MFA Network Miami 2024 - Agenda

Explore sections

Agenda

Day 1: Monday, January 29, 2024

*1:1 Allocator Meetings 8:00am– 5:00pm

8:00AM – 9:00AM

Registration & Breakfast

12:00pm – 2:00pm

All Conference Welcome Lunch

5:00PM – 6:30PM

All Conference Welcome Reception

Generously sponsored by Cboe

Offsite at the Betsy Hotel Rooftop

Day 2: Tuesday, January 30, 2024

*1:1 Allocator Meetings 8:00am– 5:00pm

6:30AM – 7:30AM

Conference Fitness Activity: HIIT Bootcamp

8:00AM – 9:00AM

Registration & Breakfast

8:00AM – 9:00AM

Allocator Breakfast & Networking (Invitation Only)

9:15AM – 9:30AM

Opening Remarks

Speakers

Bryan Corbett is MFA’s President and CEO. He is a veteran of Washington and Wall Street. For the past 12 years, he was a senior executive at The Carlyle Group, most recently as Managing Director in the Corporate Private Equity segment and Head of the firm’s OneCarlyle Global Investment Resources Group. In this role, Mr. Corbett and his team provided strategic and operational support to investment teams and portfolio companies across segments.

For the first half of his Carlyle tenure, Mr. Corbett managed U.S. government and regulatory issues affecting Carlyle, its investments and the industry. In this role, he developed legislative and regulatory strategies relating to all of Carlyle’s business segments, including private equity, credit and real estate. In addition to serving on the boards of several Carlyle portfolio companies, Mr. Corbett started the firm’s global corporate citizenship program focused on responsible investing, published Carlyle’s inaugural corporate citizenship report, and started the firm’s initiative to recruit and place diverse individuals on portfolio company boards in the U.S.

Prior to joining Carlyle, Mr. Corbett served in the George W. Bush Administration as a Special Assistant to the President for Economic Policy and as the Senior Advisor to Deputy Secretary Robert Kimmitt at the Treasury Department. He also served as Majority Counsel on the Senate Banking Committee.

Mr. Corbett earned his JD from George Washington University Law School, where he was editor-in-chief of the George Washington Law Review, and earned his BA from University of Notre Dame.

9:30AM – 10:10AM

An Inside Look at the 2024 US Presidential Election

Speakers

Jim Messina is arguably one of the world’s most successful political advisors. The mastermind behind former-President Obama and then-Vice President Biden’s 2012 re-election campaign, Jim Messina seized the reins on what Bloomberg Businessweek dubbed “the highest-wattage crash course in executive management ever undertaken”—and succeeded, earning the President another term in the White House. With the guidance of technology’s foremost leaders, Jim abandoned every step of a traditional presidential campaign and merged technology and politics in a way that was both unpredictable and unprecedented.

Jim’s strategies established the modern presidential campaign—Google’s Executive Chairman Eric Schmidt called it “the best-run campaign ever.” The American Association of Political Consultants later crowned him the Campaign Strategist of the Year (2013).

Messina is among the most sought after legislative DC insiders, having worked in the Obama-Biden administration as Deputy Chief of Staff where he worked closely with both former-President Obama and President-elect Joe Biden on the passage of the historic Affordable Care Act, the American Recovery and Reinvestment Act , which has been credited with saving the U.S. economy, and the landmark repeal of “Don’t Ask Don’t Tell.” Jim earned the nickname “The Fixer” as he worked closely with President Obama and Vice President Biden and Congressional leaders on both sides of the aisle to pass the Affordable Care Act. For over twenty years, Jim served as Chief of Staff for various Senate and House offices on Capitol Hill where he worked to pass key legislation such as multiple tax cut bills, the Medicare prescription drug bill, and several trade agreements.

Since then he has gone on to elect over a dozen Presidents and Prime Ministers on five continents including: the UK’s Theresa May and David Cameron, Mexico’s Enrique Peña Nieto, Argentina’s Mauricio Macri, Italy’s Matteo Renzi and in 2016 helped Spain’s President Mariano Rajoy win a surprising re-election margin.

In 2013, Messina launched The Messina Group. In this role, Messina provides strategic consulting to businesses around the world. The firm has been involved in winning public policy campaigns on five continents. Clients include Uber, Airbnb, Google, Delta Air Lines, Hutchison Whampoa, and over 300 others.

Previously, Jim served as Deputy Chief of Staff in President Barack Obama’s White House, where he was integral to the passage of the historic health care bill, the economic stimulus act credited with saving the US economy, and the landmark repeal of “Don’t Ask Don’t Tell.”

Messina continues to advise and guide Democratic candidates and organizations at all levels, as well as providing insight on news outlets such as MSNBC, CNN, Fox News, Bloomberg, BBC and others.

Jim serves on the boards of Organizing for Action (OFA), Virgin HyperloopOne, Google’s Advanced Technology Panel, Vectra.ai, Pillpack, Patient Safety Movement Foundation, LanzaTech, Hyp3r, the United States Soccer Foundation, Fortera, the Montana Land Reliance, and Blockchain.com.

Karl Rove, an iconic political strategist and one of the most sought-after political pundits of our time, is best known for his provocative and robust knowledge of major political issues.

Rove served as Senior Advisor to President George W. Bush from 2000–2007 and Deputy Chief of Staff from 2004–2007. At the White House, he oversaw the Offices of Strategic Initiatives, Political Affairs, Public Liaison, and Intergovernmental Affairs and was Deputy Chief of Staff for Policy, coordinating the White House policy-making process. He was the architect of President Bush’s 2008 and 2004 White House victories.

Before the White House, he ran Rove + Co. a Texas based public affairs firm that consulted on over 75 GOP campaigns for Senator, Governor, Congress and statewide offices in 24 states.

Rove was described by author and columnist Michael Barone as “…unique…no Presidential appointee has ever had such a strong influence on politics and policy, and none is likely to do so again anytime soon.” Washington Post Pulitzer Prize-winning reporter David Broder wrote that Rove was a master political strategist whose “game has always been long term…and he plays it with an intensity and attention to detail that few can match.” Conservative editor and columnist Fred Barnes, called him “the greatest political mind of his generation and probably of any generation… He knows history, understands the moods of the public and is a visionary on matters of public policy.”

Mr. Rove writes a weekly op-ed for the Wall Street Journal, appears frequently on the Fox News Channel, and is the author of the New York Times bestseller Courage and Consequence. His latest book is The Triumph of William McKinley. A Colorado native, Rove lives in Austin, Texas where he teaches at the University of Texas and serves on the Texas State History Museum and McDonald Observatory boards.

Moderated by

Bryan Corbett is MFA’s President and CEO. He is a veteran of Washington and Wall Street. For the past 12 years, he was a senior executive at The Carlyle Group, most recently as Managing Director in the Corporate Private Equity segment and Head of the firm’s OneCarlyle Global Investment Resources Group. In this role, Mr. Corbett and his team provided strategic and operational support to investment teams and portfolio companies across segments.

For the first half of his Carlyle tenure, Mr. Corbett managed U.S. government and regulatory issues affecting Carlyle, its investments and the industry. In this role, he developed legislative and regulatory strategies relating to all of Carlyle’s business segments, including private equity, credit and real estate. In addition to serving on the boards of several Carlyle portfolio companies, Mr. Corbett started the firm’s global corporate citizenship program focused on responsible investing, published Carlyle’s inaugural corporate citizenship report, and started the firm’s initiative to recruit and place diverse individuals on portfolio company boards in the U.S.

Prior to joining Carlyle, Mr. Corbett served in the George W. Bush Administration as a Special Assistant to the President for Economic Policy and as the Senior Advisor to Deputy Secretary Robert Kimmitt at the Treasury Department. He also served as Majority Counsel on the Senate Banking Committee.

Mr. Corbett earned his JD from George Washington University Law School, where he was editor-in-chief of the George Washington Law Review, and earned his BA from University of Notre Dame.

10:10AM – 10:45AM

Keynote Q&A

Speakers

Ken Griffin is the Founder, Chief Executive Officer, and Co-Chief Investment Officer of Citadel, one of the world’s leading alternative investment firms. Intrigued by finance, Ken began investing in 1986 as a freshman at Harvard. Four years later, he founded Citadel, driven by a focus on the combination of exceptional talent, advanced predictive analytics, and powerful software engineering. Today, the Citadel team of over 2,500 professionals is globally recognized as a market leader, investing on behalf of the world’s preeminent research institutions, universities, and healthcare organizations, with the mission of delivering superior long-term returns.

