Summary Points

- Incorporating short selling as part of an ESG-focused investment strategy can help shift capital away from high-emissions companies all while limiting losses for investors.

- Short selling has the potential to help reallocate $50-$140 billion of capital away from the most heavily polluting companies.

- To realize the full potential of short selling as an ESG tool, short positions of a high-emissions company should be counted separately or netted from the long positions when evaluating the ESG risk of a portfolio.

Forward

Between the SEC’s proposal to require mandatory climate reporting by public companies and significant volatility in global energy markets, never has the urgency of environmental, social, and governance (ESG) issues such as climate change been so front-and-center for regulators and investors alike.

That’s why the investment industry needs to marshal all the tools at its disposal to address these important issues.

Short-selling companies with large carbon footprints has the advantage of helping investors reduce their climate risk while also expressing their sustainability goals and values. Whether it’s in energy, transportation, or manufacturing, shorting securities offers two clear benefits. First, it further increases selling pressure on a specific security. Second, it allows investors the ability to become shareholders for change in a company without creating more ESG risk in their portfolio.

This important paper by the Managed Funds Association, in conjunction with Copenhagen Economics, details how short selling can contribute to increased capital allocation towards carbon neutral investments. It applies the theory to several scenarios and numerical examples, showing the positive impact short selling can have in pressuring companies to reduce greenhouse gas emissions.

To the same degree that owning a security helps a company finance itself and gives the owner a carbon footprint, holding a short position hinders a company’s finances and gives that holder a negative carbon footprint. Counting short positions as having a negative carbon footprint also helps facilitate positive engagement with those companies that need to change.

As more and more investors and corporations make net-zero emissions commitments, reaching a consensus on accurate carbon accounting is vital to achieving our collective aims. Even as it is important to avoid the trap of “double counting” carbon footprints, investors who short carbon emitters should get credit against their carbon footprint for doing so. This will be critical to the asset allocation decisions of many endowments, foundations, and smaller pension funds that invest in hedge funds.

Since shorting equities is a small fraction of the overall market, accounting for the carbon footprint of a short position will not eliminate the need for larger investors to act upon their sizable existing carbon footprints. But the last thing we want to do is penalize engaged—but properly hedged—investors by assigning them large carbon footprints because of misidentified offsetting short positions.

We at Harvard Management Company have learned from past experience that it is critical to develop standards around reporting so that fund managers are not overwhelmed with many unique informational requests from their LPs. We hope to see the asset management industry unify as much as possible around consistent standards to avoid competing views that could stall the process of reducing carbon from portfolios.

Ensuring that all means of reducing emissions are incorporated in our calculations will help us achieve our ESG goals.

Michael Cappucci

Managing Director, Sustainable Investing, Harvard Management Company

Executive Summary

Environmental, Social, and Governance (ESG) is becoming increasingly important to many investors. The growing focus on the risks of climate change has permeated many fields, with prominent voices such as former Bank of England Governor Mark Carney arguing that asset managers have a significant role to play in promoting the transition to a net-zero economy. Allocators of capital, such as the Harvard Management Company, have made reaching a carbon-neutral portfolio a top priority.¹ But how should one count the emissions generated by a portfolio? In particular, how should the emissions produced by companies that are sold short be counted? This paper showcases how short selling can be an essential tool to accomplish ESG goals by helping reallocate capital away from high-emissions companies all while maintaining investment performance.

Then, we introduce an equity demand model which shows that short sales have the potential to change the supply-demand balance for individual stocks and then estimate the effect of short sales on the allocation of capital. The paper then quantifies how the climate transition could have a differential effect on various sectors and how short selling allows investors to hedge that risk. In particular, the paper shows that short positions have the potential to reduce capital investment in the most emissions-heavy publicly traded companies by 3-8%.

The Current Debate of ESG and Short Selling

What are Short Sales?

Short selling is an essential, regulated trading tool that hedge funds use to expose fraud and corruption, reduce risk, enhance market integrity, and keep markets honest. Mechanically, this is accomplished by borrowing a share of stock from an owner and selling it, with the promise of buying it back and returning it later. Shorting has a very important role in modern financial markets, and sellers have a variety of motivations. Some investors short to try to take advantage of perceived overpricing while others do it as a part of a larger hedging or liquidity provision strategy.

