Adding alts to your 401(k) mitigates risk, reduces volatility, and makes it more resilient

Policymakers are looking to give 401(k) plans more latitude to include alternative investments. This has sparked a lively debate—from Washington to Wall Street to Main Street—about whether this will actually help retirement savers grow their nest eggs. (MFA showed in an earlier blog that it will.)

However, what often gets overlooked is arguably an even bigger advantage: Adding alternatives to the traditional mix of stocks and bonds reduces risk and makes portfolios more resilient. That’s crucial for anyone focused on building a more secure retirement.

The benefit comes from diversification. By giving investors access to a broader array of assets, they can generate better returns without increasing their overall risk. That’s because the performance of a private credit fund, for example, isn’t typically correlated to the performance of public equities.

Since it’s unusual for different investments to move in lockstep, when one is struggling, others might be doing fine. You create a stronger and safer portfolio by mixing asset classes that behave differently. If one segment lags, others can offset the shortfall, producing a more stable long-term outcome. In short, investing in a diverse set of assets reduces the risk of any single one hurting your overall returns.

The risk-mitigating benefits of diversification have long attracted pension funds and other institutional investors to alternative assets, which offer returns with especially low correlations to traditional investments. Policymakers now want to expand 401(k) access to alternatives so retirement savers can share those advantages.

From theory to practice: Alternative investments can offer diversification benefits

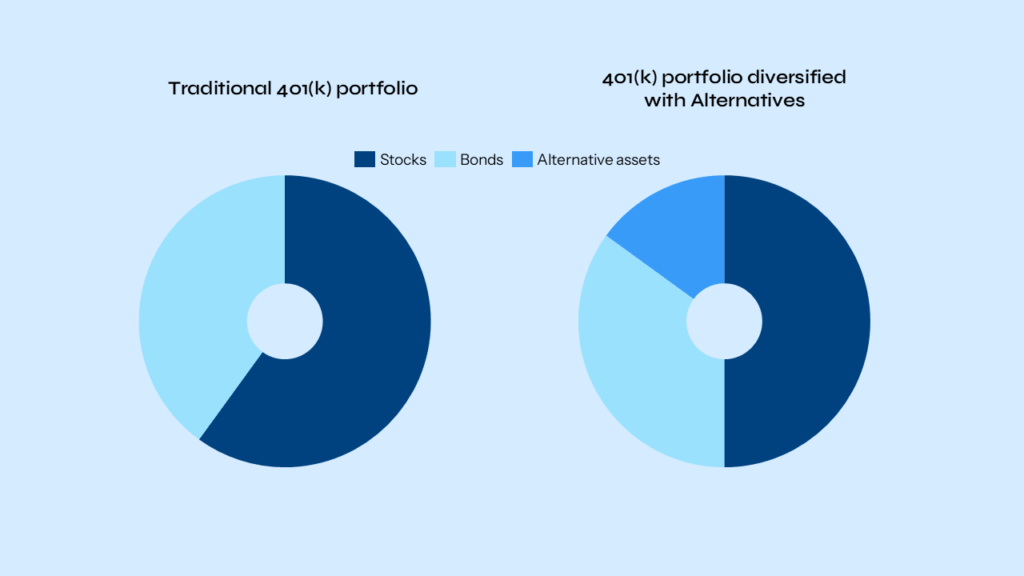

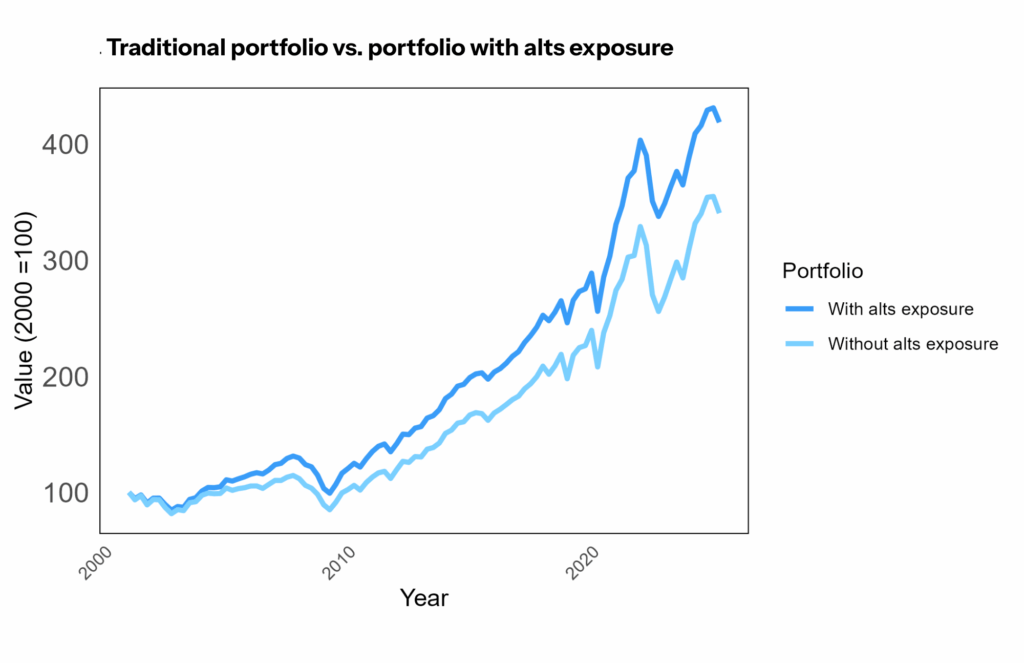

To test the long-term benefits of diversification, MFA conducted a back test of the traditional 60/40 equity-bond portfolio compared to a portfolio that includes exposures to alternative asset manager’s funds. The 60/40 portfolio is a good benchmark against which to compare a portfolio that includes alternatives because it approximates a typical portfolio many investors hold. This 25-year back test resulted in:

- A 23% increase in the final portfolio value.

- Over one percentage point decrease in volatility of annual risk adjusted returns.

- A 0.17 increase in the Sharpe ratio, a measure of average return per unit of risk.

The Sharpe ratio assesses how much of a return you’re getting for the risk you’re taking—in other words, whether the reward is worth the risk. It compares a portfolio’s return above the risk-free rate to its volatility, expressed as standard deviation. A higher Sharpe ratio indicates better returns relative to risk. The upshot? The higher Sharpe ratio for the portfolio including alternatives signals that, net of fees, these assets can improve the risk-return tradeoff for long-term investors.

Additionally, a study by Morningstar Investment Management shows that adding semi-liquid private equity and private credit funds through collective investment trusts to the usual mix of stock and bond index funds in 401(k)s helps people achieve a sustainable retirement income target.

Strengthening portfolios through alternatives

In sum, the evidence is clear: diversification is the cornerstone of making portfolios more resilient for long-term investors. By combining traditional investments with less correlated asset classes—such as private markets—investors can enhance portfolio value, reduce volatility, and improve Sharpe ratios. The integration of alternative assets strengthens traditional portfolios and supports sustainable retirement outcomes, underscoring the importance of embracing a diversified approach to long-term investing.