Research note: Adding alternative assets materially improves portfolio performance

Modern portfolio theory shows that combining assets with different risk profiles into a larger portfolio reduces the individual influence of each asset’s idiosyncratic risk. This enables investors to achieve a higher return for a given level of volatility or, what is the same thing, lower risk for the same average return.

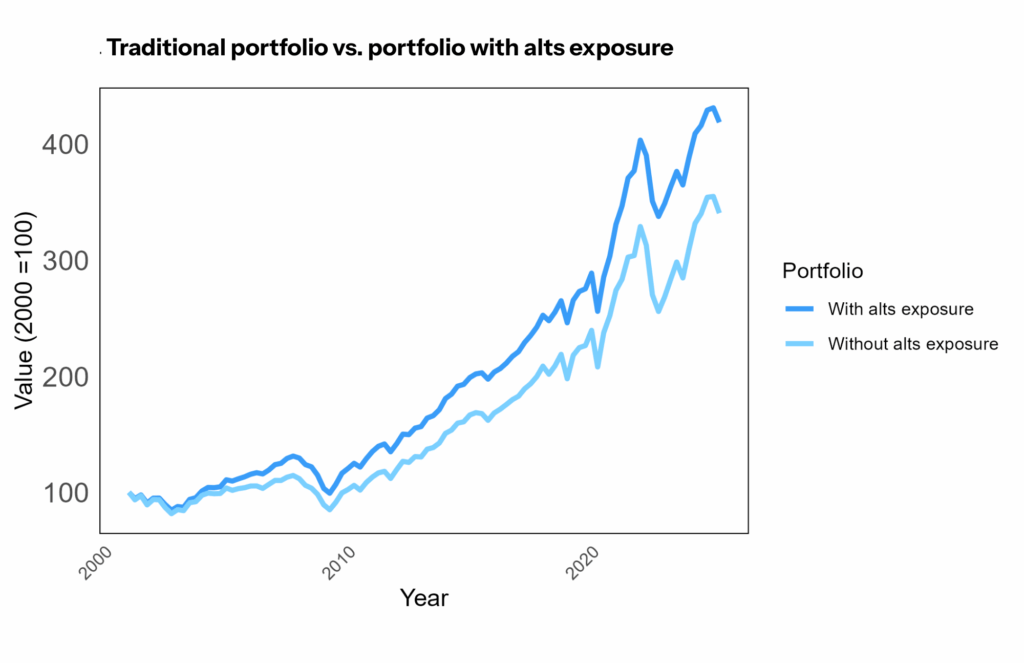

A 25 year back test of a portfolio with an allocation to hedge fund, private equity, and private credit investments compared with a 60/40 equity-bond portfolio resulted in:

-

A 23% increase in the final portfolio value.

-

Over one percentage point decrease in volatility of annual risk adjusted returns.

-

A 0.17 increase in the Sharpe ratio, a measure of average return per unit of risk.

This evidence shows that investments in alternative assets, net of fees, can offer diversification benefits beyond what traditional market exposures provide.

Data used in portfolio construction

For the back test, two portfolios were constructed using historical data from the past 25 years. The first was a standard 60/40 investment portfolio composed of stocks (60%) and bonds (40%). The second incorporated alternative assets to test the impact of including those assets on long-term performance and risk-adjusted returns.

Traditional 60/40 portfolio

- 60% Equity exposure: S&P 500 Index.

- 40% Fixed income exposure: Bloomberg U.S. Aggregate Bond Index – Total Return Value (Unhedged in USD).

Diversified alternatives portfolio

- Maintained equity and bond exposures as in the traditional portfolio:

- 50% S&P 500 Index,

- 35% Bloomberg U.S. Aggregate Bond Index.

- Added 15% total allocation to alternative assets, split evenly across:

- 5% Preqin All Hedge Fund Index (net of fees),

- 5% Preqin Private Equity ex. Venture Capital (net of fees),

- 5% Preqin Private Debt Index (net of fees).

This setup allowed for a direct comparison of a traditional equity-bond portfolio with one that includes alternative assets, using consistent benchmarks and net-of-fee returns. All returns are relative to the risk-free rate, measured using the Bloomberg U.S. Treasury Bills: 1–3 Months Total Return Index (Unhedged in USD).

Results

The back test reveals that incorporating alternative investments materially improved average returns and risk-adjusted performance over the 25-year period.

Results of traditional vs more diversified portfolio

Metric |

Traditional 60/40 portfolio |

More diversified portfolio |

| Annualized return | 5.6% | 6.3% |

| Annualized volatility | 10.0% | 8.6% |

| Cumulative return | 240.4% | 318.6% |

| Final dollar value | $340.4 | $418.6 |

| Sharpe ratio | 0.56 | 0.73 |

Compared with the standard portfolio, the alternatives portfolio produced a higher total and annualized return, reduced volatility, and achieved a higher Sharpe ratio, indicating superior risk-adjusted performance.

Related research

These conclusions are consistent with independent evidence demonstrating the benefits of potentially including alternative investments in retirement portfolios. A study by Morningstar Investment Management shows that adding so-called semi-liquid private equity and private credit funds through collective investment trusts—investment vehicles that employers could make available to retirement savers—to the usual mix of stock and bond index funds in 401(k) plans helps people achieve a sustainable retirement income target.1 The study uses data from more than 265,000 real workers to model how private investment allocations of up to 15% affected workers’ retirement incomes. In all the hypothetical scenarios, the private market allocations improved retirement outcomes for the workers, underscoring the conclusions of MFA’s analysis—alternatives can enhance risk-adjusted returns when added to the conventional 60/40 portfolio.

Conclusion

Adding alternative assets like hedge funds and private credit improved portfolio outcomes in this back test. Investors would have received higher returns, lower volatility, and a better overall risk-return profile with this portfolio than with the 60/40 portfolio. These results support the fundamental principle of diversification: combining different asset classes can lead to stronger, more resilient portfolios.