How Might Short Sales Be Incorporated Into Portfolio Metrics

A portfolio is a combination of underlying positions. With traditional long (e.g. ownership) positions, creating an aggregate statistic for a full portfolio is relatively straightforward; it is just the total of the individual components. Be it earnings, stock price momentum, or carbon emissions intensity, the process is the same. One gets data for as many of the constituent investments as possible and then adds them together, with appropriated weighting by their share of the portfolio. These weights are then used to both classify as well as construct portfolios.

Short selling adds a wrinkle to creating summary portfolio statistics with two obvious solutions. One can include the short positions but assign them negative weight or one can separately report a summary of long and shorts. The first approach has the advantage of creating a single summary statistic, which is helpful when comparing portfolios. The second approach provides more information but can complicate the ability for investors to compare across portfolios.

Two other approaches, ignoring the shorts or including them as if they were long positions, are clearly unsatisfactory. Short positions have an impact on portfolios, just as longs do. Ignoring them fundamentally misrepresents a portfolio’s exposure. But the economic implications from a short are the opposite of a long, so treating them identically would lead to incorrect conclusions about a portfolio’s composition and exposures.

ESG Metrics at the Portfolio Level

ESG is becoming an increasingly important focus for many investment managers in their investment processes and fund-raising efforts. Managers often consider climate and other ESG-related risks as part of their standard risk analysis process when making investment decisions. Many managers have specific ESG criteria they consider when selecting assets and when serving as asset owners.

Amel-Zadeh and Serafeim (2017) surveyed 413 investment professionals at firms with $31 trillion in AUM and found that appealing to potential investors via high ESG awareness is an important concern. One third (33%) cited growing stakeholder demand as being a motivating factor for ESG investing, while 32.6% said ESG was part of their commercial strategy, and another 25% were already operating under client mandates.

Investors have a variety of financial and moral motivations for preferring asset managers who have high ESG integration. For example, an investor might believe that it is both a moral imperative to engage in responsible investing and that such an investment strategy is likely to outperform one that does not take ESG impacts into account. Whatever the motivation, it is important that ESG metrics, such as commercial ratings, adequately reflect the underlying exposures and real-world impact of the actual portfolio. Most investors are reliant on such a third-party evaluation of their asset managers’ ESG performance owing to both time and data limitations.

Researchers have uncovered a variety of ways that ESG information might affect investment performance. Indeed, Christensen (2018) uncovered no fewer than 380 papers related to ESG reporting. ESG disclosures are associated with lower capital constraints (Cheng et al. 2014), cost of capital (Dhaliwal et. al 2011), analyst forecast errors (Dhaliwal et. al 2012), and with stock price movements around mandatory ESG disclosure regulations (Grewal, Riedl and Serafeim 2017). Firms with better disclosures are more valuable (Plumlee et al. 2015) while firms which do not report climate risk, such as carbon emissions in some cases, may see some negative impact for their stock prices (Matsumura et al).

If ESG metrics do not accurately reflect the economic exposure a portfolio has to underlying ESG factors, they simply will not serve as reliable economic indicators. This means short positions must be appropriately accounted for by either reporting them separately or netting them from the long positions.

Firms that do not report climate risk may see some negative impact for their stock prices.

Consider an extreme example. Suppose there was a fund whose mandate was to be 100% short ESG unfriendly companies. That fund would benefit -100% on the ESG investment factor; but under an approach where shorts count like long positions, this fund would be classified as being the opposite, having a 100% exposure to ESG risks. Clearly investors would not be properly informed based on that metric and would also likely come to distrust ESG ratings in general.

How Short Selling Can Contribute to Increased Capital Allocation Towards Carbon Neutral Investments

A central question in ESG investing is whether the practice of selecting stocks based on their environmental impact influences capital allocation, making it relatively easier for greener companies to fund their investments. If this is the case, shorting heavy emitting companies should have similar effects on capital allocation i.e., direct investments away from fossil-fuel based companies.

Therefore, in this section, we investigate how hedging against climate risks effects the availability of the stock supply and estimate the impact on capital allocation of shorting carbon-heavy stocks.