In 2002, Ken and his partners established Citadel Securities, now one of the leading global market makers. Serving more than 1,600 clients, including many of the largest sovereign wealth funds and central banks, Citadel Securities has delivered enormous benefits to investors around the world. Over the past two decades, through its trading, research, and technology, Citadel Securities has created more transparent, resilient, and competitive markets both in the U.S. and abroad. Ken is Non-Executive Chairman of Citadel Securities.

A passionate philanthropist, Ken is committed to strengthening humanity’s future by supporting initiatives that advance breakthroughs in science and medicine, and expand access and opportunity in education. His catalytic giving empowers students across our country to succeed and enables people to live longer and healthier lives.

Most recently, during the COVID-19 crisis, Ken took immediate action and mobilized partners across government, business, and healthcare to fund critical research. He played a key role in helping to safely return hundreds of Americans from Wuhan, China. Additionally, Ken’s thought leadership was instrumental in architecting Operation Warp Speed’s accelerated vaccine development strategies, which ultimately saved hundreds of thousands of lives.

As the pandemic engulfed America and schools were closing their doors, Ken enabled students to continue their learning by playing a leadership role in providing free high-speed broadband access to 400,000 low-income homes across Chicago and Miami. Championing his belief that a high-quality education is the on-ramp to the American Dream, Ken has funded transformative undergraduate scholarships to equip thousands of low-income and first-generation students with the skills and tools needed to succeed.

Ken holds an A.B. in Economics from Harvard College.

10:45AM – 11:15AM

2024 Economic Outlook and Fed Policy Analysis

Speakers

Claudio Irigoyen is managing director and head of Global Economics Research for BofA Global Research. In this capacity, he oversees the Global Economics Research team, coordinates global economics forecasts and reports on the global economic landscape.

Prior to being named head of Global Economics Research, Irigoyen was head of Latin America Economics, Equities and Fixed Income and Foreign Exchange Research. He ranked number one for several years in the Latin America Institutional Investor surveys, and under his leadership, the Latin America team ranked first overall.

Before joining BofA in 2011, Irigoyen served as head of Global Macro Trading at Deutsche Bank Proprietary Trading. Prior to joining Wall Street, he served as chief economist and director of monetary policy at the Central Bank of Argentina for half a decade. Irigoyen holds a Ph.D. in economics from the University of Chicago. He is based in New York.

Alex joined Bridgewater in 2010 and is currently a Portfolio Strategist in our Research group. In addition to conducting macroeconomic research, he communicates with Bridgewater’s clients regarding the macro outlook, Bridgewater strategies, and portfolio construction. He has expertise in portfolio construction, currencies, credit, commodity, and equity markets. Before joining Bridgewater, Alex was a consultant for Oliver Wyman Financial Services. He has an M.A. in Applied Mathematics and Statistics from Hunter College, and an A.B. in Philosophy from Princeton University.

David Zervos is currently Chief Market Strategist for Jefferies LLC and Head of the Global Macro Division of Leucadia Asset Management, LLC (“LAM”). David joined Jefferies in 2010 after spending 2009 as a visiting advisor at the Board of Governors of the Federal Reserve System in Washington, D.C. Prior to visiting the Federal Reserve, he held a variety of research, sales and trading positions in the private sector, most recently managing global macro portfolios for Brevan Howard and UBS O’Connor. He began his career as an economist at the Federal Reserve Board in the early 1990’s. He received a B.Sc. from Washington University, and an M.A. and Ph.D. in economics from the University of Rochester.

Moderated by

John Kushner joined Northern Trust in 2011 and is a Senior Vice President and Head of Relationship Management, North America, at Northern Trust Hedge Fund Services (NTHFS). John is responsible for managing and driving client service delivery, advocating for the current and future needs of the Hedge Fund and Private Equity Manager community, and extending NT’s services and relationships across the alternatives industry. John has 15 years of industry experience across the asset servicing space and 13 years of middle office, operations and client service experience within NTHFS (formerly Omnium LLC, subsidiary of Citadel LLC).

Prior to joining Citadel LLC in 2007 where he supported Fundamental Credit, Risk Arbitrage and Global Equity strategies, John managed a middle office operations team at Brown Brothers Harriman & Co. responsible for transaction processing on behalf of $2.2T in global custody client assets.

John holds a Bachelor of Arts from the University of Pennsylvania, is a Chartered Financial Analyst and an active member of several industry organizations, including SIFMA, ISDA, MFA and SWIFT.

11:15AM – 11:45AM

Regulation and Rule Readiness

Speakers

Dalia Blass is the Senior Investment Management Partner at Sullivan & Cromwell LLP. Her practice focuses on providing strategic and regulatory advice to asset managers, registered and private funds, fund boards and their service providers across the range of regulatory, governance, compliance, examination and enforcement matters they face. She has a unique and deep expertise in the intricate legal, risk and compliance issues raised by existing and new regulation under the Investment Company Act and the Investment Advisers Act, including with respect to the design and structuring of innovative fund products and addressing challenging governance matters. Her leadership in these areas supports clients as they navigate the increasingly complex global, federal and state regulatory landscape facing asset managers.

Ms. Blass previously served as the Director of the Division of Investment Management at the U.S. Securities and Exchange Commission (SEC).

Tracey joined Bridgewater in 2012 and is currently Chief Legal Officer and Corporate Secretary. She is also a Partner, and a member of the firm’s Executive Committee and Operating Committee. In her role, she oversees our Legal and Regulatory Department and is responsible for legal and corporate governance, managing legal risk across Bridgewater and its funds. Prior to joining Bridgewater, Tracey practiced with the international law firms, Milbank, Tweed, Hadley & McCloy LLP, and Dewey & LeBoeuf LLP, representing banks, issuers, private equity funds and mezzanine funds in a wide range of banking and securities transactions. Tracey also represented public and private companies on corporate law and corporate governance matters.

Tracey graduated from The Johns Hopkins University with honors, received a Master of Sciences degree from the University of Pennsylvania, and graduated from University of Southern California Gould School of Law. Tracey currently serves as Chair of Make-A-Wish Connecticut’s Board of Directors and on The Johns Hopkins Lacrosse Advisory Board. Tracey is a member of the California State Bar, New York State Bar, District of Columbia Bar, and is Authorized In-House Counsel in Connecticut.

Follow Tracey on LinkedIn

Moderated by

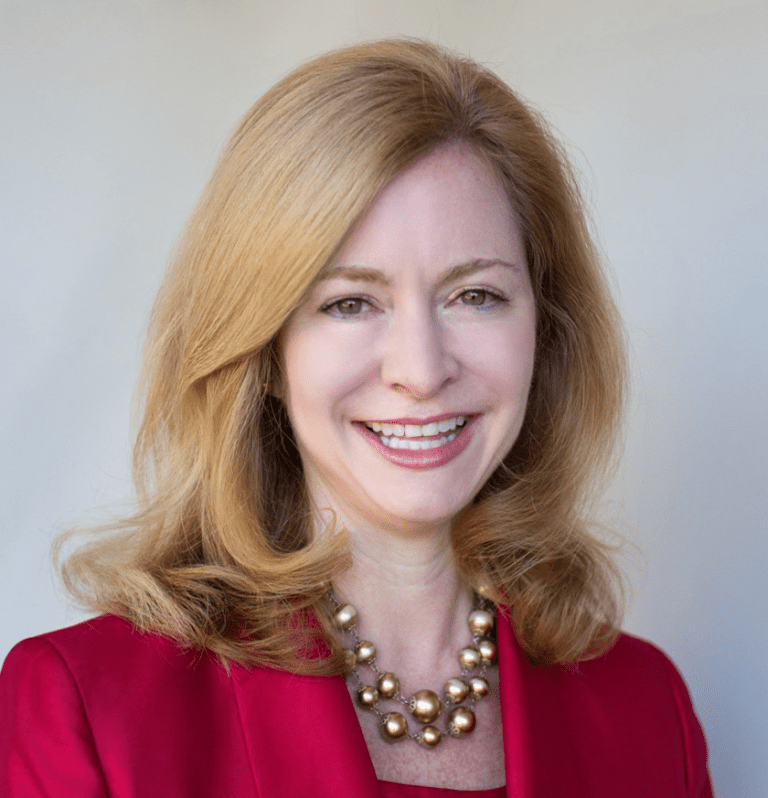

Jennifer Han is Chief Legal Officer and Head of Global Regulatory Affairs at MFA. Jennifer is responsible for the strategy and execution of the Association’s U.S. regulatory advocacy and leads MFA’s regulatory engagement. She has authority and oversight over all legal matters involving MFA, including contractual matters, litigation, compliance and legal liability. She also advises MFA members on legal, regulatory, and compliance changes and/or guidance impacting the alternative investment industry, including investment advisers, commodity trading advisors, and commodity pool operators. She has extensive experience working with policymakers and regulators, such as throughout the 2008 financial crisis, post-crisis, and to the refinement of today’s regulatory framework. She engages regularly with legislative policymakers and regulators, including the SEC, CFTC, Department of Treasury, Federal Reserve, NFA, ESMA, UK FCA, and IOSCO, among many others.

