MFA Legal & Compliance New York 2024 - Agenda

Agenda

Day 1: Wednesday, May 1

5:30pm - 8:30pm

MFA Legal & Compliance 2024 Women’s Leadership Dinner (Invitation Only)

New York Athletic Club

For invitation, please email events@MFAalts.org

Day 2: Thursday , May 2

7:15am – 8:15am

Registration and Breakfast

8:15am – 8:20am

Opening Remarks

Speaker

Bryan Corbett is MFA’s President and CEO. He is a veteran of Washington and Wall Street. For the past 12 years, he was a senior executive at The Carlyle Group, most recently as Managing Director in the Corporate Private Equity segment and Head of the firm’s OneCarlyle Global Investment Resources Group. In this role, Mr. Corbett and his team provided strategic and operational support to investment teams and portfolio companies across segments.

For the first half of his Carlyle tenure, Mr. Corbett managed U.S. government and regulatory issues affecting Carlyle, its investments and the industry. In this role, he developed legislative and regulatory strategies relating to all of Carlyle’s business segments, including private equity, credit and real estate. In addition to serving on the boards of several Carlyle portfolio companies, Mr. Corbett started the firm’s global corporate citizenship program focused on responsible investing, published Carlyle’s inaugural corporate citizenship report, and started the firm’s initiative to recruit and place diverse individuals on portfolio company boards in the U.S.

Prior to joining Carlyle, Mr. Corbett served in the George W. Bush Administration as a Special Assistant to the President for Economic Policy and as the Senior Advisor to Deputy Secretary Robert Kimmitt at the Treasury Department. He also served as Majority Counsel on the Senate Banking Committee.

Mr. Corbett earned his JD from George Washington University Law School, where he was editor-in-chief of the George Washington Law Review, and earned his BA from University of Notre Dame.

8:20am – 8:45am

The Evolution of Rulemaking and Market Dynamics: Keynote Q&A with Jay Clayton

Speaker

Jay Clayton served as the Chairman of the U.S. Securities and Exchange Commission from May 2017 to December 2020.

Prior to Mr. Clayton’s time at the SEC, he was a member of Sullivan & Cromwell’s management committee, co-managing partner of its General Practice Group and co-head of its Cybersecurity Group. He was a lead lawyer in an array of complex M&A and capital markets transactions, as well as regulatory and governance matters, in the financial, telecoms, energy, transportation and e-commerce sectors.

Mr. Clayton earned a Bachelor of Science degree in engineering from the University of Pennsylvania, a Bachelor of Arts and Master of Arts degree in economics from The University of Cambridge and a Juris Doctor degree from The University of Pennsylvania Carey Law School.

Speaker

Bryan Corbett is MFA’s President and CEO. He is a veteran of Washington and Wall Street. For the past 12 years, he was a senior executive at The Carlyle Group, most recently as Managing Director in the Corporate Private Equity segment and Head of the firm’s OneCarlyle Global Investment Resources Group. In this role, Mr. Corbett and his team provided strategic and operational support to investment teams and portfolio companies across segments.

For the first half of his Carlyle tenure, Mr. Corbett managed U.S. government and regulatory issues affecting Carlyle, its investments and the industry. In this role, he developed legislative and regulatory strategies relating to all of Carlyle’s business segments, including private equity, credit and real estate. In addition to serving on the boards of several Carlyle portfolio companies, Mr. Corbett started the firm’s global corporate citizenship program focused on responsible investing, published Carlyle’s inaugural corporate citizenship report, and started the firm’s initiative to recruit and place diverse individuals on portfolio company boards in the U.S.

Prior to joining Carlyle, Mr. Corbett served in the George W. Bush Administration as a Special Assistant to the President for Economic Policy and as the Senior Advisor to Deputy Secretary Robert Kimmitt at the Treasury Department. He also served as Majority Counsel on the Senate Banking Committee.

Mr. Corbett earned his JD from George Washington University Law School, where he was editor-in-chief of the George Washington Law Review, and earned his BA from University of Notre Dame.

8:45am – 9:15am

Litigation Expectations: Scenario Analysis

- Discussion of potential outcomes of the current litigations and the impact on other rules

Speakers

Advises private fund managers on regulatory and compliance matters with a particular focus on the Investment Advisers Act of 1940.

Chris works with clients on a variety of regulatory matters, including SEC investment adviser registration, operating effective compliance programs, managing conflicts of interest, assessing cross-border applications of US regulatory requirements, review of marketing materials, compliance with trading-related laws and handling the regulatory implications of management company restructurings and transactions. He also regularly leads training sessions for clients, including on topics such as marketing private funds, SEC rule proposals and trading-related matters.

Chris works closely with clients undergoing SEC examinations and responding to deficiency letters and enforcement referrals. He also leads compliance testing and review projects with private fund managers to identify material risks and evaluate the measures in place to address those risks. He has advised private fund managers on regulatory issues relating to blockchain technology and digital assets his entire career and actively practices in that space.

Chris actively participates in industry-related initiatives and events, and is a member of the Private Funds Subcommittee of the Federal Regulation of Securities Committee of the Business Law Section of the American Bar Association.

He is a member of the firm’s Diversity, Equity and Inclusion Committee and the Latin Affinity Group.

Isaac Haas has been associated with HBK since 2015 and serves as HBK’s General Counsel, with primary responsibility for managing the firm’s legal function. Prior to joining HBK, Isaac was an attorney at Haynes and Boone, LLP, where he advised investment funds and operating companies on corporate and securities matters. He began his legal career as an associate at Jones Day. Isaac received a B.B.A. degree in Finance and Risk Management & Insurance in 2004 from Baylor University. He received a J.D. degree magna cum laude in 2011 from Southern Methodist University Dedman School of Law, where he was a Sumners Scholar and served on the editorial board of the SMU Law Review Association.

Jonah Platt is U.S. Head of Government & Regulatory Policy for Citadel, helping to lead the firm’s engagement on legislative and regulatory initiatives across a wide range of asset classes, including fixed income, credit, commodities, and equities.

Prior to joining Citadel, Mr. Platt was an Executive Director for Sales and Trading Legal at UBS Investment Bank. Previously, he was a Derivatives and Capital Markets Associate at Allen & Overy LLP.

Mr. Platt received a bachelor’s degree with high distinction from the University of Michigan and graduated magna cum laude from the University of Michigan Law School.

Moderated by

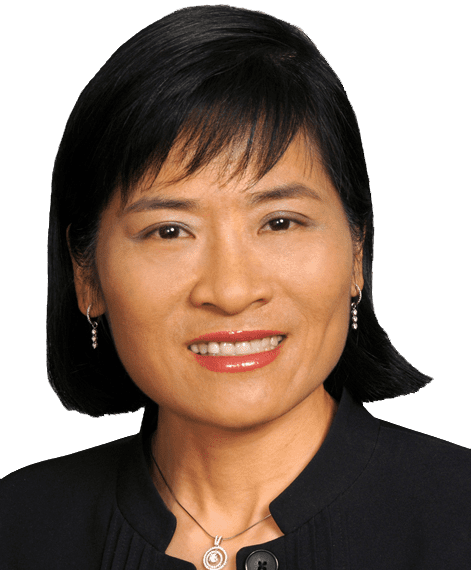

Jennifer Han is Chief Legal Officer and Head of Global Regulatory Affairs at MFA. Jennifer is responsible for the strategy and execution of the Association’s U.S. regulatory advocacy and leads MFA’s regulatory engagement. She has authority and oversight over all legal matters involving MFA, including contractual matters, litigation, compliance and legal liability. She also advises MFA members on legal, regulatory, and compliance changes and/or guidance impacting the alternative investment industry, including investment advisers, commodity trading advisors, and commodity pool operators. She has extensive experience working with policymakers and regulators, such as throughout the 2008 financial crisis, post-crisis, and to the refinement of today’s regulatory framework. She engages regularly with legislative policymakers and regulators, including the SEC, CFTC, Department of Treasury, Federal Reserve, NFA, ESMA, UK FCA, and IOSCO, among many others.

Jennifer joined MFA in 2006 as legal counsel and has served in a few different capacities before joining MFA’s executive leadership team. Prior to joining MFA, Jennifer was a staff attorney in the Office of Compliance Inspections and Examinations at the SEC, where she conducted inspections and examinations, and advised on legal and compliance matters relating to developments in securities regulations and industry practices. Jennifer began her legal career as an associate with Pickard and Djinis LLP, a boutique securities law firm in Washington, D.C. She received her Bachelor of Arts degree from Cornell University and her Juris Doctor from American University. While in law school, she was an Editor of the American University International Law Review. Jennifer is a member in good standing of the DC bar.