Climate Hedging Affects Liquidity Of The Stock Supply

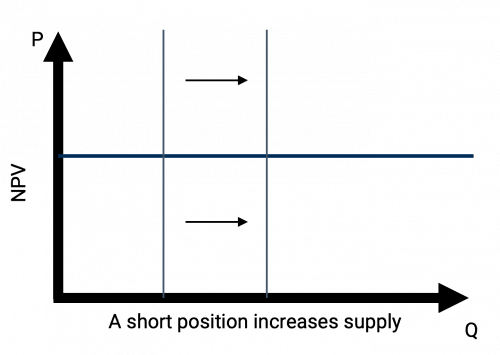

A hedging position that takes a short position in a carbon-heavy stock (and a long position in the market portfolio), increases the supply of the stock; it also increases the number of supply orders in the book (and increases the number of demand orders in the general market), see Figure 1.

FIGURE 1: Illustration of the stock supply effect of hedging

Whether such a position has a permanent price effect on the stock depends on the market response to the change in supply induced by the short position. The short position will tend to put downward pressure on the stock price. If this oversupply is not offset by an increase in demand orders reacting to the lower price, the short position will have permanent price effects.

The magnitude of the price effect depends on the ability of other investors to react to prices. If this ability is limited, the impact of short positions may be large. If other investors react strongly to idiosyncratic price movements, short selling may only have a limited effect on stock prices and capital cost.

According to traditional financial theory, where the stock price equals its fundamental value, a hedge cannot affect the allocation of capital.² If a hedging position drives prices on carbon-heavy stocks down while the market portfolio is pushed up, this will drive a wedge between the expected risk-adjusted return on carbon-heavy stocks and their price. This means that investors will be able to earn an excess (risk adjusted) return on carbon-heavy stocks. This excess return can be captured by using the opposite position, going long in carbon-heavy stocks and short in the market portfolio.

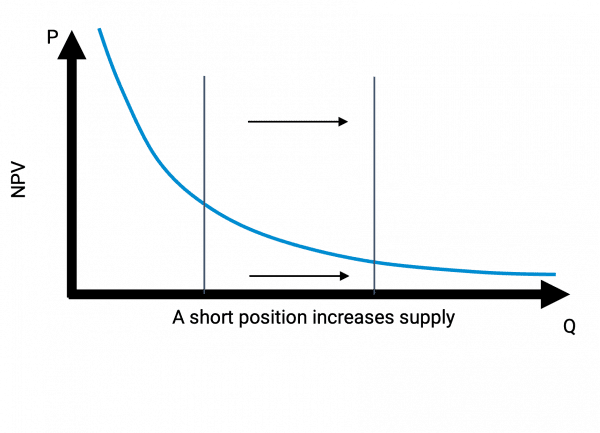

Consequently, the stock market’s reaction to an expansion of the supply book will be an unchanged market price, since the market is willing to demand an infinite amount of the stock at a price equal to the NPV. Hence, short positions in carbon-heavy stocks will have no effect on the cost of capital of carbon-heavy industries, see Figure 2.

FIGURE 2: Illustration of price effect according to classical finance.

While it is a subject of academic debate to what degree the stock prices can be said to be efficient and determined by fundamentals, a lack of complete efficiency is necessary for ESG-driven investing to have any effect. If ESG investors were completely counterbalanced by arbitrage-hunters taking opposite positions, ESG investing would not be able to affect the stock prices and thus also not the cost of equity of the polluting firms.

It has been documented that the demand curve for equity slopes downward, implying an increased short interest in a stock may affect the stock price (see also the section below, where we present elasticity from different empirical studies).³ This contradicts the efficient market hypothesis, but is an empirically well-supported prerequisite for ESG investing to affect the weighted average cost of capital (WACC). If inflows or outflows from an asset do not affect the price, ESG investing cannot affect the WACC and thus not the level of gross investments.

In practice, the observed fact that stock demand slopes downward can be explained by the fact that a large share of market participants are unable to react to stock mispricing the way that classical finance models require. For instance, 80% of the equity in S&P 500 is held by institutional investors.⁴ These often operate under a mandate which limits their ability to react to stock mispricing. Thus, the landscape of stock ownership creates an inertia in the stock market’s reaction to mispricing, meaning the stock market will not be able to absorb an infinite quantity of stock at a price equal to the NPV, see Figure 3.

FIGURE 3: Illustration of price effect according to empirical results.

Impact On Capital Allocation By Shorting Carbon-heavy Stocks

As discussed above, shorting carbon-heavy stocks would likely have an impact on equity prices. This means shorting also impacts the cost of capital and eventually capital allocation – just as ESG investing can influence capital allocation.