Jennifer joined MFA in 2006 as legal counsel and has served in a few different capacities before joining MFA’s executive leadership team. Prior to joining MFA, Jennifer was a staff attorney in the Office of Compliance Inspections and Examinations at the SEC, where she conducted inspections and examinations, and advised on legal and compliance matters relating to developments in securities regulations and industry practices. Jennifer began her legal career as an associate with Pickard and Djinis LLP, a boutique securities law firm in Washington, D.C. She received her Bachelor of Arts degree from Cornell University and her Juris Doctor from American University. While in law school, she was an Editor of the American University International Law Review. Jennifer is a member in good standing of the DC bar.

Jennifer serves on the Washington D.C. Committee of 100 Women in Finance, and on the Board of Directors for the YWCA National Capital Area.

Prior to joining MFA, Jennifer was a staff attorney in the Office of Compliance Inspections and Examinations at the SEC, where she conducted inspections and examinations, and advised on legal and compliance matters relating to developments in securities regulations and industry practices. Jennifer began her legal career as an associate with Pickard and Djinis LLP, a boutique securities law firm in Washington, D.C. She received her Bachelor of Arts degree from Cornell University and her Juris Doctor from American University. While in law school, she was an Editor of the American University International Law Review. Jennifer is a member in good standing of the Virginia bar.

11:45AM – 12:10PM

Keynote Q&A

Speakers

Joe Dowling is a Senior Managing Director and the Global Head of BAAM, where he oversees and leads all of BAAM’s investment activities.

Prior to joining Blackstone in 2021, Mr. Dowling led Brown University’s endowment, including as Chief Executive Officer from July 2018 to July 2020 and Chief Investment Officer from June 2013 to July 2018. Mr. Dowling also served as interim Chief Financial Officer of the University from May 2019 until January 2020, leading all finance and treasury functions as well as cash and debt management.

Before joining Brown University, he was the Founder and Chief Executive Officer of Narragansett Asset Management, where he managed funds for institutions, pension funds, and endowments. Mr. Dowling has also worked for First Boston and Tudor Investments.

Mr. Dowling has a B.A. from Harvard College and an MBA from Harvard Business School.

Moderated by

Edouard Matitia-Cohen is a Managing Director and Global Head of Equity Financing Distribution at Bank of America, based in New York.

In his role, he is responsible for all sales globally across Prime Financing, Equity Synthetics, Stock Loan, Capital Strategies and Business Consulting, ensuring the delivery of an integrated coverage and distribution strategy worldwide. He joined the firm in 2012 and was previously Americas Head of Equity Sales.

Prior to joining Bank of America, Matitia-Cohen was the European Head of Equity Derivatives, Convertibles and Delta One sales at Credit Suisse, based in London. He was a member of Credit Suisse’s European Equity Management Committee and Global Equity Management Committee.

Previously, Matitia-Cohen worked at Morgan Stanley for over 11 years and held various roles including the Head of U.S. Capital Structure and Special Situations business in New York, and a member of the Equity Derivatives trading team in London.

He holds a B.A. (Hons.) in economics from ICADE University in Madrid and Ecole Superieure de Commerce in Reims, France.

Matitia-Cohen serves on a variety of boards in multiple capacities across leading organization in several fields. He is a term corporate member of the Council of Foreign Relations (CFR), Executive Advisory Board member of the Hispanic Latino Advancement Org., Board member of the Managed Fund Association (MFA), and an outside advisor to the Board at the ISW, The Institute for the Study of War in Washington, D.C.

12:10PM – 1:00PM

Lunch & 1:1 Allocator Meetings Only

1:00PM – 1:35PM

CIO Insights: Navigating Today’s Economy

Speakers

Pablo E. Calderini is the President and Chief Investment Officer of Graham Capital Management, L.P. (“GCM”), an alternative investment firm with approximately $17 billion in AUM as of August 1, 2021. Mr. Calderini is responsible for the management and oversight of the discretionary and systematic trading businesses at GCM, among other things. Mr. Calderini is also a member of the firm’s Executive, Investment, Risk and Compliance committees. He joined GCM in August 2010 and became an Associated Person and Principal of GCM effective August 13, 2010. Prior to joining GCM, Mr. Calderini worked at Deutsche Bank from June 1997 to July 2010 where he held positions of increasing responsibility, most recently the Global Head of Equity Proprietary Trading. Mr. Calderini commenced his career at Deutsche Bank as Global Head of Emerging Markets. During his tenure at Deutsche Bank, Mr. Calderini also helped manage several groups across the fixed income and equity platforms, including the Global Credit Derivatives Team. Mr. Calderini received a B.A. in Economics from Universidad Nacional de Rosario in 1987 and a Masters in Economics from Universidad del CEMA in 1989, each in Argentina.

Meredith B. Jenkins is chief investment officer for Trinity Church Wall Street, where she is responsible for the investment management and oversight of the church’s endowment and real estate holdings.

Prior to joining Trinity, Ms. Jenkins was the co-chief investment officer of Carnegie Corporation of New York, Andrew Carnegie’s foundation, from 2011 to 2016. She joined in 1999 as its first investment associate and was an integral part of the build-out of the corporation’s investment capability under its first chief investment officer.

After moving to Hong Kong in 2007 for family reasons, Ms. Jenkins served as the corporation’s special representative to Hong Kong, focusing on investment opportunities in Asia, including China, Japan, India, Southeast Asia and Australia. During this time, she continued as an active member of the investment leadership team. Before joining Carnegie Corporation, she was a buy-side equity research associate for Sanford C. Bernstein & Co. and an investment banking analyst at Goldman Sachs.

Ms. Jenkins received a B.A. in English language and literature, with distinction, from the University of Virginia, where she was elected to Phi Beta Kappa, and an M.B.A. degree from Harvard Business School.

She serves on the investment committees and boards of trustees of The Wenner-Gren Foundation, The Josiah Macy Jr. Foundation, and The Windward School. She is married and the mother of three boys.

Mr. Lippmann is the Managing Founding Partner and the Chief Investment Officer of LibreMax Capital. Prior to founding LibreMax, Mr. Lippmann was head of all non-agency RMBS, ABS and CDO trading globally at Deutsche Bank, where he led a team of 30 senior professionals in New York and London. Mr. Lippmann began his career at Deutsche Bank as a trader of non-investment grade ABS and RMBS securities. In 2003, he became Global Head of ABS and CDO trading, adding non-agency MBS to his business in late 2008. Prior to joining Deutsche Bank in 2000, Mr. Lippmann was a Director and head of ABS/MBS Subordinate and CDO trading at Credit Suisse, which he joined in 1991. Mr. Lippmann graduated from the University of Pennsylvania in 1991, magna cum laude, with a B.A. in Economics and a minor in English. Mr. Lippmann serves on the board of New 42nd Street and the South Fork Natural History Museum. He is also on the Advisory Council of the American Museum of Natural History.

Dr. Dharmesh Maniyar founded Maniyar Capital in May, 2019. He previously was a Managing Director and a Partner at Tudor (2013-2020) focusing on discretionary macro trading. Prior to joining Tudor, Dharmesh was a portfolio manager at Brevan Howard Asset Management, LLP (2008-2013). Prior to joining Brevan Howard Asset Management, he worked as a post-doctoral research associate for a globally collaborated Managing Uncertainty in Complex Models (MUCM) project at Aston University in England (2006-2008). Prior to receiving his PhD, he was a Senior Software Engineer at the Centre for Development of Advanced Computing in India (2001-2003). Dharmesh holds both a BSc in Chemistry and Physics (1998) and a Master of Computer Applications (2001) from Bhavnagar University and a PhD in Applied Mathematics (Machine Learning) from Aston University (2006).

Moderated by

Herald van der Linde is HSBC’s Head of Equity Strategy, Asia-Pacific, based in Hong Kong. Prior to this, he worked for 20 years in different roles in Indonesia, South Africa and Taiwan as an analyst, equity strategist, and head of research. He holds the CFA designation, has a degree in economics, speaks multiple languages, is a certified lecturer for the Wine & Spirit Education Trust and teaches at the Hong Kong University of Science and Technology. Herald is the author of “Jakarta: History of a Misunderstood City” and “Asian Stock Markets: From The Ground Up” and will soon publish a book on Indonesia’s Majapahit empire.