Jennifer serves on the Washington D.C. Committee of 100 Women in Finance, and on the Board of Directors for the YWCA National Capital Area.

Prior to joining MFA, Jennifer was a staff attorney in the Office of Compliance Inspections and Examinations at the SEC, where she conducted inspections and examinations, and advised on legal and compliance matters relating to developments in securities regulations and industry practices. Jennifer began her legal career as an associate with Pickard and Djinis LLP, a boutique securities law firm in Washington, D.C. She received her Bachelor of Arts degree from Cornell University and her Juris Doctor from American University. While in law school, she was an Editor of the American University International Law Review. Jennifer is a member in good standing of the Virginia bar.

9:15am – 9:45am

SEC Enforcement Priorities: Keynote Q&A with Director Grewal

Speaker

Gurbir S. Grewal has been the Director of the SEC’s Division of Enforcement since July 2021. Immediately before joining the Commission, Gurbir was the Atorney General for the State of New Jersey. Prior to that, he served as the Bergen County Prosecutor, the chief law enforcement officer for New Jersey’s most populous county. Earlier in his career, Gurbir served as an Assistant United States Atorney for the District of New Jersey, where he was Chief of the Economic Crimes Unit, and an Assistant United States Atorney for the Eastern District of New York, where he was assigned to the Business and Securities Fraud Unit. He was also an attorney in private practice. He holds a J.D. from the College of William & Mary, Marshall-Wythe School of Law, and a B.S. in Foreign Service from the Georgetown University School of Foreign Service.

Since assuming the role of Director, Gurbir has focused on enhancing investor protecon and confidence in our markets by emphasizing proactive enforcement efforts and stressing the need to create a culture of compliance among market participants.

Moderated by

Mike Asaro is a leader of Akin’s white collar defense and global investigations practice. He focuses on white collar criminal defense, SEC and Commodity Futures Trading Commission (CFTC) investigations, corporate internal investigations and complex commercial litigation. Mike also regularly advises investment firms with respect to compliance with the federal securities and commodities laws.

Mike is a former assistant U.S. attorney from the Eastern District of New York, where he served as deputy chief of the Business and Securities Fraud Section. During his tenure, the office prosecuted numerous complex and high profile securities fraud, mail fraud, wire fraud, bribery and money laundering cases.

Earlier in his career, Mike served as branch chief in the SEC’s New York office, supervising staff attorneys as they worked on regulatory investigations and enforcement actions. While he was at the SEC, he was appointed as a special assistant U.S. attorney in the Southern District of New York.

Chambers USA has described Mike as “an extraordinarily smart lawyer doing fantastic work and providing practical solutions” for his clients. He regularly counsels companies and individuals in matters involving:

- Insider trading

- Market manipulation and disruptive trading

- Accounting irregularities and public company disclosure issues

- Investment advisor and broker/dealer regulation

- Conflicts of interest and breaches of fiduciary duty

- Anti-bribery and Foreign Corrupt Practices Act (FCPA)

- Complex commercial litigation.

9:45am – 10:35am

Navigating SEC Exams and Enforcement Actions as a Private Fun

- Exam and enforcement best practices and learnings

- Sweep letter examples

Speakers

James Gange, Managing Director – Chief Compliance Officer and Legal Counsel, joined Davidson Kempner in April 2009. From 2007 to 2009, Mr. Gange was Director and Chief Compliance Officer/Associate Counsel of DiMaio Ahmad Capital, LLC, an SEC registered investment adviser. From 2005 to 2007, Mr. Gange was counsel in the securities regulatory group of Wilmer Cutler Pickering Hale & Dorr, where he represented investment advisors, hedge funds and broker-dealers in regulatory enforcement proceedings and internal investigations. Prior to entering private practice, from 1999 to 2004, Mr. Gange was Senior Counsel in the Enforcement Division of the Securities and Exchange Commission. Mr. Gange received his J.D., cum laude, from Brooklyn Law School in 1999, and his B.A., magna cum laude, Phi Beta Kappa, from Brooklyn College in 1995.

Courtney Lewis is a Partner at Marshall Wace North America, where she serves as General Counsel and Chief Compliance Officer. She is also a member of Marshall Wace’s global Operating Committee. Additionally, she serves as Vice Chair of the Managed Fund Association’s Advisers, Management, and Operations Committee. Before joining Marshall Wace, Courtney was the Chief Compliance Officer and General Counsel at Hound Partners, which was seeded by Tiger Management. She began her career at Systematic Financial Management, an affiliate of Affiliated Managers Group, as Compliance Officer and Counsel.

Courtney completed her Bachelor of Arts at New York University’s Gallatin School of Individualized Study and earned a Juris Doctorate with a Masters in International Political Economy and Development from Fordham University in New York. She is an adjunct professor at Fordham Law School’s Masters of Compliance program, where she also contributed to developing the online course curriculum in Investment Management Regulation. Furthermore, Courtney serves as the Board Chairperson of Literacy Partners, an adult literacy non-profit organization focused on making a two-generation impact on education.

Serge Todorovich is Principal, General Counsel and Chief Compliance Officer at Shenkman Capital Management, Inc., a traditional and alternative credit manager based in New York with offices in Stamford, Boca Raton and London. Previously, he was General Counsel & Chief Compliance Officer of Prosiris Capital Management LP and Associate General Counsel at Eton Park Capital Management, L.P. Prior to joining Eton Park, Mr. Todorovich was Vice President and Assistant General Counsel at Goldman, Sachs & Co., where he provided legal counsel to the sales and trading desks in the Fixed Income, Currency and Commodities Division. He joined Goldman Sachs from Shearman & Sterling LLP, where he was an Associate in the Asset Management Group in New York. He has been an active member of industry associations and working groups focused on investment management, credit investing, derivatives, and financial regulation. Mr. Todorovich received his Juris Doctor from the University of Virginia School of Law, a Master of Arts in Law & Diplomacy from the Fletcher School of Law & Diplomacy and a Bachelor of Arts from Tufts University.

Moderated by

Highly respected by industry peers for his depth of regulatory knowledge, Scott Moss has counseled hundreds of investment management clients in the implementation of compliance programs, as well as in the development of plans to ensure ongoing adherence to emerging regulatory standards.

He possesses a thorough knowledge of the entire panoply of the overlapping securities and commodities laws, rules, and regulations affecting his clients. Scott is part of a team that “always understands the issues at hand, responds very quickly and is able to suggest creative solutions to issues that are often very complicated.” (The Legal 500)

Scott’s extensive experience includes representing offshore and U.S.-based funds, investment advisors, broker-dealers, commodity pool operators, and commodity trading advisors in formation and structuring, securities and commodities regulation, mergers and acquisitions, and other financial transactions.

Scott is also a prominent author and lecturer on corporate law, securities transactions, and investment management. His advisory roles include:

- Adjunct Professor at Rutgers Law School, “Hedge Funds and Investment Adviser Seminar” (2008-2017)

- Former Appointed Director of the Board of Directors for the Managed Funds Association (MFA), which represents the global alternative investment industry and its investors by advocating for regulatory, tax, and other public policies that foster efficient, transparent, and fair capital markets (2021-2023)

- Member of the Steering Committee of the Lawyers’ Advisory Forum and Conference Committee for the MFA

- IA Legal and Regulatory Subcommittee and Speaking Faculty of the National Society of Compliance Professionals

Scott continues to be recognized by Chambers USA and Chambers Global as one of America’s Leading Lawyers for Businesses for Regulatory & Compliance.

10:35am – 11:05am

Networking Break

11:05am – 11:55am

Breakout Sessions:

Select one

1) Preparing for the Unknown: Private Fund Adviser Rule

- How has the Private Fund Adviser Rule already changed the industry?

- Discussion around the interim impact, challenges, solutions

- What should you be doing now vs later?

Speakers

Michael is the General Counsel & Chief Compliance Officer at Samlyn Capital, LLC where he is responsible for all legal and compliance operations of a global equity hedge fund management firm. Prior to joining Samlyn Capital in 2009, Michael was a partner at Mintz Levin Cohn Ferris Glovsky and Popeo, P.C. in New York City from 2006 through 2009, and a corporate associate from 2000. Prior thereto, he was an associate at Skadden, Arps, Slate, Meagher and Flom LLP in New York City. Michael began his career as an associate at Whitman, Breed, Abbott & Morgan in New York City.