To analyse the effects of shorting, we estimate the impact on capital allocation of shorting carbon-heavy stocks under two scenarios:

SCENARIO 1

Evaluating the effect on WACC (weighted average cost of capital, a key measure of how much business investments cost) and total capital allocation of the current level of short interest on carbon-heavy stocks (i.e., compared to a situation of assets were not shorted at all).

SCENARIO 2

Evaluating the effect on WACC and total capital allocation if shorting of heavy emitting companies is fully used by investors to hedge climate risks (i.e., shorting increased to 10% of total market cap, which is assessed to be the maximum amount these assets realistically can be shorted over a longer time period ).⁵

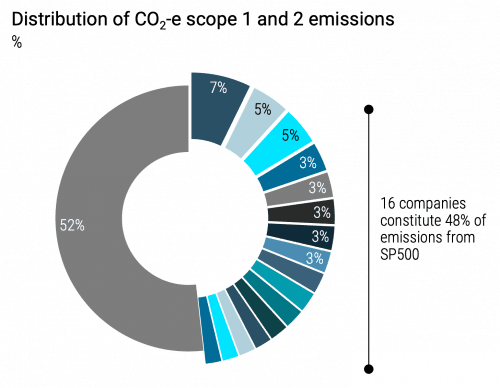

Our analysis focuses on short positions in the top 16 emitters, which are responsible for around half of all emissions (although their market capitalization only constitutes about 5% of the S&P 500). The idea is that investors would likely focus on shorting a few selected companies with high emissions to get an effective hedge against climate risks.

Assumptions in our Estimation

To estimate the impact on stock prices from shorting, we use a somewhat conservative stock demand elasticity of -2 based on empirical estimates,⁶ see Table 1 in the Appendix. The estimates vary in magnitude between papers from -0.2 to -3000. A numerically small elasticity implies that flows in and out of stocks have a large price effect while numerically large elasticities imply a small price effect.

Another important assumption is the extent that higher cost of capital reduces capital allocation. Here, we assume a capital stock elasticity of between 1-2.5, based on a previous study by Copenhagen Economics⁷ (see more details in the Appendix). This means that capital allocation for a given company declines by 1%-2.5% for each one percent the weighted capital costs increases. This is also called Weighted Average Cost of Capital (WACC), which is the rate that a company is expected to pay on average to all its security holders to finance its assets, both equity and debt.

The dynamics from higher capital costs to lower capital allocation are as follows: The higher cost of capital increases the required return an investment must have to be economically viable. This decreases the level of profitable investments for each company, giving rise to a lower capital allocation in steady state. For example, assume that a company’s WACC increases from 5% to 6%. After the WACC increase, investments with an expected return in the range 5%-6% will not be conducted, whereas they would before the WACC increase.⁸

The elasticity between capital costs and capital allocation is difficult to identify empirically. We therefore derive our elasticity from macroeconomic models, meaning it has significant uncertainty on a company level. This uncertainty is reflected in the rather wide range of 1-2.5, which we employ.