1:35PM – 2:00PM

Keynote Q&A

Speakers

Jonathan Lavine is Co-Managing Partner of Bain Capital, a leading global private investment firm with approximately $175 billion in assets under management, more than 1,650 employees and 24 offices worldwide. He also serves as the Chief Investment Officer of Bain Capital Credit and Bain Capital Special Situations.

Mr. Lavine founded Bain Capital Credit, formerly known as Sankaty Advisors, in 1998. Bain Capital Credit invests across the full spectrum of credit strategies, including leveraged loans, high-yield bonds, distressed debt, private lending, structured products, non-performing loans, equities and insurance solutions. He also created Bain Capital’s special situations investment strategy which provides bespoke capital solutions leveraging credit, equity, corporate and real estate expertise. Together, Bain Capital Credit and Bain Capital Special Situations have approximately $65 billion in assets under management, more than 420 employees and offices in Boston, Chicago, Dublin, Guangzhou, Hong Kong, Lisbon, London, Madrid, Melbourne, Mumbai, New York, Seoul, Singapore and Sydney.

Mr. Lavine joined Bain Capital’s private equity group in 1993. Prior to joining Bain Capital, he was a consultant at McKinsey & Company. He began his career at Drexel Burnham Lambert in mergers and acquisitions.

Mr. Lavine and his wife, Jeannie, formed and oversee the Crimson Lion Foundation which delivers financial resources to a wide variety of nonprofit organizations focused on leveling the playing field for individuals and families. The foundation works to address pressing social challenges in the areas of education, community and public service, health and welfare, discrimination and poverty. It supports the multi-disciplinary efforts of organizations that serve to strengthen society through research, innovation, public policy, direct service and advocacy. To that end, Mr. and Mrs. Lavine have supported a diverse array of organizations including City Year (where Mr. Lavine is Chairman Emeritus of the National Board of Trustees), uAspire (where they have dedicated the Lavine Family Center for College Affordability), WBUR/NPR (where they have dedicated the Lavine Broadcasting Center at CitySpace in Boston), LIFT, Cradles to Crayons, the Equal Justice Initiative and many others. In addition, they have provided major support to healthcare institutions including the Dana Farber Cancer Institute, Massachusetts General Hospital, Boston Children’s Hospital as well as other medical research organizations. They are longtime supporters of Columbia University, where Mr. Lavine serves as Chair of the Trustees of the University and is a former chair of the Columbia College Board of Visitors; and Harvard University, where they endowed the Lavine Family Humanitarian Studies Initiative at the Harvard School of Public Health and provided substantial support to fund scholarships for first-generation students at Harvard Business School.

Mr. Lavine is the 2017 recipient of Columbia University’s Alexander Hamilton Medal, the highest honor awarded to a member of the college community for distinguished service. He is a past recipient of Columbia’s John Jay Award for professional achievement, Columbia’s David Truman Award for outstanding contribution to academic affairs, the Dean’s Leadership Award for the Class of 1988 25th Reunion, Columbia/Barnard Hillel’s Seixas Award, Opportunity Nation’s American Dream Award, Voices for National Service Citizen Service Award and of the New England Anti-Defamation League’s Distinguished Community Service Award. He is the first recipient of the London School of Economics Alternative Investments Conference’s “Distinguished Speaker Honour.” Mr. Lavine was appointed a Member of the United States Holocaust Memorial Museum Council by President Obama and reappointed by President Biden. He is also a member of the investor group and a director of the Boston Celtics.

Mr. Lavine graduated from Columbia College, Phi Beta Kappa and Magna Cum Laude, and holds an M.B.A with Distinction from Harvard Business School. He received an Honorary Doctor of Laws degree from Columbia University in 2023.

Moderated by

Kim Y. Lew is CEO of Columbia Investment Management Company which manages the $11 billion endowment of Columbia University of New York. Previously, she was the CIO of Carnegie Corporation of New York, the private grant making foundation founded by Andrew Carnegie in 1911 which she joined from the Ford Foundation. Lew started her career in the middle market banking group of Chemical Bank and following business school joined Prudential Capital Group.

Lew graduated from the Wharton School of the University of Pennsylvania with a B.S in Economics and from the Harvard Graduate School of Business with an MBA. She is a CFA charterholder and has served as both a standard setter and grader.

Lew serves on the Boards of Ariel Investment Management Mutual Funds, TIFF Advisory Services, and Girls Who Invest. She serves on the investment committees of the ACLU and National Gallery of Arts.

2:00PM – 2:30PM

Building Resilient Portfolios: Fund Manager Insights

Speakers

Otto Hamaoui is Director of Portfolio Management at Man AHL, responsible for all portfolio construction, management and optimisation at Man AHL. He is also a member of Man AHL’s investment and management committees. He was previously Deputy Head of Equities Research, having joined in 2016 to build out the medium frequency cash equities trading effort. Prior to joining Man AHL, Otto spent five years at Morgan Stanley in various equity derivatives roles, developing and running quantitative trading models. He holds a Master’s degree in Applied Maths from École Centrale Paris and Master’s degree in Quantitative Finance from Université Denis Diderot Paris 7.

Charlotte Hamill is a principal at Bracebridge Capital focused on both the firm’s structured products and energy transition assets. Bracebridge is a Boston-based hedge fund manager with approximately $12 billion under management. For over 25 years, the firm has focused on generating returns that are largely uncorrelated with broad moves in equities, currencies, and rates. Ms. Hamill is the co-head of the firm’s structured products group and is the portfolio manager for commercial real estate-related investments, including U.S. and European commercial mortgage-backed bonds, synthetic indices, loan portfolios, direct asset holdings and other bespoke structures. Ms. Hamill is also involved in evaluating non-performing loan and complex instrument trades spanning residential, commercial and unsecured consumer debt in the global ABS portfolio. Additionally, she is the portfolio manager for our environmental markets investments including carbon credits and related derivatives. She joined Bracebridge Capital in 2006. Ms. Hamill graduated cum laude from Harvard University with an A.B. in Applied Mathematics and Economics and a citation in French.

Mark is the leader of Wellington Management’s Global Macro team. Mark is a veteran macro risk-taker, the lead portfolio manager for the team’s investment portfolios, and the architect of Wellington’s US$10 billion multi-PM macro platform. As a manager of portfolio managers, he is responsible for internal manager selection, alpha and risk allocation to managers, and risk management across the team’s investment portfolios.

Mark received his BA from Colgate University. In addition, he holds the Chartered Financial Analyst and Chartered Market Technician designations.

Moderated by

Amelie Lonergan is the Americas Head of Prime Brokerage Sales for UBS Investment Bank. She joined UBS in 2023 from Morgan Stanley, where she spent 8 years as a Managing Director in the Americas Prime Brokerage Sales team, focusing on the origination and monetization of key hedge fund clients.

Prior to Morgan Stanley, Amelie spent 15 years at Credit Suisse, primarily in Prime Brokerage Sales and Relationship Management after starting her career in M&A at Credit Suisse First Boston in London.

Amelie is an alumnus of Centrale Supélec in Paris, where she earned a degree in engineering. She is a native Parisian, dual French/American citizen and is married with two daughters.

2:30PM – 2:55PM

Keynote Q&A

Speakers

Justin W. Slatky joined Shenkman Capital in 2011. He has 23 years of investing experience in high yield and distressed securities. Prior to joining Shenkman Capital, Mr. Slatky was Co-Head and Managing Director of the Distressed Bond business in New York and London for Goldman Sachs. He was also a member of the Credit Investment Committee charged with reviewing proprietary investments within the Credit Department. Before joining the distressed bond business in 2002, Mr. Slatky was a telecom high yield analyst and a recipient of Institutional Investor’s Runner-Up award. He joined Goldman Sachs from Credit Suisse First Boston in 2000, where he worked as a high yield analyst as part of an II ranked telecom team. Mr. Slatky graduated magna cum laude with a BS in Economics (1998) and an MBA (1999) from The Wharton School at the University of Pennsylvania.

Moderated by

Charmel Maynard currently serves as Chief Investment Officer & Treasurer for the University of Miami. In this capacity, he leads the University’s efforts to invest over $4B in assets, including endowment and pension funds. Mr. Maynard is also responsible for the University’s ~$2B capital structure, including liquidity and debt issuances. Additionally, he manages treasury and cash management.

Mr. Maynard was previously a vice president with J.P. Morgan’s Investment Bank in New York City. During his 10-year career with J.P. Morgan, he focused on investment banking debt capital markets and leveraged finance, where he advised clients on capital structure solutions, deal structuring, and execution of syndicated revolving credit facilities, institutional term loans, and bond issuances.

2:55PM – 3:15PM

Networking Break

3:15PM – 3:45PM

Investing in Biotech: Why Now?