Greg Hegerich joined Bain Capital in 2007. He is the head of compliance for North American Private Markets serving as Chief Compliance Officer to several Bain Capital affiliated registered investment advisors. Prior to joining Bain Capital, Mr. Hegerich served as the Risk Management Officer of the Massachusetts PRIM Board. Mr. Hegerich began his career in the assurance business of PricewaterhouseCoopers. Mr. Hegerich received an MBA in Finance and a BS summa cum laude in Accounting from the Carroll School of Management at Boston College. Mr. Hegerich is a Certified Public Accountant.

Michael Kitson is Bridgewater’s Chief Compliance Officer and Counsel and is responsible for overseeing the firm’s compliance program and advising Bridgewater’s senior leaders on key compliance initiatives and regulatory developments in the US and around the world. Michael regularly represents Bridgewater with industry groups and trade associations including Managed Funds Association, Alternative Investment Management Association, and the Securities Industry and Financial Markets Association. He is also a regular panelist on topics such as investment adviser regulation, the regulatory rule-making process, cross-border regulatory developments, enabling compliance programs via technology, financial crimes compliance, and the structure and resourcing of in-house legal and compliance functions. Outside of Bridgewater, Michael is a Term Member of the Council on Foreign Relations as well as an Adjunct Professor at Fordham University School of Law where he teaches courses on corporate compliance.

Prior to joining Bridgewater, Michael held multiple legal and regulatory roles at global financial institutions and advised on topics including sales and trading of securities and derivatives, cross-border trade financing, anti-money laundering, sanctions, and consumer lending.

Michael received his J.D. from Fordham University School of Law and his B.A. degree from Boston College. He is a member of the New York and New Jersey bars and is an Authorized In-House Counsel in Connecticut.

Jason Slutsky is the Chief Legal Officer of Graham Capital Management, L.P. (“Graham”) and oversees legal matters related to the firm’s business. He joined Graham in 2018 and became a Principal of Graham effective as of January 17, 2020 and an Associated Person effective as of January 28, 2020. Prior to joining Graham in 2018, Mr. Slutsky was Vice President and Associate General Counsel at AQR Capital Management, LLC, an investment firm. Mr. Slutsky started his career as an associate in the corporate department at Proskauer Rose LLP where he primarily focused on advising fund managers and investors on all aspects of the hedge fund business. Mr. Slutsky received a J.D. from the University of Pennsylvania with honors in 2009 and a B.S. from Cornell University in 2006. Mr. Slutsky received the designation Chartered Financial Analyst in 2019.

Moderated by

Co-leader of Morgan Lewis’s global financial institutions practice, Christine Lombardo advises investment managers and broker-dealers on financial regulatory matters. She concentrates her practice on securities regulation for a broad range of financial firms including retail asset managers, private fund managers, family offices, broker-dealers, other professional traders, and high-net-worth individuals. Christine also counsels legal, compliance, and business personnel on the structure, operation, and distribution of advisory programs, including digital advisory offerings, and investment products, including hedge funds, private equity funds, venture capital funds, real estate funds, and other alternative investment products.

Christine also counsels financial firms through examinations by industry regulators, as well as on enforcement related matters. She previously served as a co-leader of the firm’s financial technology (fintech) industry team. Before joining Morgan Lewis, she was an associate at an international law firm in New York and worked for the Division of Enforcement at FINRA.

2) Private Credit: Structuring and Negotiation Best Practices

- Best practices around fund documents, restructuring debt, valuation challenges, and maturity risk.

Speakers

Kevin Bloss is AB CarVal’s Associate General Counsel. He oversees all legal and regulatory matters related to the organization, financing and management of the firm’s private and public credit funds as well as its US and European CLO platforms. Mr. Bloss also advises on legal and regulatory matters affecting AB CarVal’s management company.

Before joining the firm in 2008, Mr. Bloss began his career advising on a range of corporate matters with a focus on capital markets and private equity transactions at the law firms of Fried Frank, and Cooley LLP in New York. Mr. Bloss earned his J.D. from the University of Minnesota and received his B.A. from Carleton College in Northfield, Minnesota.

AB CarVal is an established global alternative investment fund manager focused on distressed and credit-intensive assets and market inefficiencies. The firm has $16 billion in assets under management in corporate securities, loan portfolios, structured credit and hard assets.

Jeff Himstreet is Vice President and Senior Counsel with the MFA’s Global Regulatory Affairs team.

In this position, he analyzes and helps shape regulatory and legislative initiatives affecting the private funds industry.

Prior to joining the MFA, Jeff was a senior member of the PGIM (Prudential) Fixed Income law team, where he advised on a wide range of investment advisory, private fund, and derivatives matters. Prior to joining PGIM, he was a partner with Bingham McCutchen, where he advised investment advisers, private funds, investment companies, and broker-dealers on asset management and regulatory issues. He has also worked in-house as the chief managed product support for a dually-registered firm and as the chief legal officer for the wealth management division of a regional bank. Before this, he was an attorney with the SEC’s Division of Investment Management.

Jeff received his J.D. from the Willamette University College of Law and his LL.M. (with honors) from the Georgetown University Law Center.

Dr. Cindy Ma is Managing Director and Global Head of Houlihan Lokey’s Portfolio Valuation and Fund Advisory Services. Cindy works primarily with private equity funds, hedge funds, venture funds, business development companies and corporate clients. She has extensive experience in valuing illiquid and complex securities across capital structures, industries and geographies. She advises senior fund managements in establishing best in class valuation policies and procedures.

She has extensive training, academic expertise, and trading experience in commodities, derivatives, securities, foreign exchange, fixed incomes, structured transactions, hedging strategies, and risk management issues. She has served as a consulting and testifying expert for the SEC on various fund- and valuation-related matters.

She is a member of Houlihan Lokey’s Management Committee, Diversity, Equity & Inclusion Council, and Technical Standards Committee. Externally, she is on the Financial Instrument Board of and the International Valuation Standards Council (IVSC). She is a Fellow of the Royal Institute of Chartered Surveyors (FRICS). She also holds the designation of CFA and obtained her CPA license (now inactive) in the state of Colorado. She was selected as the 50 Leading Women in Hedge Funds in 2020.

Prior to Houlihan Lokey, she was a Partner at Ernst & Young, worked as a derivatives trader for a global commodity house, and taught as an adjunct professor at the Columbia Graduate School of Business.

She graduated from Columbia University with a Ph.D. in Finance and from Indiana University with a B.S. in Accounting. She has published numerous articles on valuation, derivatives and risk management and co-authored a college textbook on derivatives. She is a frequent speaker in industry conferences. She is a board member of PENCIL, a NYC based charity which connects public school students to success.

Moderated by

Kevin Neubauer is a partner in and co-head of Seward & Kissel’s Investment Management Group. Kevin works with sponsors and managers of various private investment funds and other pooled investment vehicles, including private equity funds, hedge funds, funds of funds, commodity pools, and various “hybrid” funds. In particular, Kevin focuses on fund formation and structuring, the offering of interests by private investment funds, and the negotiation and documentation of such investments. Kevin has significant experience in organizing both domestic and offshore partnerships and other investment vehicles, including separately managed accounts and funds-of-one. Kevin also represents fund sponsors in connection with seed-capital investments, and funds of funds and other institutional investors in connection with their investments in private funds. Kevin regularly counsels investment advisers on regulatory and compliance matters, including the development of comprehensive compliance programs and in connection with regulatory examinations. Kevin previously worked in the Legal & Compliance group of Providence Equity Partners L.L.C/Benefit Street Partners L.L.C.

In 2020, Kevin was named to Private Debt Investor’s (PDI) 2020 Rising Stars list. The list recognizes industry figures who PDI believes have the potential to shape the future of the private debt asset class. Kevin was also recently named a “Rising Star” in the Private Equity Fund practice area by the International Financial Law Review. This category recognizes young partners who work on complex private equity deals and are highly recommended by their clients and peers.

Mr. Neubauer received a B.A. from Fairfield University and a J.D. from Boston College Law School.

3) Trading-Related Rules and Regulations

- Next steps and practical guidance around Treasury Clearing, Dealer Rule, 13f-2 and T+1 settlement.