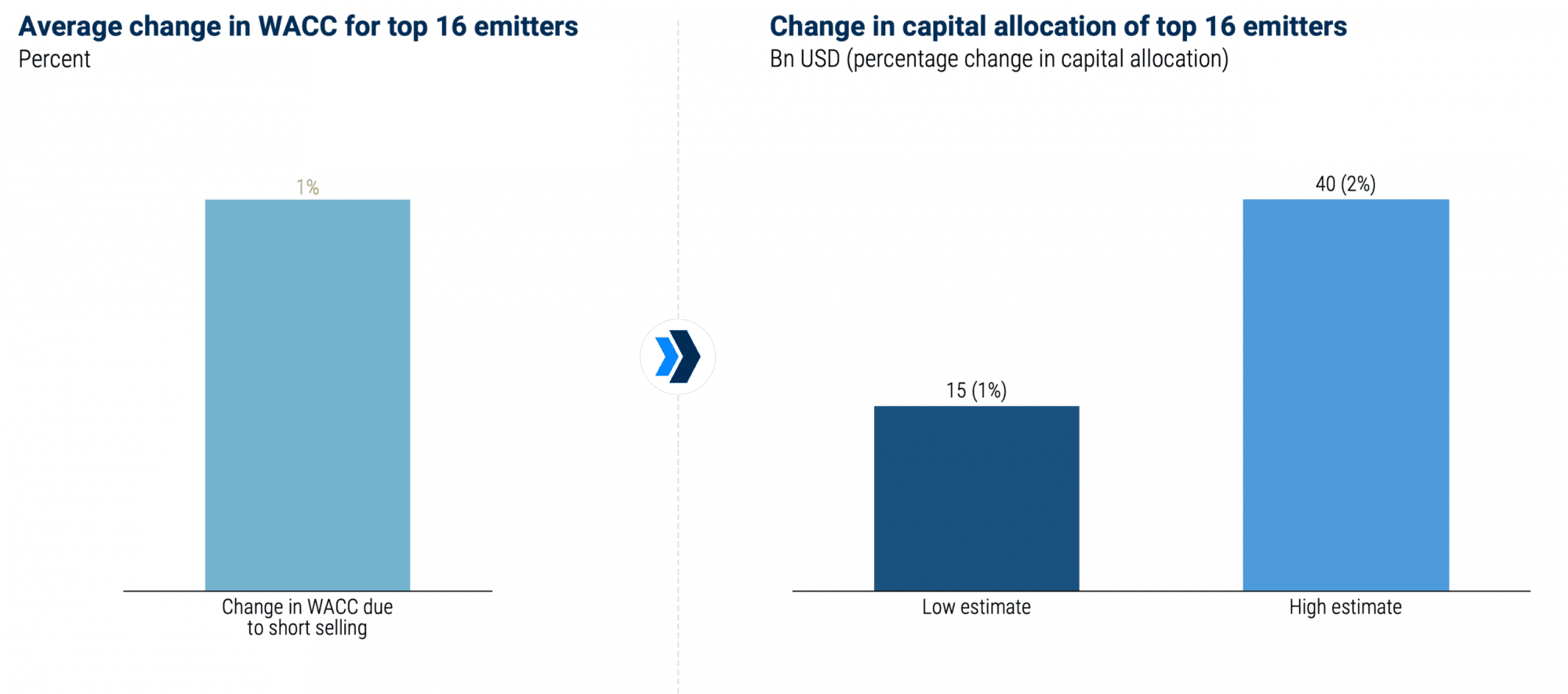

Scenario 1

In this scenario, we estimate how the current level of shorting has impacted WACC and capital allocation. Concretely, we assess the change compared to a situation of no shorting of the assets, to the current level of the short interest.

First, we find the WACC increases with an average of 0.045 percentage points for the heavy emitting companies, corresponding to a relative increase in WACC of 1%, see Figure 4.

Second, we estimate this increase in WACC results in a decline in capital allocation in the range of 1%-2% for the 16 top emitting companies. This corresponds to USD ~15-40bn. As mentioned, the range is due to uncertainties in the elasticity between WACC and capital allocation.

FIGURE 4: Scenario 1- Change in WACC and total assets

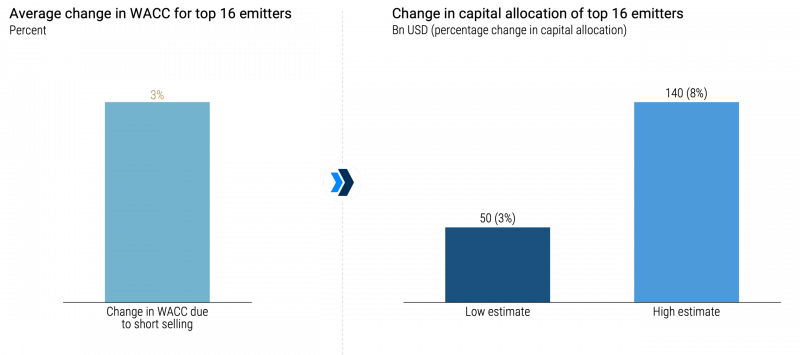

Scenario 2

In this scenario, we simulate the impact if shorting is used to the full extent in order to hedge climate risks. Concretely, we assume the heavy emitting stocks (top 16) is shorted by up to 10% of total market cap, which is assessed to be the maximum amount these assets realistically can be shorted over a sustained period.

First, we find that WACC increases with an average of 0.13 percentage points for the heavy emitting companies, corresponding to a relative increase in WACC of 3% on average, see Figure 5.

Second, we estimate that this increase in WACC results in a decline in capital allocation in the range of 3-8% for the 16 top emitting companies. This corresponds to ~$50-$140bn. As mentioned, the range is due to uncertainties in the elasticity between WACC and capital allocation.