Speakers

Shomesh E. Chaudhuri co-founded QLS Advisors in 2019 and currently serves as the Firm’s CEO and Co-CIO. Dr. Chaudhuri has developed portfolio intelligence platforms for several biopharma companies, consulting directly with CEOs, CFOs, and their staffs to help align their financing structures with their scientific and medical objectives. He has also led the development of the Firm’s core analytics platform, including QLS’s machine-learning driven forecasts of clinical trial outcomes, and has overseen the implementation of the entire QLS technology infrastructure and computational architecture. Prior to QLS, Dr. Chaudhuri was a postdoctoral associate at MIT’s Sloan School of Management where he designed new funding vehicles and business models to access previously untapped pools of capital to support biomedical innovation. He has published articles in top finance and biotech journals including JAMA Oncology, the Journal of Financial Economics, and Management Science and is the co-author of the textbook “Healthcare Finance: Modern Financial Analysis for Accelerating Biomedical Innovation”. He received a B.S. in biomedical engineering from Harvard University and an M.S. and Ph.D. in electrical engineering and computer science from the Massachusetts Institute of Technology.

Kiran Reddy is a Senior Managing Director in the Blackstone Life Sciences group having joined in May 2020. Dr. Reddy was previously the President & CEO of Praxis Precision Medicines, which he co-founded in November 2016.

Previously, Dr. Reddy was at Biogen where he was part of the corporate development and strategy leadership team. Dr. Reddy was also an Associate Partner at Third Rock Ventures. He supported and managed various portfolio companies in addition to focusing on new company formation and new investments. He was part of the founding team and interim Chief Business Officer for SAGE Therapeutics through its IPO. Dr. Reddy was part of the team that launched Foundation Medicine, and he has served as a Board Observer for Alnara pharmaceuticals, Rhythm pharmaceuticals and PanOptica pharmaceuticals.

Dr. Reddy holds MD and MBA degrees from Georgetown University. He completed his internship in medicine and his neurology residency at Harvard/Massachusetts General Hospital. Dr. Reddy was previously a Howard Hughes science fellow and has authored several peer-reviewed scientific papers in the field of epilepsy, neuroimmunology and neurodegenerative diseases.

Stephanie leads a team at RTW overseeing business development, strategic partnerships, communications, and investor relations.

Her background in investment banking and expertise in financial markets has helped position the firm as both a partner to life sciences companies and a steward of investors’ capital. Stephanie also manages RTW’s relationships with key partners including banks, academic institutions, corporations, investors, and NGOs. She has led the firm’s entry into the UK and European markets and serves as a director of the RTW Biotech Opportunities Ltd, a publicly traded investment fund listed on the London Stock Exchange.

Prior to joining RTW, she served as director at Valhalla Capital Advisors, a macro and commodity investment manager. Stephanie also worked in the New York and London offices of Lehman Brothers, where she advised on various Merger & Acquisitions, IPOs, and capital market financing transactions with a focus on cross-border transactions for the firm’s global corporate clients.

Stephanie graduated with honors from Columbia University and also received a Master’s Degree from the Columbia Graduate School of Journalism.

She serves as president of the RTW Charitable Foundation; and co-chair of Council of the New York Philharmonic.

Moderated by

Carlos Rangel is vice president and chief investment officer for the W.K. Kellogg Foundation in Battle Creek, Michigan. In this role, he supports the foundation’s efforts to promote thriving children, working families, and equitable communities. During his more than a decade tenure at the foundation, Rangel has contributed his skill and innovative approaches to investments. Most recently, Rangel has been a co-executive sponsor for the Expanding Equity work for the Kellogg Foundation in partnership with the CEO’s office and the vice president for program strategy. Before joining the foundation, Rangel spent nine years at Managed Asset Portfolios researching public equities. From 2008 – 2010, he taught undergraduate finance classes as an adjunct instructor at Walsh College of Accountancy and Business Administration. Rangel earned his bachelor’s and master’s degrees in finance from the University of Michigan – Dearborn. He holds the following designations: Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), Chartered Alternative Investment Analyst (CAIA), and Certificate in Investment Performance Management (CIPM). He is on the boards of the Ewing Marion Kauffman Foundation and Family & Children Services.

3:45PM – 4:10PM

Keynote Q&A

Speakers

Fahmi Quadir is the Founder and Chief Investment Officer of Safkhet Capital Management. The primary fund is short-only, focused on high-conviction opportunities where investigative and forensic methods are used to assess possible fraud, criminality, and consumer abuse, among other predatory activities. Fahmi regularly advocates for a deeper understanding of the market utility of short selling, including pushing for fairer short selling treatment and stronger fraud reporting protocols.

Moderated by

Anne-Marie Fink serves as the State of Wisconsin Investment Board’s Chief Investment Officer for Private Markets and Funds Alpha. At SWIB since 2020, she is responsible for overseeing more than $70 billion in assets in private equity, real estate, hedge funds, externally managed accounts, private debt, and venture capital portfolios, and a team of 38 professionals.

Anne-Marie has more than two decades of investment management experience. She served as the chief investment officer for the Employees’ Retirement System of Rhode Island and for a large family office. Anne-Marie started her investment career at JP Morgan, where she spent more than 16 years as an equity and hedge fund analyst. Before SWIB, she was at State Street Global Advisors as the portfolio strategist for alternative investments.

Anne-Marie earned a Bachelor of Arts degree from Yale University and an MBA from Columbia Business School. She is also the author of The Money Makers: How Extraordinary Managers Win in a World Turned Upside Down, which draws on investors’ experience to identify best practices in business management across companies and industries.

4:10PM – 4:40PM

Private Credit Outlook

Speakers

James serves as the Deputy Chief Investment Officer for Arizona Public Safety Personnel Retirement System (PSPRS) and works on developing strategic initiatives, process improvements, and provides leadership support to meet the goals and objectives of the trust’s investment program. He joined the investment team in 2018 and manages investments for the diversifying strategies portfolio and has managed the contractual income portfolio.

James has more than a decade of experience in building investment programs, portfolio construction, and alternative investment management. Prior to joining PSPRS, James worked for MIG Capital, Wedbush Securities, Roth Capital, and PricewaterhouseCoopers.

James holds a BA in Business Economics from the University of California, Los Angeles and is a CFA charter holder and CPA. James and his wife, Christina, have two children.

Ms. Lee is Co-Head of Private Credit and a member of the Investment Committee. Prior to joining Brigade in 2022, Ms. Lee was the Co-Head of JPMorgan’s Leveraged Capital Markets Group. At JPMorgan, Ms. Lee focused on the Healthcare, Automotive, and Consumer industries, and Financial Sponsor clients. Ms. Lee was also the Co-Head of JPMorgan’s US Debt Capital Markets Diversity, Equity and Inclusion Committee. Ms. Lee started her career at JPMorgan as an associate in the Healthcare Mergers and Advisory group in 1993. Ms. Lee received a BA in Biology and Art History from Amherst College and an MBA from the Yale School of Management. Additionally, Ms. Lee is on the Board of Women in Need and heads the audit committee.

Mr. Weinstein is a managing director and portfolio manager in the Newport Beach office and leads corporate special situations, focusing on PIMCO’s opportunistic and alternative strategies within corporate credit. Prior to joining PIMCO in 2019, he worked for KKR as a portfolio manager for the firm’s special situations funds and portfolios, which he managed since their inception in 2009. He was also a member of the firm’s special situations, real estate, and India NBFC investment committees and the KKR credit portfolio management committee. Previously, Mr. Weinstein was a portfolio manager with responsibility across KKR’s credit strategies. Prior to joining KKR, he was with Tishman Speyer Properties as director of acquisitions for Northern California and at Boston Consulting Group as a consultant. He has 22 years of investment experience and holds an MBA from Stanford University and a bachelor’s degree in civil engineering and operations research from Princeton University.

Moderated by

Jake Pollack is the Global Head of JPMorgan’s Credit Financing business which includes Private Credit and Syndicated Loan financing solutions across our Secured Portfolio Financing, CLO Primary and Loan TRS businesses. He is also responsible for JPMorgan’s Direct Lending business for Global Credit Markets, in partnership with Debt Capital Markets and the Commercial Bank. Jake began his career at JPMorgan in 2004 as a credit analyst in the Commercial Bank, before joining Credit Markets as a Desk Analyst in 2005. As a key risk manager for the Credit Markets franchise, Jake’s single name credit expertise spans a wide array of industries, from Autos in the 2008 Financial Crisis, to Technology, Healthcare, and more recently, pandemic-dislocated sectors. He has a MBA from Columbia Business School and a B.A. in Economics from New York University. Jake lives with his wife and three children in New Jersey.