Speakers

Tim Cruise is the Deputy Chief Compliance Officer at ExodusPoint Capital Management, LP. Tim joined ExodusPoint in 2020 and is responsible for the global trading compliance program, providing real-time and long-term compliance advisory coverage to the Firm’s business management, investment staff and other front office teams. Prior to ExodusPoint, Tim was at Two Sigma from 2014 to 2020, providing compliance advisory coverage for the Research and Trading Compliance group and was head of Advisory Compliance starting in 2019. From 2008 to 2014, Tim was at Morgan Stanley where he was initially responsible for handling regulatory inquiries before transitioning to the equity advisory compliance group.

Abby Greenberger is the Deputy Chief Compliance Officer & Counsel for Bridgewater Associates, LP. She has been a part of Bridgewater’s Legal and Regulatory Group since joining the firm in January 2014. Prior to joining Bridgewater, Abby was a Senior Vice President & Regulatory Counsel in the Compliance department at D. E. Shaw & Co., L.P. Prior to that, Abby was a Vice President in the Law Division at Morgan Stanley & Co. Incorporated, and she began her career as an Associate at the law firm of Davis, Polk & Wardwell.

Mr. Ortega Barrales joined Two Sigma in 2012 and currently leads a team that is responsible for regulatory matters in connection with Two Sigma’s portfolio management and trading activities. He earned a J.D. from Fordham University School of Law and a B.A. in Philosophy from Amherst College.

Mr. Walz joined Element Capital in October 2011. His responsibilities include managing all legal, compliance and regulatory matters for Element Capital. From October 2011 through February 2021, Mr. Walz was also Chief Compliance Officer of Element Capital. Prior to joining Element Capital, Mr. Walz was General Counsel and Chief Compliance Officer at Moon Capital Management LP, since May 2007. Prior to May 2007, Mr. Walz practiced law at Bingham McCutchen LLP, Bryan Cave LLP and Emmet, Marvin and Martin LLP. Mr. Walz holds a J.D. from Tulane Law School and a B.A. in Sociology from St. Joseph’s College. He was admitted to practice law in New York in 1998 and Connecticut in 1997.

Moderated by

Brian advises fund managers on the full spectrum of regulatory, compliance and operational matters. He has extensive experience helping clients navigate regulatory examinations and crises, and with mapping out their regulatory compliance obligations under the rules and regulations of the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the National Futures Association (NFA) and numerous futures exchanges. Brian also regularly represents clients in regulatory examinations, enforcement actions, investigations, contentious matters, operational and trading inquiries, management company transactions and in seeking no-action or similar relief. Having spent nearly a decade in-house as general counsel and chief compliance officer at several global investment management firms, Brian is well versed in the wide range of legal and business challenges facing investment advisers, commodity pool operators and commodity trading advisors.

Brian is a recognized leader in advising alternative investment fund managers on regulatory and compliance matters. Chambers Global and Chambers USA list Brian as a “leading individual” in investment funds. Brian is a member of the Managed Funds Association’s Board of Directors, Outside Counsel Forum and its CTA/CPO Forum and of the Alternative Investment Management Association’s CFTC Working Group.

4) Mastering the Talent Wars

- Final FTC Rule on non-competes

- Compensation structures

- IP/confidentiality protocols

- DEI and employment issues

Speakers

Heather Glatter is Managing Director & Senior Counsel, and leads the global Employee Relations and Employment Law team at Apollo Global Management, Inc. Prior to joining Apollo in 2019, Heather worked as Employment Counsel in the General Counsel Group at Credit Suisse Securities (USA) LLC. Previously, Heather was an Associate in the Labor and Employment Group at Orrick, Herrington, and Sutcliffe LLP.

Heather graduated from Cornell University with a BS in Human Development and received her JD from Fordham University.

Solomon Kuckelman is the General Counsel for Americas & APAC at Man Group.

Based in New York, Solomon works within Man Group’s Legal Department. He is responsible for all legal aspects of Man Group’s US and APAC businesses, including strategic advisory, fund and separate account formation and lifecycle management, mergers and acquisitions, employment, litigation, entity management, corporate governance and general corporate matters. Prior to joining Man Group in 2008, Solomon worked at Paul Hastings LLP as an Associate in the Private Funds Group and at Sadis & Goldberg LLP as an Associate in the Financial Services Group.

Solomon holds a J.D. from Brooklyn Law School and a B.A., cum laude, from Colgate University.

Andrew Nathanson is the General Counsel and Chief Compliance Officer of Suvretta Capital Management, LLC. Prior to joining Suvretta Capital, Mr. Nathanson served as Legal Counsel & Chief Compliance Officer for Mirae Asset Global Investments (USA). Mr. Nathanson earned his BS in economics from the University of Wisconsin-Madison and a J.D. from Suffolk University Law School.

Moderated by

5) The Growing Imperative of Cybersecurity

- Issues around data privacy and IP; vendor management

- Responding to a data breach or attack; reporting to regulators

- Forthcoming adviser Cybersecurity Rule

Speakers

Ms. Dunn joined Farallon in 2007, where she oversees the firm’s legal and compliance initiatives globally. Prior to joining Farallon, Ms. Dunn served as an associate in Sidley Austin LLP’s investment funds, advisers and derivatives practice group. She graduated from the University of California, Berkeley School of Law with a J.D. and from the University of Notre Dame with a B.A. in History and Anthropology. She is a co-author of the first edition of the book U.S. Regulation of Hedge Funds (2005).

Jason Gordon is the Chief Compliance Officer of Cinctive Capital. Jason previously served as the Chief Compliance Officer at Autonomy Capital. Prior to that he served as Chief Compliance Officer of FX Solutions and in various senior compliance roles at Prudential Global Investment Management—including Chief Compliance Officer for Prudential Private Placement Investors. He also was a Compliance Officer for Perella Weinberg Partners and National Life Group/Sentinel Investments. Jason has over twenty years of financial and regulatory compliance experience, including over fifteen years running compliance programs for investment firms. Previously in his career, Jason worked at Bear Stearns where he focused on institutional capital markets transactions. Jason earned a Juris Doctor from Baylor Law School. He also earned a Bachelor of Arts in Political Science, summa cum laude, from the American Jewish University.

Mr. Russo serves as General Counsel and a Managing Director at ZAIS Group, LLC. Mr. Russo was appointed General Counsel in April 2017. Before joining ZAIS in February of 2007, Mr. Russo was an attorney at Thacher Proffitt & Wood LLP in the Structured Finance Practice Group from 2004 to 2007. He received a B.S. with distinction from The Pennsylvania State University and a J.D. from St. John’s University School of Law.

Moderated by

Mike Pappacena is a Partner based in New York for ACA Aponix, ACA Group’s cybersecurity and risk division. In this role, he provides leadership for division initiatives, mentoring and guidance of staff, and vision for future planning and growth. Simultaneously, he serves as a team leader in providing cybersecurity risk assessments, vendor due diligence, policy authoring, staff training, and product development.

Prior to ACA, Mike served as a project manager for Jefferies LLC and worked on several compliance initiatives. In addition, he spent fifteen years at Goldman Sachs, where as a vice president in the Technology Division, he managed development teams supporting the firm’s Legal, Compliance and Audit, Sarbanes-Oxley, Operational Risk, and Technology Risk departments. He also managed Fundamental Equities and Alternative Investments in the GSAM division. Earlier in his career, Mike worked as an engineer at Long Island Lighting Company (now PSEG).

Mike earned his Bachelor of Electrical Engineering degree from the Pratt Institute and his Master of Business Administration degree (Finance concentration) from Adelphi University.

