley, Managing Director, is Global Head of Corporate Development for BlackRock. He oversees firm-wide M&A and strategic minority investment activity and serves as a member of the Finance Executive Committee and the Global Operating Committee.Prior to joining BlackRock, Mr. Hartley served as Head of M&A and Ventures at S&P Global, having joined the firm through its merger with IHS Markit where he previously was Managing Director and Head of Corporate Development. Prior to IHS Markit, he held several senior corporate strategy and development roles at Ipreo, a Blackstone and Goldman Sachs Merchant Bank portfolio company and leading provider of financial technology and market intelligence solutions to financial sponsors, institutional investors, investment banks and corporate issuers.

Mr. Hartley earned a BA from Georgetown University with a double major in International Business and Marketing, and an MBA degree from Fordham University.

Moderator

Kevin is a managing director in the Strategic Client Coverage Group, where he is responsible for overseeing relationships with key clients in Global Banking & Markets – Public. He is also head of the US Southern Region Equities franchise. Kevin joined Goldman Sachs in 1996 as an associate.

From 1999 to 2001, he led Technology Research Sales in Chicago and became head of the Research Sales desk in 2001. In 2005, Kevin moved to New York and co-headed New York Research Sales and managed the US Merchandising desk. In 2008, he returned to Chicago, where he was head of the Midwest Institutional Equities business. In 2013, Kevin assumed additional responsibility as head of West Coast Institutional Equities and held both roles until assuming his current role in 2014. He was named managing director in 2004.

Kevin earned a BA in Business and an MS in Foreign Service from Georgetown University, where he served as president of the Alpha Sigma Nu and Beta Gamma Sigma honors societies. Prior to attending university, He served in the United States Marine Corps as an infantry squad leader. Kevin served two tours in the Middle East, including Operation Desert Storm, and before

that he worked with a security forces group in Naples, Italy.

4:15pm – 5:15pm

Pitch perfect 2026: Emerging manager pitch contest

Texas-based emerging managers pitch their best investment ideas to industry leaders in a live contest format

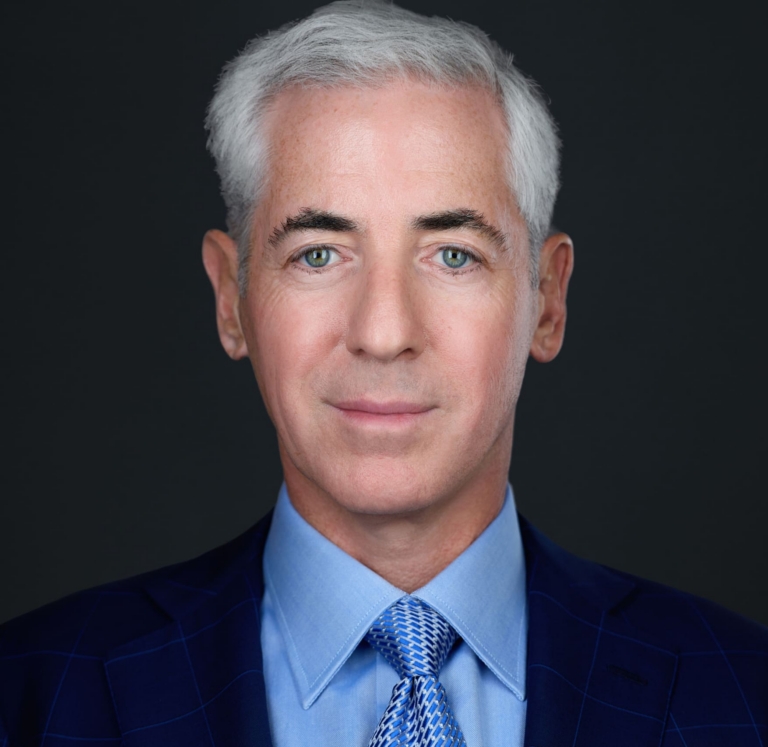

Judges

Bill Ackman is CEO of Pershing Square, a leading investment firm with $30 billion of assets under management. Mr. Ackman founded Pershing Square in 2004.

Pershing Square principally makes investments in a concentrated portfolio of high-quality, simple, predictable, cash-generative durable growth businesses. Pershing Square often works with its portfolio companies as an engaged and active investor to help create substantial long-term value.