4:30PM – 7:00PM

Women’s Investment Leadership Dinner (Invitation Only)

5:30PM – 7:00PM

All Conference Cocktail Reception

Day 3: Wednesday, January 31, 2024

*1:1 Allocator Meetings 8:00am– 5:00pm

6:30AM – 7:30AM

Conference Fitness Activity: Yoga

8:00AM – 9:00AM

Registration & Breakfast

8:00AM – 10:00AM

Institutional Investor Symposium (Invitation Only)

10:00AM – 10:05AM

Opening Remarks

Speaker

Natalie is responsible for overseeing Anchorage’s day to day operations. Having previously served as Anchorage’s Chief Operating Officer, Natalie was responsible for creating and developing a well-respected and industry-leading credit and distressed infrastructure organization. She is the Chair of the ACG Management Committee, a member of the Operational Risk & Security Committee, the Best Execution Committee, the Valuation Committee, the Allocation Committee and the Proxy Voting Committee. She is also a voting member of Anchorage’s Legacy Funds Investment Committee. Natalie joined Anchorage in February 2007. Natalie currently serves as the Chair of the Managed Funds Association’s Board of Directors. Prior to joining Anchorage, Natalie was the Chief Operating Officer of Arden Asset Management. Previously, Natalie served in various senior management positions with Deutsche Bank/Bankers Trust, where she worked for 17 years. During this period, Natalie served as Chief Operating Officer for Deutsche Bank’s Absolute Return Strategies Group as well as Deutsche Bank’s U.S. Institutional Asset Management business. Natalie has a total of 35 years of experience in the financial services industry and received an M.B.A from New York University’s Stern School of Business and a B.S. from Elizabethtown College.

10:05AM – 10:30AM

Building Resilient Portfolios: Allocator Insights

Speakers

Anders W. Hall serves as Vanderbilt University’s vice chancellor for investments and chief investment officer. He leads the Office of Investments, where he is responsible for managing the university’s $7 billion long-term investment pool, including the endowment. Vanderbilt’s endowment serves as the financial underpinning for the university’s mission of teaching, cutting-edge research, and service.

Hall came to Vanderbilt in September 2013 from Duke University, where he worked for over a decade as head of public securities for DUMAC, the university’s investment management company. He oversaw public investments for the Duke University endowment, pension plan, health system’s long-term assets, and the Duke family foundation.

Prior to that, Hall was an investment consultant with Hewitt Investment Group in Rowayton, Connecticut, and Atlanta, Georgia, where he advised approximately 20 institutional clients. They included the New York Stock Exchange, Freddie Mac, and the University of Alabama System.

He also spent three years in the Prudential Advanced Management Development Program, a highly-selective leadership training program based in Newark, New Jersey.

Hall, a chartered financial analyst, double-majored in public policy studies and economics at Duke University, where he earned a bachelor of arts in 1993. He earned an MBA from the New York University’s Stern School of Business, where he majored in finance and economics and graduated with high honors in 1999.

Hall serves on the boards of Big Brothers Big Sisters of Middle Tennessee, the Pi Kappa Phi Foundation, Rock the Street Wall Street, and The Healing Trust. He previously served as a member of the governing board of Westminster Presbyterian Church and co-chaired the Annual Fund at University School of Nashville.

Hall lives in Nashville with his wife, Joanna, and their three children: Latham, Stewart, and Charlie.

Ms. Molnar joined Fairfax County Retirement Systems in 2013 and currently serves as Chief Investment Officer of the Fairfax County Police Officers Retirement System, a $1.8 billion plan. Her responsibilities include all aspects of portfolio management and oversight, including strategic and tactical asset and risk allocation, selection and supervision of external investment managers and risk management. From 2001 until 2012, Ms. Molnar was Vice President, Senior Research Analyst at AIG Investments’ Hedge Fund Solutions Group – both in London and New York. At AIG Investments, Ms. Molnar was responsible for due diligence procedures and research including: sourcing new managers, monitoring current hedge funds, analyzing portfolio risk and performance, making new investment recommendations to an investment committee as well as hedge fund asset allocation recommendations for portfolio construction. She was additionally responsible for portfolio reviews and overall asset allocation recommendations for external client portfolios. Previously, she was Vice President, Market Research Analyst at Citigroup Investments’ Alternative Investment Strategies group. Prior investment management experience includes positions at Paribas Asset Management as well as Trevor Stewart Burton & Jacobsen. Additionally, Ms. Molnar spent one year in Warsaw, Poland launching the first retail mutual funds available to the Polish market as well as two years in Frankfurt, Germany as an intern with J.P. Morgan. Ms. Molnar received a B.S. in Business Administration/Finance from the University of North Carolina at Chapel Hill. She is a CFA charterholder.

Anthony joined Fiducient Advisors in 2011. Anthony directs the firm’s Marketable Alternatives research effort and chairs the firm’s Capital Markets Team. He is a member of the firm’s Investment Committee, Discretionary Committee, Research Forum and Marketable Alternatives Research Team.

Prior to joining the firm, Anthony held various roles at National City, Conversus Asset Management and William Blair & Company. Anthony received a Master of Business Administration from the University of Chicago Booth School of Business with concentrations in Analytic Finance, Economics & Entrepreneurship and a Bachelor of Arts in Finance from the Eli Broad College of Business at Michigan State University. He is a CFA® charterholder and member of the CFA Society Chicago and CFA Institute. Anthony is actively involved with YearUp, a nonprofit providing urban young adults with the skills, experience and support to pursue professional careers and higher education. He is also on the Advisory Board for the Michigan State University Financial Markets Institute and serves as Midwest Regional Director of the Hedge Fund Association. In his free time, Anthony enjoys playing guitar, golf, running after his two young sons and all things Michigan State Spartans.

Moderated by

Rick joined the Société Générale group via its Newedge subsidiary and counts over 15 years of experience in capital introduction roles; managing a portfolio of key hedge fund client relationships as well as maintaining a global network of institutional investors. After a brief stint with Jefferies, Rick re-joined SG in 2015 to contribute to the build-out of the multi-asset prime brokerage platform, with a particular focus on expanding investor coverage. He currently leads a team of industry professionals focused on helping SG’s hedge fund client base connect with appropriate pools of capital as well as the production of strategic content. Rick graduated from the University of Richmond with a B.S. in Business Administration, concentrations in Finance and Marketing, and a minor in Spanish Language Studies.

10:30AM – 10:55AM

Keynote Q&A

Speakers

Karen Karniol-Tambour is Co-Chief Investment Officer at Bridgewater Associates, responsible for managing the company’s investment process. Karen oversees the systemization of Bridgewater’s research into trading strategies, manages the development of proprietary investment management models, directs the design and implementation of client investment strategies, and publishes timely market understanding to clients and global policy makers via Bridgewater’s Daily Observations. She also co-leads the firm’s Sustainable Investing efforts, overseeing the design of new investment solutions with both financial and sustainability objectives. Karen joined Bridgewater in 2006 after graduating from Princeton University. She serves on the boards of Search for Common Ground and Seeds of Peace. Karen is a World Economic Forum Young Global Leader, was included in Fortune’s “40 Under 40” most influential leaders in business in 2019, and has been named to Barron’s list of “Most Influential Women in US Finance” for three years in a row.

Moderated by

Ashbel C. Williams is Vice Chair, J.P. Morgan Asset Management. With assets under management of $2.7 trillion, the firm is a global leader in investment management.

Prior to joining J.P. Morgan Asset Management in 2022, Williams was Executive Director and Chief Investment Officer and of the Florida State Board of Administration (SBA), with assets of over $250 billion. Previously, he was a Managing Director at Fir Tree Partners and President and CEO of Schroder Capital Management. Earlier in his career he held senior roles in the executive and legislative branches of Florida state government, including initial leadership of the SBA from 1991-96.

Williams is a trustee of the Florida State University Foundation, and the National Institute for Public Finance. He serves on the investment committees of the IEEE and the Episcopal Diocese of Florida. He also serves on the board of the Economic Club of Florida, is a Hull Fellow of the Pacific Pension and Investment Institute, a Special Advisor to the Managed Funds Association and a member of the Council on Foreign Relations.

He received BS and MBA degrees from the Florida State University (FSU) and lives in Tallahassee, FL with his wife; they have three grown daughters.

10:55AM – 11:25AM

Is Multi-Strat Dominance Here to Stay?