12:00pm – 1:00pm

Lunch & Networking

1:00pm – 1:30pm

Treasury Market Trend Lines and Financial Stability: Keynote Q&A with Josh Frost

Speakers

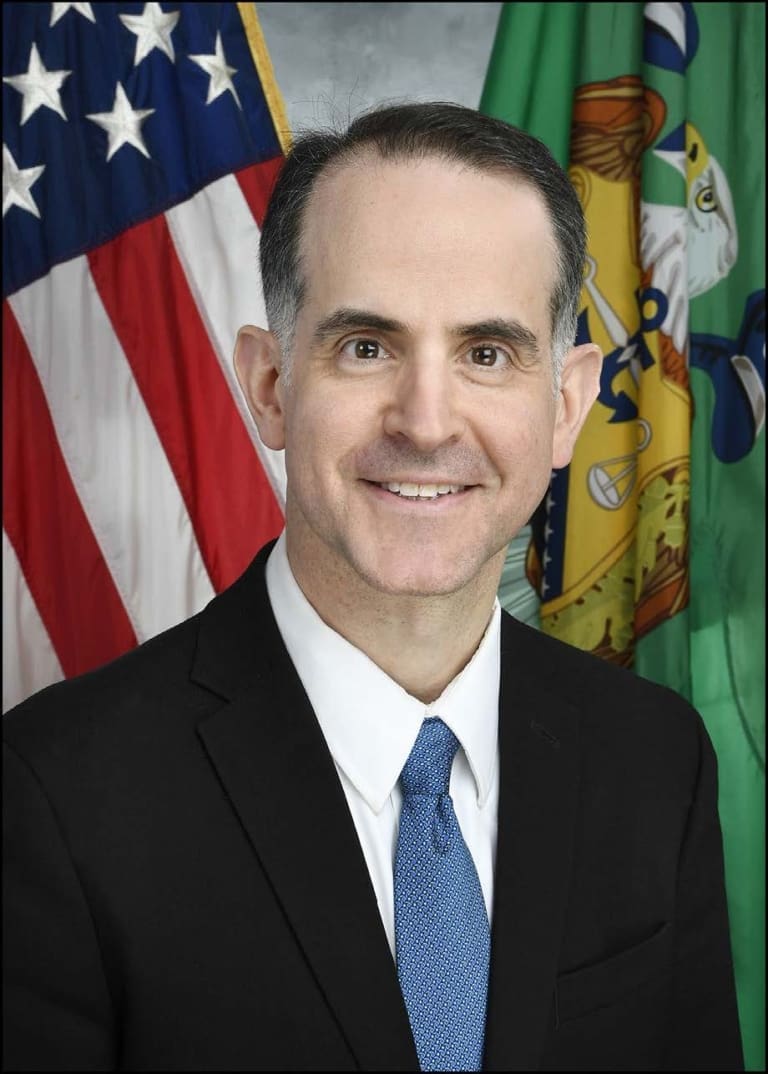

Joshua Frost is the Assistant Secretary for Financial Markets at the U.S. Department of the Treasury. Josh has a long

history with financial markets, including more than two decades of experience at the Federal Reserve Bank of New

York.

Before serving as Assistant Secretary, Josh was most recently the co-chair of the Liquidity Program for systemically

important financial institution supervision at the New York Fed. Prior to this, he spent almost two decades in the New

York Fed’s Markets Group in a variety of positions, including a role overseeing the two corporate credit facilities

launched in response to the pandemic. Josh also served as the Director of Money Markets and Director of Treasury

Markets, where his teams launched the Secured Overnight Financing Rate, conducted open market operations, and

facilitated auctions of debt on behalf of the Treasury. Josh began his career at the New York Fed in 1998 as an analyst

on the Central Bank and International Account Services team.

Josh received his bachelor’s degree in mathematics and psychology from Rutgers University and his master’s degree in

business administration with a concentration in finance from New York University. He lives in Washington, D.C. with his

wife and daughter.

Moderated by

Jillien Flores serves as Chief Advocacy Officer at MFA.

In this role, she develops and executes MFA’s advocacy strategies to advance the ability of alternative asset managers to raise capital, invest, and generate returns for their beneficiaries. Flores also oversees efforts to connect MFA’s advocacy with member growth and engagement. Her deep understanding of the industry, strong relationships with policymakers, and keen political instincts have delivered positive results for the industry and its investors, including pensions, foundations, and endowments.

Since joining MFA in 2021, Flores has created a more favorable public policy environment for alternative asset managers in the U.S., U.K., and E.U. In the U.S., Flores informs policymakers and their staff about the industry’s significant contributions to local communities and the global economy and push back against proposals that would harm managers, investors, and everyday Americans. Abroad, she spearheaded MFA’s expansion in Brussels to push back against harmful EU rules and in London to shape the future of the U.K.’s capital markets post-Brexit.

Flores joined MFA after six years at Vanguard, one of the world’s leading asset managers. There, she advocated on a range of issues related to US capital markets, tax, and retirement policy.

Prior to joining Vanguard, Flores represented clients before Congress and federal financial regulators as a Director of Government Relations at Porterfield, Lowenthal, Fettig & Sears. She was involved in the legislative and rule-writing process for several financial services laws and regulations, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Jumpstart Our Business Startups Act.

1:40pm – 2:30pm

Breakout Sessions

Select one

1) Complying with Form PF

- Understanding the new current reports and the 2024 amendments

Speakers

Mr. Backofen is a Managing Director and serves as Chief Compliance Officer, responsible for all compliance matters for the firm, and Head of Operations, responsible for managing the firm’s Operations team. Prior to joining MKP in 2013, Mr. Backofen was a Manager within Financial Risk Management at KPMG providing regulatory, operational, and process advice to investment management institutions. Prior to that role, Mr. Backofen worked for over 10 years as Partner/Vice President at HedgeOp Compliance, LLC implementing and monitoring compliance programs for SEC registered investment advisors and unregistered investment advisors.

Mr. Backofen received a B.S. in Economics from Quinnipiac University.

Scott Hendler is Deputy General Counsel responsible for legal, compliance, regulatory, and transactional matters. Prior to joining Viking in 2017, Scott was an Executive Director in the Legal and Compliance division at Morgan Stanley, and an Associate at Cadwalader, Wickersham & Taft and Skadden, Arps, Slate, Meagher & Flom. Scott received a J.D. from the New York University School of Law, an MBA from Columbia Business School, and a B.A. in economics, summa cum laude, from Binghamton University.

Daniel Taub is the General Counsel and Chief Compliance Officer at Junto Capital Management LP. Previously, Mr. Taub spent nearly 10 years at Viking Global Investors LP as an Associate General Counsel responsible for legal, regulatory and compliance matters. Prior to joining Viking, Mr. Taub was an Associate in the Investment Management department of Schulte Roth & Zabel LLP and an Associate in the Corporate department of Stroock & Stroock & Lavan LLP. Mr. Taub earned his JD from New York University School of Law and his BA from Emory University where he graduated with High Honors and Phi Beta Kappa.

Moderated by

Joel Wattenbarger is a partner in the asset management group and co-head of the firm’s private funds regulatory practice. Joel represents investment management clients, focusing primarily on hedge funds, funds of funds, private equity funds and fund managers. He advises clients on the establishment of funds and fund management companies, trading and other operational issues, and compliance issues faced by registered investment advisers. Most recently, Joel has devoted substantial time to advising hedge fund and other private fund clients on the impact of the Dodd-Frank Act and the proposed rules and final rules issued by the SEC under the Act. Joel also has considerable experience representing institutional investors in private investment funds.

Joel has represented a number of private funds and fund managers in connection with the establishment of fund management companies and the organization of hedge funds, private equity funds and funds of funds. Joel’s advice to fund managers has covered the drafting of fund agreements and offering documents, facilitating strategic investments by seed investors in newly established funds, negotiating with prime brokers, administrators and other service providers to funds, trading issues, investor relations, fund restructurings, and wind-downs.

Joel has also advised fund managers and their principals with respect to economic and governance issues at fund management companies. He has advised U.S. and foreign investment managers regarding the U.S. investment adviser regulatory regime and has assisted numerous advisers with registering as an adviser and adopting and administering compliance policies and procedures.

Joel also has extensive experience representing institutional investors, including pension plans, endowments, insurance companies and funds-of-funds, in making investments in private investment funds and other structured investment vehicles. These investments have included both traditional hedge fund and fund of fund investments as well as specialized vehicles established to pursue highly customized investment strategies.

2) Credit Derivatives and Mitigating Trading Risk

- The rise, fall, and recent growth of CDS

- Regulatory scrutiny and impacts

- Mitigating policy implications of CDS, including defaults and synthetic risk transfers

Speakers

Dannia Altemimei is Senior Deputy General Counsel at Balyasny Asset Management (BAM), where she manages a broad range of complex legal matters for the firm, including derivatives and finance, fund structuring and other transactional negotiations. She is a member of several key committees at BAM, including the Valuation Committee, Counterparty Credit Committee, Expense Committee, and Generative AI working group. Dannia was recently features as one of the 50 Leading Women in Hedge Funds in 2023.

Prior to joining BAM in 2017, Dannia held roles representing clients in a variety of structuring and transactional matters. She began her legal career with Sidley Austin as an associate attorney in the Investment Funds, Advisers and Derivatives group.