Prior to founding Pershing Square, Mr. Ackman co-founded Gotham Partners in 1992, a research-driven, value-oriented investment firm that managed public and private equity investments. Before Gotham, Mr. Ackman began his career in real estate investment banking at Ackman Brothers and Singer, Inc.

Mr. Ackman is co-trustee of The Pershing Square Foundation, a family foundation established in 2006 to support exceptional leaders and innovative organizations that tackle important issues and deliver scalable and sustainable global impact. Pershing Square Philanthropies, which includes The Pershing Square Foundation, has committed more than $930 million in grants and investments in target areas including health and medicine, education, economic development and innovation.

Mr. Ackman currently serves as Executive Chairman of the board of Howard Hughes Holdings Inc. and as CEO and Chairman of Pershing Square SPARC Holdings, Ltd. He has previously served on the boards of numerous private and public companies. In addition, he served as a member of the Investor Advisory Committee on Financial Markets of the Federal Reserve Bank of New York and the Board of Dean’s Advisors of Harvard Business School.

Mr. Ackman holds an MBA from Harvard Business School and a Bachelor of Arts, magna cum laude, from Harvard College.

Jens Foehrenbach, CFA, is the President and Chief Investment Officer of Graham Capital Management, L.P. (“Graham”), an alternative investment manager with approximately $21B AUM as of January 1, 2025. Mr. Foehrenbach oversees and supervises Graham’s discretionary and systematic portfolio manager teams, trading, and research. Mr. Foehrenbach is also a member of the firm’s Executive, Investment, and Risk committees. Prior to joining Graham, he worked at Man Group from September 2008 to February 2025, most recently as Head of Public Markets within Discretionary Investments at Man Group. Mr. Foehrenbach has served in several capacities for the Man Group during his tenure at the firm, including Chief Investment Officer of Man Solutions and Chief Investment Officer of Man FRM. Prior to joining Man Group, Mr. Foehrenbach worked at Harcourt Investment Consulting AG as Senior Analyst and Head of Relative Value. Prior to Harcourt Investment Consulting AG, he was employed by UBS AG, where he worked on the bank’s fixed income derivatives trading desk in Switzerland and London. Jens Foehrenbach received a Master’s degree in Business Economics from the University of Basel, Switzerland in 2001.

Dave Snyderman is the Senior Managing Partner of Magnetar and Global Head of the firm’s Alternative Credit and Fixed Income business. He also serves as Chairman of the firm’s Investment Committee and is a member of both the Executive Committee and the Management Committee. As the Global Head of Alternative Credit and Fixed Income, Dave oversees the sourcing and management of investment opportunities across a broad range of private and public credit markets – including specialty finance, significant risk transfer (SRT) and opportunistic primary and secondary market investments across a variety of asset classes.

With over 25 years of experience in fixed income markets, Dave joined Magnetar in 2005 shortly after the firm’s launch.

Prior to joining Magnetar, Dave was Head of Global Credit and a Senior Managing Director at Citadel Investment Group. Over his nearly seven-year tenure at Citadel, he worked on the convertible bond desk, helped establish the credit trading desk and ultimately presided over the merger of these two groups. He also served in a senior leadership role as a member of Citadel’s Management, Portfolio Management and Investment/Risk Committees.

Earlier in his career, Dave managed portfolios focused on convertible securities, merger arbitrage and special situations at Koch Industries, Inc., working in the firm’s Houston, Wichita and Switzerland offices over a five-year period. He began his career at PricewaterhouseCoopers.

He holds a Bachelor of Arts in Economics from Washington University and completed the Certified Public Accountant exam.

Pitchers

Michael is responsible for overseeing and directing all investment strategies and operations across private funds, SMAs, structured finance and direct-deal transactions. Prior to Waterloo Associates, Michael worked for the Teacher Retirement System of Texas in the Private Markets group where he oversaw over $2 billion of investments across Real Asset, Private Equity and Energy Infrastructure verticals. He also spent time working at Castle Hill Partners where he analyzed, structured and executed on a variety of direct investment strategies and operations across a wide range of real estate, operating company and structured finance transactions. Michael graduated from Texas A&M with a B.A. in Business Administration and Economics and a M.S. in Finance with a focus in Real Estate.