Speakers

John Claisse joined Albourne in July 1996, relocated from London to San Francisco in July 2003 and became Albourne Group CEO in August 2015. John is an equity partner and member of Albourne’s Executive Committee and also chairs the firm’s Corporate Planning Council, which comprises Albourne’s function and region heads. John helped develop the firm’s proprietary risk analytics and was formerly the Senior Analyst for quantitative equity strategies and multi-strategy hedge funds. John remains a Portfolio Analyst working with several public and corporate plans, large endowments and foundations. John also serves on the Advisory Board of the Sussex University School of Business, on the Board of Trustees of Standards Board of Alternative Investments (SBAI), and on the Governing Board of The Robert Toigo Foundation.

John holds a first class Mathematics Degree and a PhD from Sussex University.

Albourne is an independent advisory firm focused on hedge funds, private equity, private credit, real assets, real estate and dynamic beta. Founded in 1994, Albourne has over 300 clients with over $650bn invested directly in alternative investments.

Carsten Schmitz leads Winton’s investment management and research activities. He is a member of Winton’s executive management and investment committees.

Carsten joined Winton in 2008 as a researcher focused on the design of quantitative trading strategies. From 2012 Carsten was leading Winton’s Zurich research team, before moving back to London and being promoted to Head of Investment Strategy and subsequently Head of Research.

Carsten earned a Diploma with distinction from RWTH Aachen in Germany and a PhD with distinction from the University of Zurich. For his PhD and postdoctoral position, Carsten worked at the DESY collider facility in Hamburg, analysing data from high-energy particle collisions.

Jeff Shen, PhD, Managing Director, is Co-CIO and Co-Head of Systematic Active Equity (SAE) at BlackRock. He is a member of the BlackRock Global Operating Committee, BlackRock Systematic (BSYS) Management Committee and the BlackRock Asian Middle Eastern & Allies Network (AMP) Executive Committee.

Dr. Shen’s service with BlackRock dates back to 2004, including his years with Barclays Global Investors (BGI), which merged with BlackRock in 2009. At BGI, he was the Head of Investment for Asia Pacific and Emerging Market active equities. Prior to joining BGI, he began his career in 1997 with JP Morgan where he held numerous positions in global macro investment and asset allocation research in both New York and London.

Dr. Shen earned a BA degree in Economics from Hobart College, a MA degree in Economics from University of Massachusetts at Amherst, and a PhD degree in Finance from New York University.

Dr. Shen is an adjunct professor at NYU teaching an MBA class on international investment. He also serves on the advisory board of the Clausen Center at UC Berkeley.

Moderated by

Mithra Warrier is a Managing Director in Citi Prime Finance Origination, and is also Head of North American Capital Introductions. Mithra joined Citi in January, 2022, from TD Securities, where she oversaw Sales, Capital Introductions, and Client Services for the U. S. Prime Services business. Prior to joining TD Securities in November 2017, Mithra spent 15 years at Barclays, which she joined in 2008 through the acquisition of Lehman Brothers. During her time at Lehman Brothers and Barclays, Mithra worked in several areas of Financing, including Repo Salestrading, Credit Financing, Prime Origination, and Prime Account Management. Mithra graduated from Northwestern University in 2002 with a Bachelor of Arts degree in Economics.

11:25AM – 11:50AM

Keynote Q&A

Speakers

Mr. Magnusson is the Chief Investment Officer of Garda’s Fixed Income Relative Value Strategy. Mr. Magnusson provides strategic direction for the investment strategy of the firm.

Prior to co-founding Garda in 2016, Mr. Magnusson worked at Black River and its predecessor, Cargill Financial Markets. He began his career at Cargill in 1996 working within the Corporate Treasury Group. Mr. Magnusson then joined the Fixed Income Relative Value Portfolio Management Team in 2000. Following the formation of Black River in 2003, his Portfolio Management responsibilities continued to grow and in 2008, he became the Senior Portfolio Manager for the Fixed Income Relative Value Strategy, that continues to be the strategy managed at Garda today. He assumed CIO responsibilities for the strategy in 2022.

Mr. Magnusson graduated Summa Cum Laude from Central Michigan University with a Bachelor of Science degree in Business and German. He also holds an MBA from the Thunderbird School of Global Management and is a CFA® charterholder.

Moderated by

Mr. Lohuis is a Managing Director, and Chairman of Global Financing at Barclays.

Based in New York, he is responsible for advising senior client relationships and overseeing resource allocation for the businesses within Prime and Structured Financing, including Fixed Income, Equity Finance and Prime Derivative Services as well as Structured Financing. Prior this role, he was the Global Head of Financing and the Resource Management Group.

Mr. Lohuis joined Barclays in 2008 from Lehman Brothers and has extensive experience in the Investment Banking Industry and Global Markets. During this tenure, he held various senior leadership roles, including Head of Fixed Income Financing, Head of Money Market Trading and Short Rates Trading.

Mr. Lohuis is a member of the Markets Management Team. He is also a member of SIFMA-Funding Executive Committee. Mr. Lohuis holds a bachelor’s degree from the University of Illinois and sits on the board of Portsmouth Abbey School.

11:50AM – 12:25PM

Lunch & 1:1 Allocator Meetings Only

12:25PM – 12:50PM

Keynote Q&A

Speakers

Peter Kraus is the Chairman and CEO of Aperture Investors. For over four decades, Peter has worked at major financial institutions including Goldman Sachs, Merrill Lynch, and most recently at AllianceBernstein (AB) where he served as Chairman and CEO, successfully leading the firm’s turnaround after the crisis in 2008. Throughout his career, Peter has been a vocal proponent of pay-for-performance compensation models and the need for trust between active managers and their clients.

After years of watching diminishing returns and increasing outflows, he concluded that a disruptive idea like performance-linked fees would only be successful in an entirely new firm, one built from scratch with client performance as its primary objective. That’s why Peter teamed up with Generali to launch Aperture in 2018.

Peter serves on the boards of multiple organizations including CalArts and the Capital Markets Institute of Third Way, and is the co-founder of The Kraus Family Foundation, a non-profit that supports public art and emerging artists. He is also the Chairman of Marstone, a leading independent digital wealth management platform. Peter received his B.A. in economics from Trinity College and his M.B.A. from NYU Stern School of Business. He and his wife Jill are avid collectors of contemporary art and enjoy spending time at their home in Dutchess County where they commission outdoor artwork.

Moderated by

Ed Robertiello, CFA, is currently Managing Director and Head of Private Markets for the Missouri State Employee Retirement System (MOSERS) were he leads the investment activities and team related to all private market investments. Prior to joining MOSERS he was the Chief Investment Officer of Blueprint Capital Advisors where he was responsible for all facets of the investment, negotiation and structuring activities related to private market and alternative strategies. Ed has over 25 years of experience in public and private market strategies covering portfolio management, asset allocation, manager research and selection, due diligence, and operations. Clients include both institutional and wealth management investors.

Previously, Ed was Senior Portfolio Manager at CalPERS responsible for the pension fund’s approximately $10.0 billion portfolio of Absolute Return Strategies, private credit, distressed, infrastructure and MultiA sset Class portfolios. Ed was a member of CalPERS Investment Strategy Group (the internal Investment Committee that oversees $400 billion of assets across all asset classes), Operating Committee and Derivatives Committee.

Prior to CalPERS, Ed was a Managing Director in the asset management division of Russell Investments, were he created the Alternative Strategies business. He was also amember ofthe Investment Committeethatoversaw$250 billion in multi manager and OCIO portfolios.

Before joining Russell, Ed was a Managing Director in Credit Suisse’s Asset Management business. He headed institutional and wealth management alternative asset mandates globally. At its peak he was responsible for $25 billion in AUM, 65 investment professionals and over 80 individual portfolios. Before Credit Suisse, Ed held positions at Asset Alliance, and the Blackstone Group’s affiliate Blackstone Alternative Asset Management. Ed began his investment career at RJR Nabisco, serving as Vice President Pension and Benefit Investments.

Ed received his BA in Accounting from Montclair State University and his MBA in Finance from Fairleigh Dickinson University. He is a holder of a Chartered Financial Analyst (CFA) designation. He has been a frequent speaker at pension and alternative investment conferences including events sponsored by SALT, Institutional Investor, Milken and Pensions and Investments.

12:50PM – 1:20PM

Trading Troubled Assets: The Distressed Debt Landscape

Speakers

Ms. Gibbons joined Davidson Kempner in July 2007. Ms. Gibbons was appointed Managing Director in January 2015 and became a Managing Member in January 2020. From 2003 to 2005, Ms. Gibbons worked as an Associate at Montgomery & Co., advising healthcare companies on private placements and mergers and acquisitions. From 2001 to 2003, she was an Analyst in the healthcare investment banking group at JPMorgan. Ms. Gibbons received her M.B.A. from Harvard Business School in 2007 and her B.A. from Dartmouth College in 2001.

