The Rise of Private Credit

Private credit refers to lending by nonbank investors—such as private funds and institutions—to businesses that need capital, often small and mid-sized firms. The market has grown rapidly since the global financial crisis, providing flexible financing that supports growth, jobs, and economic stability.

Private Credit’s Role in U.S. Financial Stability

During periods of market stress – such as the onset of the COVID-19 pandemic – many traditional lenders tend to pull back. Private credit providers, by contrast, continue to lend capital to businesses in need, helping companies maintain operations, retain workers, and fund investment.

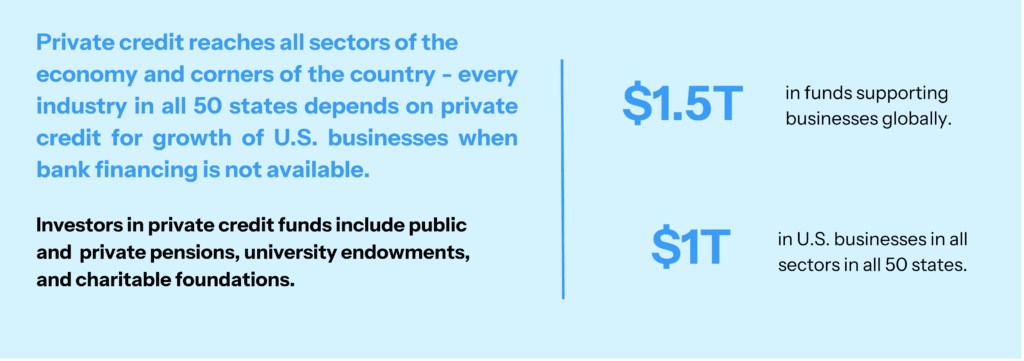

Private credit funds have become a crucial source of financing for small and mid-sized U.S. companies that might otherwise struggle to access bank funding. According to Federal Reserve analysis, the U.S. private credit market has grown to roughly $1.34 trillion in the United States and nearly $2 trillion globally by mid-2024, after expanding roughly fivefold since 2009.1

This scale, and the ability to supply credit when banks retrench, has made private credit an increasingly important part of the U.S. financial system.

How private credit helps stabilize financial markets and limits taxpayer risk.

Limited Liquidity Risk

Most private credit funds are closed-end with multi-year investor commitments and no on-demand redemptions, which are structured to limit potential runs, in contrast with deposit-taking banks. The long-term holding periods prevent runs on a fund and provide stability.

No Direct Government Exposure

Private credit funds are not backstopped by the federal government, meaning taxpayers are not liable if funds experience losses.

Low Risk of Contagion

Historical evidence and the structural design of private credit funds indicate that if a fund fails, losses are borne by that fund’s manager and investors and do not typically impact other funds or the broader financial system. The failure is generally insulated from systemic spillovers, limiting contagion risk.

Limited Evidence of Systemic Threat

A 2020 Government Accountability Office report found that private funds’ lending activities have not threatened financial stability.2 Private credit default rates are generally limited due to the strong debt structure, documentation, and underwriting that are adequately protective of lenders.3

References

1. “Bank Lending to Private Credit,” Federal Reserve, 2025

2. “Financial Stability,” Government Accountability Office, 2020.

3. “The Role of Private Credit in U.S. Capital Markets,” Proskauer, 2022.