Dannia earned a Juris Doctorate degree summa cum laude from the University of Illinois at Urbana-Champaign and a Bachelor of Arts in Political Science magna cum laude from Loyola University.

Eugene Fialkovskiy is a Managing Director and Associate General Counsel at King Street. His coverage includes special situations, workouts, credit investments, direct lending, CLOs and derivatives. Prior to joining King Street in 2011, Eugene worked at Credit Suisse and Latham & Watkins. Eugene received a B.S. from Stony Brook University and a J.D. magna cum laude from St. John’s School of Law.

Dan King is the Associate General Counsel – Treasury & Investments at Hudson Bay Capital Management, a global multi strategy investment firm. Dan is responsible for advising on trade structuring, documentation and execution across Hudson Bay. Prior to joining Hudson Bay, Dan was a derivatives attorney at Kramer Levin Naftalis & Frankel in New York and Simmons & Simmons in London.

Moderated by

Fabien Carruzzo, Chair of Kramer Levin’s Derivatives and Structured Products practice, counsels asset managers, investment banks, commodity traders and other market participants in the full spectrum of transactional and regulatory derivatives matters.

Recognized by Chambers Global and Chambers USA as one of the leading practitioners in derivatives and structured products, Fabien’s work covers a wide range of equity, credit, currency, commodity, and fixed-income derivatives and bespoke structures, as well as structured financing swaps, repos and other asset-based financing arrangements. Drawing on his experience advising clients on high-profile financial insolvencies, Fabien counsels clients in assessing and mitigating the liquidity, credit, insolvency and regulatory risks inherent in trading financial products. He also advises market participants on the implementation of regulatory reforms affecting the derivatives and futures industry globally.

Fabien’s work with credit derivatives has also involved advising traders on numerous prominent credit and succession events over the years, including recently, as counsel for the members of the International Swaps and Derivative Association (ISDA) Determinations Committee in the landmark decision in Sears to include a syndicated leveraged loan in the list of instruments that can be used to settle Sears’ Credit Default Swap (CDS) contracts.

Fabien holds a Master of Law degree from The University of Chicago Law School and is a graduate, magna cum laude, of the University of Lausanne Law School and School of Forensic Science and Criminology, in Switzerland, where he received both a J.D. and a Master in Criminology.

3) Off-Channel Communications and the Future of Recordkeeping

- The (lack of) rhyme or reason with settlement amounts and terms

- Are the benefits of self-reporting real?

- What do the cases mean for the future of recordkeeping requirements, communication, supervision and data management?

Speakers

Matthew Bloom is General Counsel responsible for overseeing all legal, compliance, regulatory, and transactional matters for the firm. In addition, he is counsel to Viking’s Management Committee. Matthew was previously Deputy General Counsel and Associate General Counsel. Prior to joining Viking in 2013, Matthew was a Litigation Associate at Cravath, Swaine & Moore. He also served as a law clerk to the Hon. Joel M. Flaum of the United States Court of Appeals for the Seventh Circuit. Matthew received a J.D. from Yale Law School and a B.A. in history from Yale College.

Amanda Hector is General Counsel and Chief Compliance Officer. Prior to joining D1, Amanda served as General Counsel of another investment firm. Prior to holding that position, Amanda spent eight years as an Assistant United States Attorney in the United States Attorney’s Office, Eastern District of New York, where she most recently served in the Business and Securities Fraud Unit. Before becoming a federal prosecutor, Amanda was a litigation associate at Simpson Thacher & Bartlett for four years.

Amanda graduated from Princeton University, Woodrow Wilson School of Public Policy, Phi Beta Kappa in 1999. She received a JD from Yale Law School.

Owen Schmidt is the Chief Operating Officer, General Counsel and Chief Compliance Officer of Kinetic. Prior to joining Kinetic, Owen was a Partner in the Investment Management group at Schulte Roth & Zabel LLP, where his practice focused on advising private fund managers on legal and regulatory compliance matters as well as growth equity and venture capital investment transactions. Before Schulte, Owen spent almost seven years as a partner, general counsel and chief compliance officer at two large investment fund managers, where he oversaw the firms’ legal and compliance departments, advised on all aspects of the firms’ operations, and served on numerous firm committees, including valuation, conflicts, expense, risk, and cybersecurity. Owen holds a Juris Doctor from the Fordham University School of Law and a Bachelor of Science from the University of Arizona.

Moderated by

Greg provides transactional, regulatory and compliance advice to investment advisers, mutual funds, closed-end funds, business development companies, private equity funds and hedge funds. He devotes a large portion of his practice to the structuring, launch and operation of registered investment companies and hedge funds and to the sales, acquisitions and restructurings of asset management firms.

Financial institutions, technology companies and asset managers also turn to Greg for guidance in connection with transactional, regulatory and compliance issues concerning digital currency and blockchain activities, including digital currency fund formation.

In addition, Greg advises financial institutions, fund sponsors, corporations, employees’ securities companies and other entities regarding exemptions under the Investment Company Act and Investment Advisers Act.

4) The Evolution of Insider Trading Rules: What You Need to Know

- Unpacking Shadow Trading

Speakers

Erin Mullen is the Chief Compliance Officer for Woodline Partners, LP. Previously, Erin worked at Citadel supporting the Fundamental Equities businesses and Citadel’s alternative data initiative. Prior to joining Citadel, she worked at Bank of America Merrill Lynch in a number different of legal and compliance roles. Erin began her career working at Gibson, Dunn & Crutcher and Chadbourne & Parke. Erin attended the Georgetown University Law Center and the University of Minnesota.

Joined LPC in 2007. Investment management associate at Schulte Roth & Zabel, LLP (2005-2007). Corporate associate at Friedman Kaplan Seiler & Adelman LLP (2000-2005). Corporate associate at Simpson Thacher & Bartlett (1998-2000). Graduated from Columbia University School of Law (1998) and Columbia University (1994).

Simon Raykher is the General Counsel and Chief Compliance Officer of Kepos Capital, a systematic investment management firm. Prior to joining Kepos in 2013, Simon served as General Counsel and Chief Compliance Officer of Lombard Odier Asset Management (USA) Corp, the US asset management subsidiary of one of the oldest and largest private banks in Switzerland. For the previous seven years, he was General Counsel, Chief Compliance Officer and Principal of Satellite Asset Management, L.P., a multi-strategy investment manager, based in New York and London. Prior to Satellite, Simon was an attorney with the law firm of Schulte Roth & Zabel LLP. Earlier in his career, he was a prosecutor with the Investigation Division of the New York County District Attorney’s office, where he conducted tax fraud and money laundering investigations. Simon started his career as an auditor with Coopers & Lybrand. Simon is an Adjunct Professor at Fordham University School of Law. Simon earned a B.B.A. and an M.B.A. in Accounting from Pace University and a J.D. from Fordham University School of Law.

Moderated by

Lance represents corporations, investment advisers, broker-dealers and other financial institutions, as well as boards and individuals, in a range of internal and government investigations, regulatory examinations and enforcement proceedings and litigation.

Prior to joining Akin, Lance served as senior counsel in the Division of Enforcement of the U.S. Securities and Exchange Commission’s (SEC) Los Angeles Regional Office. During his decade-long tenure at the Commission, Lance conducted complex, high-stakes investigations and litigation concerning investment adviser violations, insider trading, offering fraud, FCPA violations, public disclosures, FINRA and Nasdaq compliance, Ponzi schemes, broker-dealer registration, Bank Secrecy Act reporting, director independence, director compensation and accounting fraud. Notably, while at the SEC, he led a multiyear FCPA fraud case involving a multinational company, resulting in $1.8 billion in SEC remedies, one of the largest ever achieved by the agency.

Lance leverages his deep knowledge of the federal securities laws and intimate familiarity with the SEC and its processes, tactics and staff to his clients’ benefit—offering key insights to prevent misconduct before it occurs, minimize exposure and, if necessary, formulate an informed, strategic response to regulators. He also has extensive experience working closely with other regulatory authorities, including the U.S. Department of Justice (DOJ), the Federal Reserve, the Financial Industry Regulatory Authority (FINRA), state securities regulators, and state and federal banking regulators.

Lance received his B.A. summa cum laude from Boston College and his J.D. with highest honors from Columbia Law School, where he was a James Kent Scholar. Prior to his tenure at the SEC, he was an associate in the litigation and bankruptcy groups of a leading Los Angeles-based law fi rm and clerked for Judge Naomi Reice Buchwald in the Southern District of New York and Judge Pamela Ann Rymer in the U.S. Court of Appeals for the Ninth Circuit.