Paul Goldschmid is a Partner and Co Portfolio Manager at King Street. Paul is a member of the Management Committee, Global Investment Committee, Risk Committee and Conflicts Committee. Prior to joining King Street in 2006, Paul was an Analyst at Compass Partners International, a boutique merchant banking firm, focusing on principal investments and cross border mergers and acquisitions.

Paul received a B.A. from Harvard University and a J.D. and M.B.A. from Columbia University.

In his role as Co-Chief Investment Officer, Thibault is responsible for overseeing the firm’s portfolio management, risk management, asset allocation, and investment decisions with respect to the Successor Funds. He is responsible for the management of the ACO funds as well as stressed and distressed credit products. Thibault is also responsible for the research and trading process supporting Anchorage’s Legacy Funds, ACP and AIO products. He is a voting member of Anchorage’s Investment Committees, the Proxy Voting Committee, the Allocation Committee, and Co-Chair of the Research Review Committee. Thibault joined Anchorage in January 2009 to help establish the firm’s London office and develop the firm’s European research and investment efforts. Prior to joining Anchorage, Thibault was a Vice President at Greywolf Capital. Prior to joining Greywolf, he was an Analyst on the distressed bond desk at Goldman Sachs in New York. Thibault has a total of 22 years of experience in the financial services industry and received a B.S. in Engineering and a B.A. in Economics from Brown University, where he graduated magna cum laude.

Moderated by

Ryan Sandahl is a Managing Director in the Financial Restructuring Group at Houlihan Lokey, with over 20 years of experience in leveraged finance spanning debt and equity capital raising, liability management transactions and sell-side and buy-side M&A both in- and out-of-court. Ryan’s clients include public and private companies and all types of investors / creditors, including private equity, hedge funds, private credit / CLOs, bondholders and banks providing capital structure solutions in challenging situations.

Ryan has developed a unique range of industry expertise over the years in agriculture and food and beverage, chemicals and industrials, business services, digital media, asset management and timeshare, among others. Prior to joining Houlihan Lokey in 2005, Ryan worked in M&A and leveraged finance at PricewaterhouseCoopers Securities and Bank of America. Ryan has a double major in Economics and Finance from Washington University in St. Louis. Ryan and his family live outside Chicago. Ryan also enjoys managing a row crop farm in Iowa where he grew up.

1:20PM – 1:45PM

Keynote Q&A

Speakers

Bruce Richards is the Chief Executive Officer & Chairman of Marathon Asset Management who is responsible for general oversight of funds Marathon manages on behalf of its institutional investors. Mr. Richards leads Marathon’s Executive Committee, representing senior leadership at Marathon, where the firm’s strategic direction is established. Mr. Richards sits on Marathon’s Investment Committee, which convenes weekly to evaluate select investments and establishes guidelines for asset allocation. Prior to founding Marathon in 1998, Mr. Richards worked on Wall Street for 15 years, including 10 years as a Managing Director in the fixed income divisions of Smith Barney and Donaldson, Lufkin & Jenrette where he was head of a trading desk responsible for principal investments and market making. Mr. Richards has demonstrated a strong commitment to philanthropy and was the recipient of Help for Children | Hedge Fund Cares’ Award for Caring and the CFA Society’s Humanitarian Award. He has also been honored by the UJA Federation of New York and HELP USA, and was the recipient of the Boomer Esiason Foundation’s Most Valuable Player Award and the R Baby Foundation’s Philanthropic Leadership Award. Mr. Richards served on the Investment Committee of The University of Maryland for 10 years. Mr. Richards is married with two children and resides in Manhattan. He received his B.A. in Economics, summa cum laude, from Tulane University and a member of Phi Beta Kappa.

Moderated by

1:45PM – 2:15PM

Spotting Value and Opportunity in Emerging Managers

Speakers

Erik Serrano Berntsen is the CEO of Stable, responsible for defining and executing the firm’s Investment Strategy. With offices in New York and London, Stable backs Founders of investment firms who appreciate that delivering extraordinary performance requires building a great organization. Stable’s track record of success is down to working with inspiring investors and business-builders across public and private markets. Prior to Stable, Erik was with Bain & Co., where he was part of the Private Equity Group (PEG). A believer in education as a tool for change, Erik supports initiatives such as the LSE Alternative Investment Conference, the largest student conference for alternatives globally, Girls Who Invest, and Girls Are Investors. Amongst other initiatives, Stable is a supporter of 100 Women in Finance and a Founding Partner of #10000blackinterns. Erik holds a Bachelor of Arts in Politics, Philosophy and Economics from Keble College, University of Oxford and a Masters of Business Administration with honours and a Concentration in Finance from the University of Chicago Booth School of Business.

Peter Bremberg is the Founder and Chief Investment Officer of The Quarry, a global multi-strategy investment management firm. In his role as CIO, Peter is responsible for portfolio construction and capital allocations to The Quarry’s portfolio managers. From 2016-2021 Peter was the Chief Operating Officer of Boothbay Fund Management LLC, a global multi-manager hedge fund with over $5 billion of capital allocations to 100+ portfolio managers.

Prior to Boothbay, Peter was a Director in the Global Prime Solutions & Financing division of BNP Paribas from 2010-2016. Before BNP, he was the 8th employee and Treasury Manager at Northern Arc Capital in India, a structured credit and specialty finance company that has enabled financing for over 50 million underserved households and businesses in India. Peter began his career at Bear, Stearns & Co. in the Equities Division.

Peter has an M.B.A. in Finance from the Stern School of Business at New York University, and a B.A. in Philosophy from Franciscan University of Steubenville.

Art Mbanefo founded Phoenix Merchant Partners in 2022 and serves as Chief Executive Officer and Chief Investment Officer.

He was formerly the Chief Investment Officer at ORIX USA, Barclays Bank PLC and Paloma Partners, where he also served as co-Chief Executive Officer.

Art started his career at JP Morgan after receiving his BSc (Honours) from Loughborough University in the United Kingdom and qualifying as a Fellow of the Institute of Chartered Accountants in England and Wales. Art serves as a non-executive director on the public board of BGC Group, where he chairs the audit committee and the ESG committee.

He lives in New York with his wife and children.

Moderated by

Peter D. Greene, Partner and co-head of the Investment Management Group, focuses his practice on all matters related to the formation and structuring of private funds and management companies, compliance and regulatory requirements, and public to private investment opportunities. He has particular experience in insider trading determinations, including the purchase, analysis and use of alternative data and related enforcement. Peter has advised on many of the leading hedge fund launches over the past 17 years; his clients include well-pedigreed managers launching their first funds and some of the largest hedge fund managers. Having previously served as the General Counsel and Chief Operating Officer of a buy-side investment firm, Peter has a unique understanding of his clients’ goals and the nature of their interactions with investors, regulators, auditors, administrators, employees and outside counsel.

Peter is recognized as a leading investment funds lawyer for his work in the hedge funds space by Chambers USA, Chambers Global and The Legal 500 US, with clients stating that “he is the lawyer that I rely most heavily on and he is a really good resource for commercial legal advice” and “an exceptional lawyer” who “combines an excellent business sense with a strong legal background.” Business Insider recently recognized Peter as one of “the 29 bankers, advisors, and lawyers to know if you’re thinking about starting your own hedge fund.” Peter has served on the Board of Directors of the Managed Funds Association (MFA), the leading trade association for the hedge fund and global alternative investment industry. He is also Chairperson of the Board of Directors of The Acceleration Project, a female-founded, female-led business advisory non-profit dedicated to keeping local economies vital and channeling talent into the economy.

2:15PM – 2:45PM

Commodities Boom and Bust: Navigating Swings in the Market

Speakers

Marcus Frampton, CFA, CAIA, FRM serves as the Chief Investment Officer of the Alaska Permanent Fund Corporation, where he manages a team of 25 investment professionals and is responsible for leading the firm’s investment activities. Mr. Frampton has been with APFC since 2012 and served as the Director of Investments, Real Assets & Absolute Return before his promotion to CIO in 2018.

Prior to joining APFC, Marcus held diverse roles ranging from investment banking with Lehman Brothers, private equity investing with PCG Capital Partners, and as an executive with LPL Financial, a private equity backed portfolio company.

Mr. Frampton holds a BA in Business-Economics with a minor in Accounting from UCLA. In addition to serving on the Board of Directors of Managed Funds Association, Marcus is also a Director of Scientific Industries, Inc. (OTC: SCND), a leading manufacturer of laboratory equipment and developer of intellectual property and products around bioprocessing; Nyrada, Inc., a privately-held drug development company; and Twin Creeks Timber, LLC, a privately-held owner/operator of institutional quality timberland assets.