Portfolio Climate Risks Mitigation Through Short Selling of Carbon-Heavy Stocks

In the previous section, we described the effect short selling could have on emissions-intensive investments. In this section, we demonstrate this through a numerical example of a generic portfolio resembling the S&P 500 index.

There is no single correct way to short heavy emitting stocks to hedge against climate and other risks – there are likely as many optimal strategies as there are investors. Also, investors can use several tools to hedge against climate risks. For example, buying emission allowances (which likely would increase in value in a transition risk scenario shock) is another possible strategy.

Thus, the purpose of the presented example is merely to showcase how shorting of heavy emitting stocks can be used to create a portfolio that would express the investment thesis that climate change regulations will be costly to some companies. As with all investment ideas, this might or might not come to pass, and we do not mean this example to constitute investment advice. Indeed, some investors will have a thesis that future climate change regulations will be less onerous than is currently expected by markets, and accordingly desire the inverse of the portfolio described below, e.g. one that overweighs heavily emitting sectors.

Different Sectors’ Exposure To Climate Risks

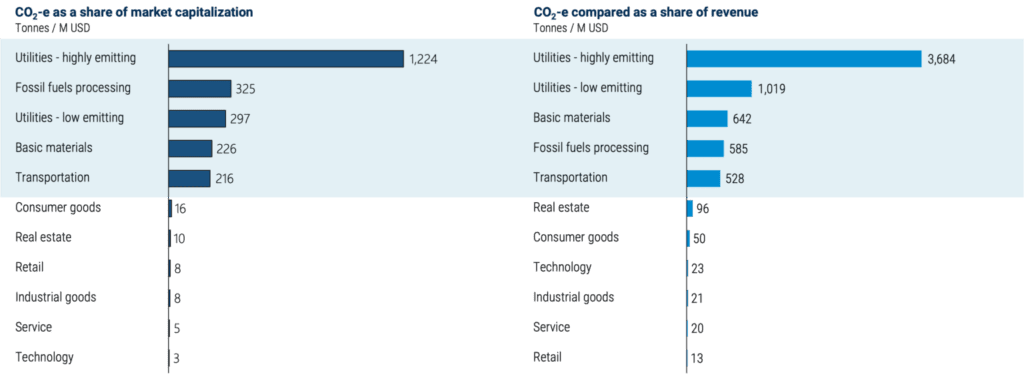

As a first step, we map out the climate risks within the different sectors represented in S&P 500, see sector definitions in Figure 13 in Appendix. Examining the different sectors’ emissions as a share of market capitalization and revenue confirms the hypothesis from Section 1, namely that climate risks are largely concentrated at a few highly emitting companies. In fact, we find that the top 16 highest emitting companies make up around half of total scope 1 and 2 emissions from the S&P 500. Utilities primarily based on fossil-fuel energy, called Utilities – highly emitting, are responsible for more than one quarter of total emissions from S&P 500 companies.

This heterogeneity makes shorting of carbon-heavy stocks a useful tool to hedge against climate risks; investors can achieve large upside to climate risks through hedging relatively few heavy emitting companies.

FIGURE 6: Scope 1 and 2 emissions a share of market capitalization or revenue

In general, we find five sectors that have especially high emissions compared to both their market cap and revenue, as indicated in the figure above. Going forward, we will refer to these as highly emitting sectors and the remaining sectors as low emitting sectors.

Shorting As A Hedging Tool Against Climate Risks: A Numerical Example

For simplicity, in this paper, we let scope 1 and 2 emissions be the driving force in our analyses (i.e., high emissions reflect high climate risks). As described in Section 2, there are in fact several drivers of climate risks, whose magnitude depends on which policy scenario is imposed to drive the green transition – however to demonstrate the use of shorting to mitigate these risks – our simpler approach suffices.

For companies towards the end of the value chain and closer to consumers, we assume an impact close to the net present value of future expected discounted CO₂ prices. Most of these companies have small emissions compared to market cap (for example, tech and the service sector) and therefore will experience a modest impact on equity value.