5)The Ethical Implications of Tech for Private Funds

- Discussion of the ethical issues faced at private funds, including AI, cybersecurity, and data privacy

Speakers

Max Abend is Counsel at PDT Partners, a global investment manager that develops and deploys quantitative, model-driven strategies to trade liquid assets using proprietary technology. Max also serves as one of the co-heads of the FISD Alternative Data Council, which brings together investment and data professionals to establish alternative data standards and guidelines. Prior to joining PDT, Max was a litigator at Cravath, Swaine & Moore in New York. Max holds a BBA in Management Information Systems from Western Connecticut State University and a JD from the New York University School of Law.

Steven M. Felsenthal. Mr. Felsenthal is General Counsel and Chief Compliance Officer of Millburn Ridgefield Corporation and all of its US and global affiliated entities. Prior to joining Millburn in January 2004, Mr. Felsenthal was a senior associate in the investment management group at Schulte Roth & Zabel LLP (September 1999- January 2004), where he represented and advised hedge funds, registered investment companies, investment advisers, broker-dealers and banks in connection with all facets of their asset management businesses, and a member of the tax department of Kramer, Levin, Naftalis & Frankel LLP (October 1996- September 1999). He graduated cum laude from Yeshiva University in 1991 with a bachelor of arts degree in political science, and order of the coif from Fordham University School of Law in 1996, where he also served as an editor of the Fordham Environmental Law Journal. Mr. Felsenthal received an LL.M degree in taxation from NYU School of Law in 2001 and has written and been quoted in numerous published articles on various topics related to investment management.

Neil has been the General Counsel of Tilden Park since April 2013, and the Chief Compliance Officer of Tilden Park at various times during his tenure at Tilden Park and most recently resumed this role in September 2023. Before joining Tilden Park, Neil was Associate General Counsel of Millennium Management LLC. Prior to Millennium, Neil was an Associate within the Investment Management Group of Schulte Roth & Zabel LLP. Neil holds a J.D. from the Fordham University School of Law and a B.A. in Philosophy from the University of Maryland at College Park.

Ed Hornstein is currently the Deputy Chief Compliance Officer and Counsel at Cinctive Capital Management. Ed previously served as the Deputy Chief Compliance Officer, Global Head of Regulatory Compliance at ExodusPoint Capital Management. Prior to that, he was the Chief Compliance Officer at Geller Advisors and an executive director in the compliance department at JPMorgan. Prior to JPMorgan, Ed founded a long-short hedge fund. Ed began his career as an associate in the securities practice of Morgan Lewis & Bockius.

Ed received his JD from The George Washington University Law School and his BA from Binghamton University.

Moderated by

Elizabeth L. Mitchell has more than twenty years’ experience representing and advising public companies, broker-dealers, hedge funds, investment advisers and boards, as well as senior executives and other individuals, in regulatory investigations, enforcement actions, and litigation involving the federal securities laws and other sensitive matters. Strategic and results-oriented, Ms. Mitchell has been recognized for her ardent advocacy, her unique combination of public company and securities trading and markets experience, and her ability to achieve risk-balanced solutions in multifaceted and bet-the-company cases. She is ranked in Chambers USA (Nationwide), where clients note her “extremely pragmatic, very thoughtful and creative” approach to helping clients achieve regulatory and business objectives.

2:30pm – 3:00pm

Networking Break

3:00pm – 3:30pm

THE CFTC Outlook: Keynote Q&A with Commissioner Mersinger

Speaker

Summer K. Mersinger was nominated by President Biden to serve as a Commissioner of the Commodity Futures Trading Commission and was unanimously confirmed by the Senate. She was sworn into office on March 30, 2022.

Prior to her appointment, Ms. Mersinger served as the Chief of Staff to CFTC Commissioner Dawn D. Stump. She also served as the Director of the Office of Legislative and Intergovernmental Affairs at the Commodity Futures Trading Commission under former Chairman Heath Tarbert.

Ms. Mersinger has 20 years of Capitol Hill and government relations experience. Prior to joining the CFTC, she was Senior Vice President at Smith-Free Group, a leading government affairs practice, where she worked on financial services issues including advocating for large fintech organizations.

From 2004 to 2016, Ms. Mersinger was a top aide to current Senate Minority Whip John Thune, who represents her home state of South Dakota. Most recently she served as his DC Chief of Staff, coordinating legislative activities for Sen. Thune’s team and working regularly with Senate leadership and senior staff on both sides of the aisle. Ms. Mersinger was instrumental during policy debates involving banking, finance, telecommunications, surface transportation, agriculture, and trade issues. Ms. Mersinger was also directly involved in the communications efforts spearheaded by Sen. Thune through his leadership post on the Senate Republican Conference.

Prior to joining Sen. Thune’s staff, Ms. Mersinger was a director of government relations at Arent Fox, and she also worked in Sen. Thune’s office while he was a member of the U.S. House of Representatives from 1999 to 2002. Summer completed her undergraduate degree from the University of Minnesota and her law degree from the Catholic University’s Columbus School of law. She is a proud mother of four children, two daughters and two sons, and resides in Northern Virginia with her husband.

Moderated by

Carl Kennedy is a partner and Co-Chair of Katten Muchin Rosenman LLP’s Financial Markets and Regulation practice.

With a varied background as a former regulator with the U.S. Commodity Futures Trading Commission (CFTC), former senior in-house counsel at a large investment bank, and senior counsel at a global financial services trade association, Carl Kennedy has deep experience in commodities and derivatives regulatory matters. Carl’s clients include U.S. and non-U.S. swap dealers, banks, futures commission merchants, investment managers, proprietary trading firms, exchanges, trade repositories, clearinghouses and other derivatives users. Carl regularly represents these clients before the CFTC, the U.S. Securities and Exchange Commission, the National Futures Association, as well as other federal regulatory agencies and self-regulatory agencies. Clients value his prior government and business experience when seeking advice on regulatory compliance, transactional, and enforcement-related issues in the commodities and derivatives markets.

Carl received his BA, MBA and JD from Temple University.

3:30pm – 4:20pm

International Regulations: Navigating Investment Overseas

- The latest trend towards non-bank financial institution regulation and efforts to reduce leverage

-

State of play in UK and Europe, including the latest FCA Consultation, AIFMD II, securitization regulation, and ESG

Speakers

Ben is the General Counsel of Aperture Investors, an alternative asset manager investing in various equity and credit strategies with offices in New York, London, and Paris. Prior to joining Aperture, he was Associate General Counsel at Corbin Capital Partners, an alternative asset management firm that specializes in multi-strategy hedge fund and opportunistic credit investing. Before his time at Corbin, Ben was an Associate in the investment management group at Debevoise & Plimpton. He earned a J.D. from Harvard Law School and a B.A. (cum laude) in Political Science and Hispanic Studies from Columbia University. He also holds the Chartered Alternative Investment Analyst (CAIA) designation.

Hunter Landrum serves as Deputy General Counsel at Two Sigma, an investment manager specializing in trading assets in liquid global markets across a range of conditions using a disciplined, scientific approach. Hunter is responsible for the firm’s engagement with governments and regulators as well as litigation and enforcement matters. Hunter is an active participant in the global financial regulatory community. He is currently based in New York having previously practiced in London and Washington D.C.

Hunter joined the firm in 2015. Before joining Two Sigma, Hunter was an attorney at WilmerHale in Washington D.C. In this role, he focused on government affairs and representing international financial institutions in high-profile investigations before a variety of domestic and international regulators. Hunter holds a J.D. from the University of Virginia School of Law and a B.A. in Political Science from the University of Alabama.

LEONARD NG is a member of Sidley Austin LLP’s Executive Committee and heads the firm’s UK/EU Financial Services Regulatory Group. Based in the firm’s London office, Leonard advises a wide range of global financial institutions on complex UK/EU financial services regulatory issues. He has particular experience in advising clients on operating under the regulatory framework established after the last financial crisis, and more recently on Brexit, sustainable finance/ESG, and crypto-asset regulation. Leonard is a past member of the Board of MFA, the trade association for the global alternative asset management industry, and is a frequent speaker at industry conferences. Leonard has received acknowledgements from numerous industry ranking guides, including Chambers UK (2012–2024). In 2022 and again in 2023, Leonard was selected by Financial News as one of Financial News’ ‘Fifty Most Influential Lawyers’. Leonard earned a LLB from the National University of Singapore Faculty of Law and an LLM from the University of Chicago Law School.