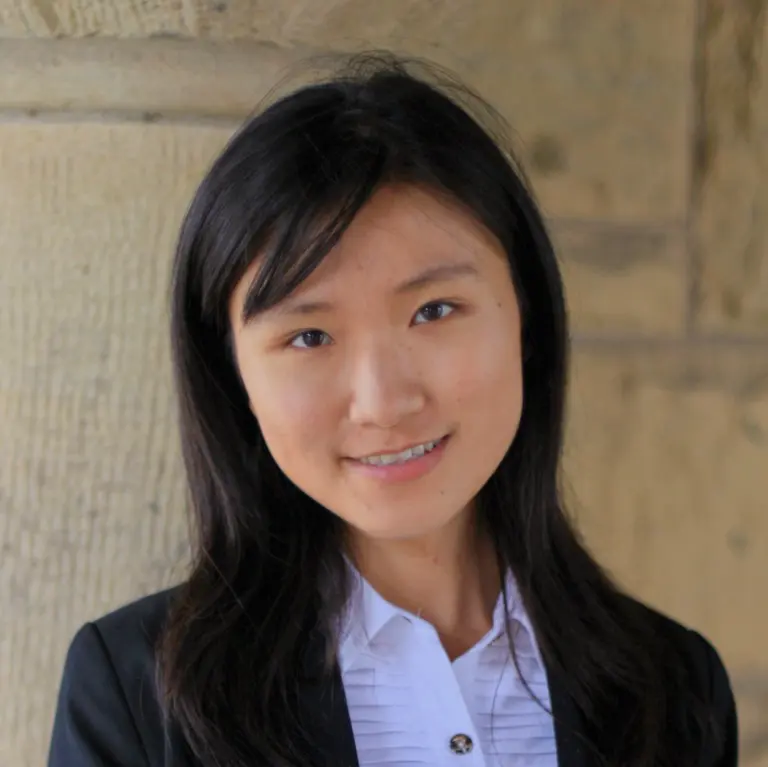

Xiaoying Tian is the Founder and Chief Investment Officer of Saturn V Capital Management. Prior to founding the firm in 2021, Ms. Tian spent four years at Farallon Capital Management investing in biotech companies with upcoming event catalysts. There she pioneered the statistical methods used to predict clinical trial outcomes for these catalysts. Using this data-driven approach, she applied fundamental and quantitative methods to underwrite clinical trials and position her portfolio based on the forecasted probabilities. The fund utilizes a combination of scientific analysis, financial modeling and proprietary statistical methodologies to predict the outcomes of clinical trials pivotal to FDA approval. The prediction and investment positioning are based on the outputs of these models in combination with our financial and scientific underwriting.

Xiaoying holds a PhD in Statistics from Stanford University where she collaborated extensively with Stanford Medical School while developing her statistically based, trial underwriting approach. Her work was published in top science and statistical journals, including Proceedings of the National Academy of Sciences. Ms. Tian also earned a BS in Mathematics from Fudan University, graduating top of her class and ranking 4th in the Chinese Undergraduate Mathematical Competition.

Host

Steven Wilson is Director in the Public Markets group at the Teacher Retirement System of Texas, a $200 billion pension system serving 1.8 million active and retired educators and their families. Mr. Wilson is responsible for the $10B Stable Value Hedge Fund Portfolio, which includes allocations to Equity Market Neutral, Macro, Managed Futures, Platform, Volatility, and Reinsurance Hedge Funds. He is also responsible for the $7B World Equity Portfolio, which includes Beta Sensitive strategies benchmarked to global equity indices.

Prior to joining TRS, Mr. Wilson was an Investment Director at Ameriprise Private Wealth Advisors, where he oversaw fund selection for $250 million of client assets.

Mr. Wilson received an MBA from the Rice University Jones School of Business in 2012, is a graduate of the University of Texas at Austin McCombs School of Business, and holds the CAIA designation.

5:15pm – 5:45pm

The LP CIO perspective: Building durable portfolios amid economic shifts

Speakers

Anne-Marie Fink serves as the State of Wisconsin Investment Board’s Chief Investment Officer for Private Markets and Funds Alpha. With SWIB since 2020, she is responsible for overseeing more than $75 billion across private equity, real estate, hedge funds, externally managed accounts, private debt, and venture capital portfolios, and a team of 40 professionals.

Anne-Marie has more than two decades of investment management experience. She served as the chief investment officer for the Employees’ Retirement System of Rhode Island and for a large family office. Anne-Marie started her investment career at JP Morgan, where she spent more than 16 years as an equity and hedge fund analyst. Before SWIB, she was at State Street Global Advisors as the portfolio strategist for alternative investments.