For utilities and companies involved with fossil-fuel based extraction and processing, we use a different approach. Here, we assume going forward they will be able to retrieve their current estimated cost of equity (i.e., initially be able to pass on the CO₂ price bill to their customers). The reason being that we expect it to be unlikely that renewable energy sources can be scaled up quickly enough to meet the demand entailed in the climate risks scenario of a gradual transition to carbon neutral in 2050. This means, for the years to come, fossil-fuel based energy will still be the marginal energy source, thus being decisive for energy prices. Instead, we assume production within fossil-fuel based assets will be phased-out following the phase-out projected by the International Energy Agency (IEA)⁹, see Figure 14 in Appendix.

We demonstrate concretely how shorting can be used to hedge climate risks via a numerical example on how companies’ equity value is affected by a future carbon price of USD 150 per tonnes CO₂¹⁰, which is around the level of CO₂ price most international institutions expect is needed to incentivise transformation to carbon neutrality by 2050.

Current portfolio: A portfolio where an investor owns 0.1% of the S&P 500 index (only including stocks where emissions data is available).¹¹

Carbon divesting portfolio: The current portfolio where heavily emitting companies are divested. ¹²

Carbon neutral portfolio: The current portfolio where heavily emitting companies are divested and shorted until change in equity of the portfolio is unaffected. ¹³

In the following, we first investigate how the different portfolios perform in the climate risk scenario.

1 - Current Portfolio

We find an average decline in equity value of around of 4% of total market capitalization, corresponding to USD 1.4bn due to a sudden increase in the carbon price of USD 150 per tonnes CO₂, see Figure 8.

The loss is mainly driven by the five highly emitting sectors, where changes in equity value are in the range of -24% to -46%. The sector with the highest climate risks is “Utilities – highly emitting,” which faces a loss of USD 0.2bn corresponding to 46% of their current market capitalization. However, these high emitting sectors only make up 10% of total market capitalisation, implying that the large changes in equity value do not result in a large change in the equity value of the entire portfolio.

FIGURE 8: Decline in equity value as a share of market cap for the current portfolio

2 - Carbon Divesting Portfolio

Having divested all the high emitters from the portfolio, the impact of the CO2 price is less than a quarter as large, with a loss of 1% of the market capitalization, corresponding to some USD 0.3bn, see Figure 9.

The reduction in lost equity value achieved by divesting all stocks from the two sectors with the highest emissions per market capitalization: “Utilities – highly emitting” and “Fossil fuels processing,” as well as top 15% stocks with highest number of emissions per market cap. The vast majority of divestment take place within the high emitting sectors, except for a few within “Consumer goods” and “Service.”¹⁴

The above example demonstrates that divesting can take investors quite far in increasing the robustness towards climate risks – but cannot avoid investors still facing a net loss. To make a portfolio truly neutral to climate risks, we need to hedge via short positions.

FIGURE 9: Decline in equity value as a share of market cap for the carbon divesting portfolio