Moderated by

Orville Thomas is an Executive Director in the UBS Business Consulting team based in New York. Orville has almost 15 years of experience in prime brokerage/financing where he has advised hedge funds in various capacities including legal, business consulting and capital introductions. Prior to joining UBS, Orville was a member of the Capital Introductions team and BofA Securities in New York having previously worked at Credit Suisse in Hong Kong, and Morgan Stanley in both London and Hong Kong. Orville began his career as a lawyer in London and received a B.A. in political science from Boston College and a J.D. from Boston College Law School.

4:20pm – 5:10pm

Preparing for the Continued Growth of AI

- What are the risks and benefits of large language models (LLM)?

- Predictive Analytics proposal; recent sweep among investment managers

- AI washing and disclosure risks

Speakers

Kathleen Clapper is a Managing Director in NFA’s Compliance Department. In this role, she helps oversee the department’s examination, investigation, and financial surveillance programs. Prior to joining NFA, Ms. Clapper served as Chief Compliance Officer for R.J. O’Brien & Associates, LLC where she was responsible for leading a team of compliance professionals, administering the policies and procedures of the futures commission merchant (FCM) to ensure compliance with applicable rules and regulations, and developing strategic compliance initiatives. Ms. Clapper also spent more than 12 years at CME Group in roles supporting the exchange’s self-regulatory organization functions, including performing financial and compliance examinations of FCMs. Ms. Clapper received a Bachelor of Science in Accountancy from the University of Illinois at Urbana-Champaign and an MBA from DePaul University. She is a Certified Public Accountant and Certified Fraud Examiner.

Brendan Kalb is the General Counsel of ExodusPoint Capital Management, LP. Prior to joining ExodusPoint, Brendan was a partner in the Investment Management Group at Morgan Lewis in New York. Prior to joining Morgan Lewis, Brendan was the General Counsel at AQR Capital Management, LLC, a quantitative registered investment adviser based in Greenwich, CT, where he was responsible for managing the full spectrum of the firm’s legal affairs. Prior to joining AQR, Brendan worked as an associate at the law firms of Willkie Farr & Gallagher and Seward & Kissel. Brendan received his JD from Cornell Law School and graduated magna cum laude with a B.A. in International Relations & Economics from the University of Pennsylvania. Brendan has served as a member of the Board of the Directors of the National Futures Association and as a member of the Managed Funds Association’s Investment Adviser and Government Affairs Committees, and as Chairman of the MFA’s CTA, CPO and Futures Committee. Brendan also serves on the Board of Advisors of the Institute for Law and Economics, a joint research center between the Law School, the Wharton School and the Department of Economics at the University of Pennsylvania

Mr. Morof joined Trexquant in 2019 after eight years as Chief Compliance Officer (CCO) and Counsel at a Chicago proprietary trading and private fund management firm. Previously he has served as CCO, and other roles, for professional traders, market makers, and retail options brokers and clearing firms since 2001. Mr. Morof received a JD from Washington University in St. Louis, after a Bachelor of Arts in English Literature and Rhetoric from the University of Illinois in Champaign-Urbana.

Moderated by

DAVID FORM focuses his practice on hedge funds and other alternative investment products and their investment advisers in connection with corporate, regulatory, and compliance matters. David’s clients implement a broad variety of strategies, including long/short equity, credit arbitrage, distressed credit, mortgage-related, quantitative /systematic, reinsurance, and multistrategy and range in size from startup managers to large institutional advisers. David was shortlisted by Euromoney Legal Media Group for its second annual Americas Rising Stars Awards under the category of investment funds and won that organization’s 2019 “Deal of the Year” award for his work on the launch of ExodusPoint’s flagship hedge fund, which was reported by news outlets to be the largest hedge fund startup launch in history. David has also been recognized as a “Rising Star” by Law360 in the Fund Formation category (2020), and by Who’s Who Legal as a leading Private Funds formation lawyer (2022).

5:10pm– 6:00pm

2024 Election Insights: Keynote Q&A with Chuck Todd

Speakers

Fifty years from now, one journalist will be the voice and face of our political era — and that journalist is Chuck Todd. A self-described political junkie, he has earned a reputation as one of the most passionate journalists and sharpest analysts in American media. He is NBC News’ chief political analyst and, from 2014-2023, served as the revered moderator of Meet the Press — the flagship Sunday morning public affairs program, the longest-running broadcast in television history, and the number one-rated Sunday public affairs program for several consecutive years. Todd also hosted the daily NBC News Now show, Meet the Press NOW, which builds on the success of its previous iteration, Meet the Press Daily, which Todd anchored for eight seasons.

Influencers and competitors praise him as “a tireless reporter” with “an encyclopedic knowledge of politics” and the ability to “break down barriers and get people off of their talking points.” With what Washingtonian calls a “savant-like knowledge of politics,” he has become a fixture in the White House press room, a steady and constant presence on television, and a tireless voice on the campaign trail. His up-to-the-minute poll analysis and insightful commentary have made him one of the most sought-after voices in American political coverage.

Previously, Todd served as NBC News chief White House correspondent (2008–2014), as well as the host of NBC News’ The Daily Rundown (2010–2014), featuring interviews with members of Congress and other newsmakers. As the network’s chief political analyst, he plays a key role in shaping the editorial for all aspects of NBC’s political coverage. Exclusively represented by Leading Authorities speakers bureau, Chuck Todd has the unique ability to deliver an all-consuming passion for politics with razor-sharp analysis. As the political news of today becomes tomorrow’s American history, he offers a comprehensive picture of the current political landscape and serves as the voice of America in the early 21st century.

A Star in Political Journalism. Todd was among the media’s most-trusted voices in the run up to the 2020 elections, during which he co-moderated two of NBC’s presidential primary debates. The first, in June 2019, set records as the most-watched Democratic presidential debate in history — a record that was broken by the second debate in 2020. During the 2008 presidential election, Todd became a frequent contributor to several television news outlets, and during the 2004 elections, he had the rare privilege of moderating one of the few presidential candidate forums in Iowa.

Todd also hosts The Chuck ToddCast and teaches a graduate-level political communications course at Johns Hopkins University. In 2012, GQ named Todd “The Most Powerful Journalist in Washington.” That same year, he also won the Jeopardy! Power Players match. In 2005, Washingtonian featured him in its “Best of” issue in the journalism section, and in 2009, the magazine named him one of the top 50 journalists covering Washington. In 2001, George magazine named Todd one of the 50 most influential people in politics.

Todd was one of the founders of Sports Business Daily (now known as Sports Business Journal) in 1994, serving as the publication’s managing editor before returning to politics in 1995.

Covering Campaigns, Candidates, and Everything in Between. Todd loves to follow races, issues, and campaigns, and when he isn’t following politics, he’s writing about them. He contributes to publications like the New York Times, the Washington Post, and the Atlantic Monthly, where he is a contributing editor. In 2009, Todd co-authored the definitive election analysis book How Barack Obama Won. His second book, The Stranger: Barack Obama in the White House, was released in 2014.

In 2007, Tim Russert, then-Washington bureau chief and Meet the Press moderator recruited Todd to join NBC as the network’s political director. Before that, he was the editor-in-chief of National Journal’s The Hotline, Washington’s premier daily briefing on American politics. In his 15 years working at the Hotline or one of its affiliates, Todd became one of Washington’s foremost experts on political campaigns of all levels. He helped to grow the publication from a single daily political exposition into an elite paper at the epicenter of politics.

Moderated by

Noah Theran is MFA’s Executive Vice President and Managing Director, Head of Global External Affairs.

Noah joined MFA after six years at Internet Association, a national trade association representing more than 40 of the world’s top internet companies, where he oversaw global communications, creative, marketing, events, and grassroots. In this role, he helped grow Internet Association from a startup into a respected voice on tech policy issues.Prior to Internet Association, Noah was Director of Communications at the American Investment Council, the trade association representing the interests of the world’s largest private equity firms. There, his team earned a PRSA Silver Anvil Award of Excellence, Reputation/Brand Management for their campaign to help the private equity industry manage the spotlight of the 2012 presidential election.

Noah also worked at Rasky Baerlein Strategic Communications in Washington, where he developed and executed communications strategies for a diverse set of clients with broad reputation, image, and crisis management challenges.

Noah earned his B.S. from Cornell University in Ithaca, NY.