Anne-Marie earned a Bachelor of Arts degree from Yale University and an MBA from Columbia Business School. She is also the author of The Money Makers: How Extraordinary Managers Win in a World Turned Upside Down, which draws on investors’ experience to identify best practices in business management across companies and industries.

Jason R. Safran joined Texas Christian University (TCU) in 2012 as part of the Endowment team and was appointed the second Chief Investment Officer (CIO) of TCU in December 2021, following five months of service as Interim CIO. As CIO, he oversees the daily operations of a team of seven professionals responsible for managing the University’s Endowment assets and short-term investment portfolios. Safran’s investment approach is grounded in mission-aligned stewardship of permanent capital, seeking to compound at a high rate across market cycles through an objectives-based framework, disciplined risk oversight, and active management with a select group of exceptional partners. Before becoming CIO, Safran was a Senior Asset Manager for TCU’s Endowment, where he focused on researching and evaluating investment opportunities across various asset classes.

Safran began his career as a research associate at John McStay Investment Counsel, a boutique equity investment firm. After earning his MBA, he joined Cimarron Asset Management, an institutional advisory firm specializing in relative-value portfolios. Following a merger, he worked as a portfolio manager at Smith Asset Management, L.P., overseeing relative-value equity strategies. Before joining TCU, he was a senior investment analyst at Texas Capital Bank.

Safran earned his MBA from the University of Texas at Austin in 2006 and his BBA in finance with a minor in economics from TCU in 2001. He is a CFA® charterholder and serves on the strategic advisory board for the CFA Society of Dallas/Fort Worth and on the investment committee at Texas Health Resources.

As a member of the Chancellor’s Cabinet, Safran serves as the liaison to the Investment Committee of TCU’s Board of Trustees. He is also part of the Executive Committee for TCU’s Private Partnership Development, which focuses on campus development planning and oversight.

Safran is dedicated to mentoring the next generation of investment professionals through classroom lectures, one-on-one mentoring, and active involvement in a student internship program.

John D. Skjervem is Chief Investment Officer for Utah Retirement Systems (URS) which manages a financial and real asset portfolio totaling $65.4 billion as of December 31, 2025, and comprises defined benefit and defined contribution retirement programs as well as insurance-related assets. Prior to URS, John was Chief Executive Officer of Alan Biller and Associates, responsible for its $131 billion institutional investment advisory practice.

John also previously served as Chief Investment Officer for Oregon State Treasury where his team managed a $111 billion, globally-diversified investment program. Before his tenure in Oregon, John held a variety of portfolio management and leadership positions at Northern Trust including Chief Investment Officer for that firm’s $180 billion wealth management division.

John is a member of the Alaska Permanent Fund Corporation’s Investment Advisory Group, an advisor to the Retirement Board of the Public Employee Retirement System of Idaho and a member of the IEEE Foundation’s investment committee. He is also a member of the Milken Institute’s Global Capital Markets Advisory Committee, serves on the Investor Advisory Group of the International Sustainability Standards Board and is an Investor Board Member for the National Institute of Public Finance. John holds the Chartered Financial Analyst designation, received his BA in Economics from the University of California, Santa Barbara, and earned an MBA with concentrations in Finance and Statistics from the University of Chicago’s Booth School of Business.

Moderated by

Jens Foehrenbach, CFA, is the President and Chief Investment Officer of Graham Capital Management, L.P. (“Graham”), an alternative investment manager with approximately $21B AUM as of January 1, 2025. Mr. Foehrenbach oversees and supervises Graham’s discretionary and systematic portfolio manager teams, trading, and research. Mr. Foehrenbach is also a member of the firm’s Executive, Investment, and Risk committees. Prior to joining Graham, he worked at Man Group from September 2008 to February 2025, most recently as Head of Public Markets within Discretionary Investments at Man Group. Mr. Foehrenbach has served in several capacities for the Man Group during his tenure at the firm, including Chief Investment Officer of Man Solutions and Chief Investment Officer of Man FRM. Prior to joining Man Group, Mr. Foehrenbach worked at Harcourt Investment Consulting AG as Senior Analyst and Head of Relative Value. Prior to Harcourt Investment Consulting AG, he was employed by UBS AG, where he worked on the bank’s fixed income derivatives trading desk in Switzerland and London. Jens Foehrenbach received a Master’s degree in Business Economics from the University of Basel, Switzerland in 2001.

5:45pm - 6:00pm

Closing remarks

Speakers