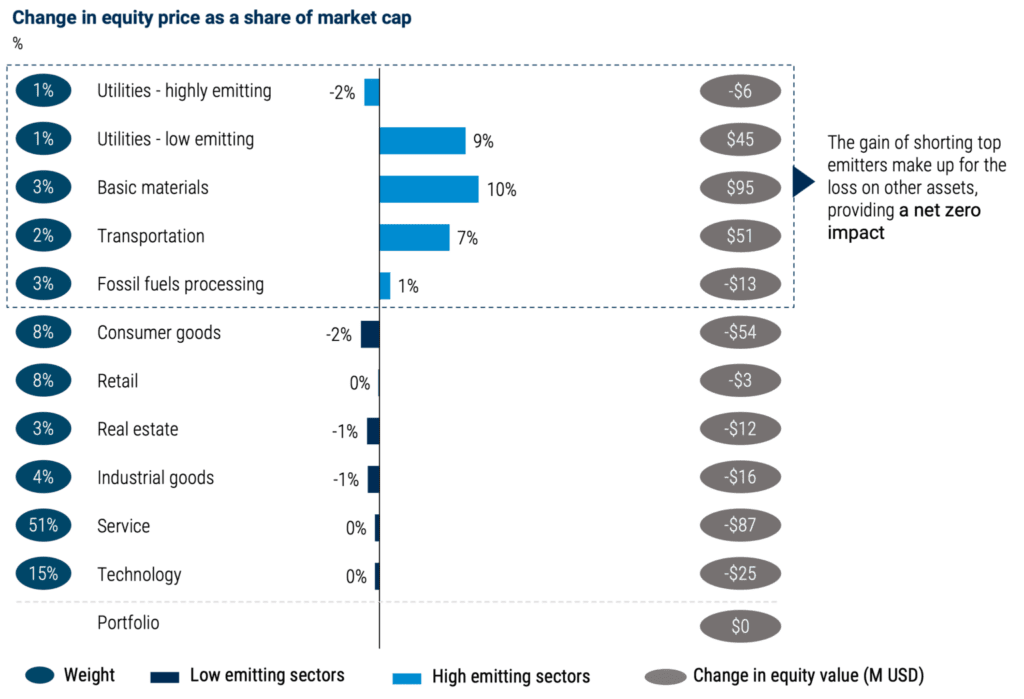

3 - Climate Risk Neutral Portfolio

In the climate risk neutral portfolio, the strategy is to divest and take short positions in stocks until the gain of the shorted stocks make up for the loss of the other stocks. This is done by shorting the stocks with the highest change in equity value until the change in equity value is zero. In our example, this approximately corresponds to shorting 0.1% of the 22 stocks with highest change in equity value.

All the highly emitting sectors apart from “Utilities – highly emitting” now make a gain from the shorted positions, see Figure 10. This gain is big enough to close the gap of the loss from the other stocks exposed to climate risks. The sector “Utilities – highly emitting” still faces some climate risk, although the change in equity has been reduced significantly from -46% to -2%.

An extension of the climate risk neutral portfolio is one where the investor shorts high emitters to fund buying shares in order to buy more green companies. This could be because the investor has a market neutral mandate, and therefore needs to balance longs against shorts. Just as the additional supply of shares from shorting increases the cost of capital and reduces investment, so too would an increase in demand for shares reduce the cost of capital and stimulate investment. Investors frequently short companies in order to fund their long positions. In other words, one has more money to buy stocks due to the proceeds from shorting other stocks. So would have the effect of funnelling capital investment from more to less polluting sectors. Long and shorts have symmetrical, opposite effects. So, to the extent that climate motivated investors are buying shares in ESG-friendly companies, which will lead to more green capital investments.

FIGURE 10: Decline in equity value as a share of market cap for the climate neutral portfolio

Conclusion

ESG is an increasingly important focus for investors of all types. Short selling is an important tool by which investors can have a real-world impact and hedge their portfolios from climate and regulatory risks. Short selling can potentially reallocate $50-$140 billion of investments away from the most heavily polluting companies. But to fully realize this potential, ESG portfolio metrics cannot ignore short positions or incorrectly treat any exposure, be it long or short, the same.

1: https://www.hmc.harvard.edu/net-zero/

2: Bodie, Kane, A., Marcus, A. J. (2021). Investments. (12. ed.). McGraw-Hill Education.

3: Gabaix, X., and Koijen, R. S. J. (2021). In search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis. National Bureau of Economic Research – Link

4: Pensions & Investments. (2021). 80% of equity market cap held by institutions. – Link

De La Cruz, A., Medina, A., Tang, Y. (2019). Owners of the World’s Listed Companies. OECD Capital Market Series. – Link

5: See appendix for the intuition behind 10% short interest

6: Chang, Y. C., Hong, H., Liskovich, I. (2014). Regression Discontinuity and the Price Effects of Stock Market Indexing. National Bureau of Economic Research – Link

7: Copenhagen Economics. (2021). Financial transaction tax study: impact on pension savers and the real economy – Link

8: Finally, we assume a WACC of 4.4% based on sector average estimation by Damodaran, A. (2021). Data on coal and related energy, oil and gas, and utilities – Link. For a description of the foundation of our model assumptions, see Appendix.

9: IEA (2021): Net zero by 2050 A Roadmap for the Global Energy Sector, page 101 and 115: Link

10: See Appendix for a description of the methodology

11: Only stocks where emission data is available is a part of the portfolio implying the portfolio consists of 361 stocks

12: Divesting all stocks from the two sectors with the highest emissions per market cap: “Utilities – highly emitting” and “Fossil fuels processing” as well as all stocks with emissions per market cap above 172 M USD per tonnes. This threshold is based on top 15% of stocks with highest number of emissions per market cap.

13: In practice this corresponds to short 100% of top 20th emitters and 9% of 21st highest emitter.

14: 65 stocks divested in total, primarily from highly emitting sectors, but also two from consumer goods and three from services